http://www.telegraph.co.uk/finance/n...ing-fears.html

Bank of America issues `bond crash' alert on Fed tightening fears

The return of confidence and healthy growth in the US risks setting off a “bond crash” comparable to 1994 and triggering a string of upsets across the world, Bank of America has warned.

Taxis drive past a Bank of America branch in New York on February 23, 2009

Bank of America said the “Great Rotation” under way from bonds into equities closely tracks the pattern of 1994, with bank stocks leading the way. Photo: AFP

Ambrose Evans-Pritchard

By Ambrose Evans-Pritchard

7:32PM GMT 24 Jan 2013

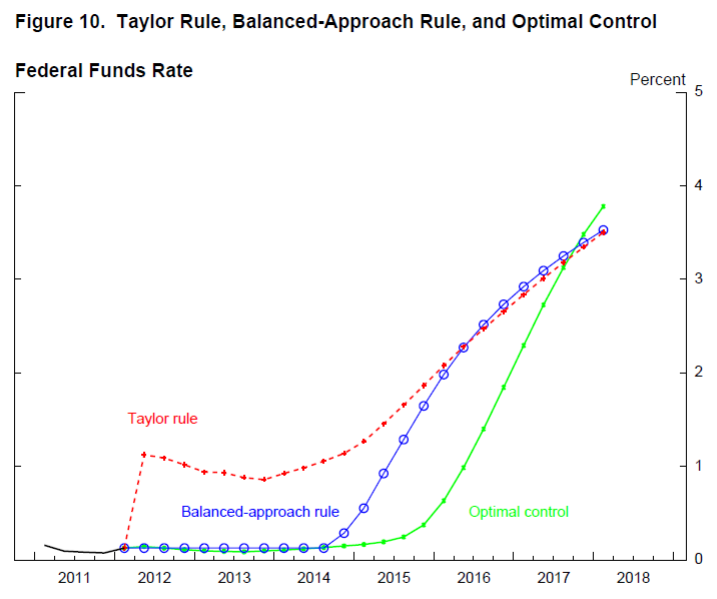

The US lender said investors face a treacherous moment as central banks start fretting about inflation and shift gears, threatening a surge in bond yields.

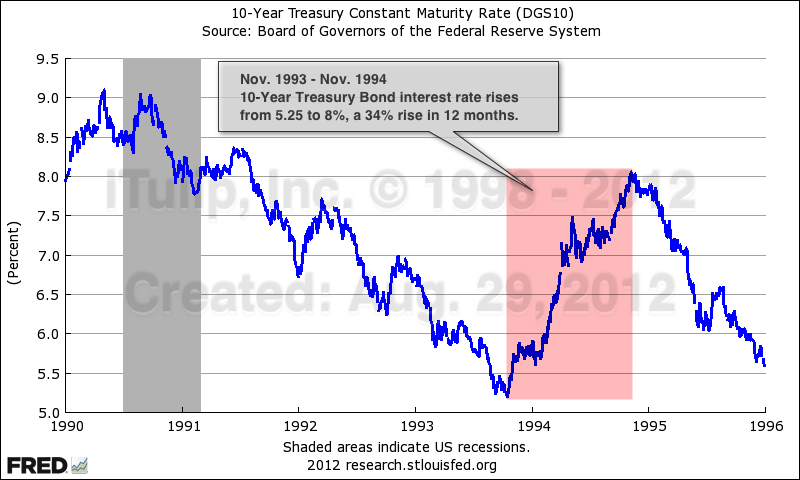

This happened in 1994 under Federal Reserve chief Alan Greenspan when yields on US 30-year Treasuries jumped 240 basis points over a nine-month span, setting off a “savage reversal of fortune in leveraged areas of fixed income markets”.

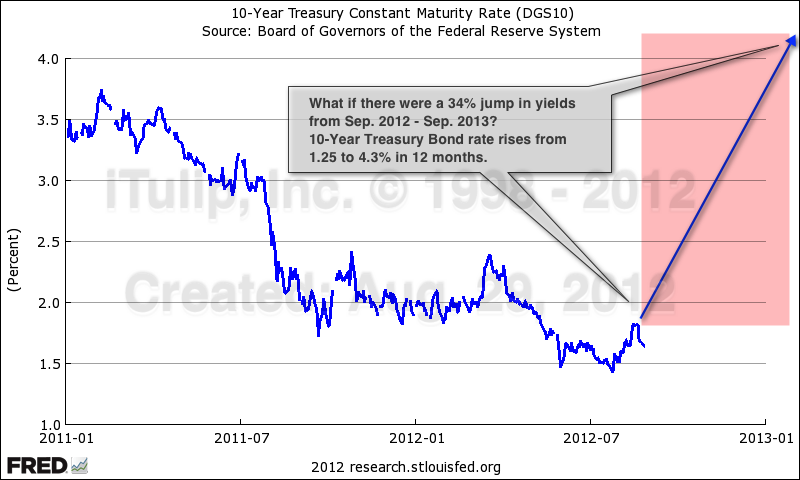

A similar shock this year is “likely” if the US economy continues to gather strength. “The moment we hear the first rhetorical talk of exit strategies by central banks this could turn,” said chief investment strategist, Michael Hartnett. There was already a whiff of this in the most recent Fed minutes.

“The period of Maximum Liquidity is close to an end. Yes, the Japanese reflation is gaining steam in 2013 but we regard this as the last of the great reflations. The big picture is a transition from deflation to normal growth and rates,” he said.

The 1994 bond shock - and seared in the memories of bond-holders - ricocheted through global markets. It bankrupted Orange Country, California, which was caught flat-footed with large bond positions. It set off the Tequila Crisis in Mexico as the cost of rolling over `tesobonos’ linked to the US dollar suddenly jumped.

Most emerging markets now raise debt in their own currency but the effect of a worldwide tightening cycle could expose a host of problems. “Frontier markets are attracting tremoundous capital inflows and this new carry trade could reverse quite violently. The risk of local bubbles bursting is high,” said Mr Hartnett.

Bank of America said the “Great Rotation” under way from bonds into equities closely tracks the pattern of 1994, with bank stocks leading the way.

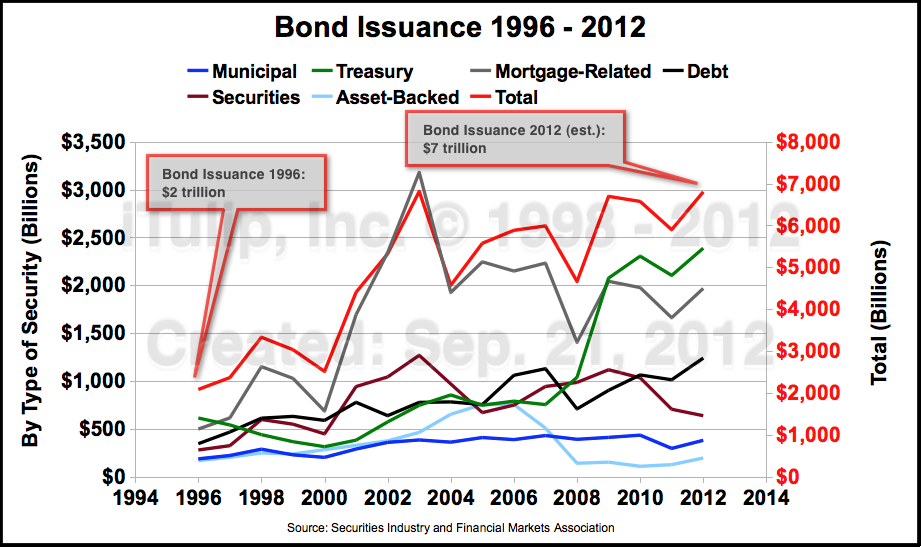

Over the past seven years US investors have pulled $600bn from US equity funds and poured $800bn instead into bond funds. This process is going into reverse. Equity funds have drawn $35bn over the last 13 trading days alone, creating the risk of an unstable “melt-up” in stocks over coming months.

The Bank for International Settlements has issued an alert on the high-yield `junk’ bonds and mortgage debt, currently trading at record lows. The Swiss-based watchdog said parts of the credit market credit are “highly valued in a historical context relative to indicators of their riskiness.”

The European Central Bank’s Mario Draghi warned earlier this month that leveraged buyouts and private equtiy deals are becoming frothy again.

Wall Street’s veteran technical analyst Louise Yamada said a whole generation of small investors has been lured into bonds since the stock market crash in 2008 in the belief that is a safe strore of wealth, seemingly unaware of the risk once inflation returns. “I am quite concerned. It’s distrubing to see a lot of retirees who got stuck at the top of the stock market, now got stuck at the top of the bond market,” she said.

She says the world may be at a turning point comparable to 1946 when deflation was defeated and the last bear market in bonds began, though it is likely to be a slow process. She advises people to switch into shorter term maturities, citing a “bottoming process in rates rates, which means a topping process in price”.

The great question is whether the world economy really is at the start of a fresh cycle of growth, or whether the roaring asset rally of the last few months is another false dawn driven by central bank liquidity that is failing to gain economic traction.

The International Monetary Fund’s said this week that the world economy is not yet out of the woods. “It is clear that financial markets are ahead of the real economy. The question is whether they are too much ahead or not, whether we are seeing a bubble,” said chief economist Olivier Blanchard.

Albert Edwards from Societe Generale said the bullish mood has returned to the “heights of optimism last seen in mid-2007” even though the global and US profit cycles have both peaked, and some shipping indicators point to a further economic relapse.

Mr Edwards said the markets will be caught out yet again as the West slides deeper into into the same deflationary trap as Japan and bond yields fall to historic lows.

Investors will have to wait a little longer for a “once in a life-time” chance to buy stocks dirt cheap, he said.

Bank of America issues `bond crash' alert on Fed tightening fears

The return of confidence and healthy growth in the US risks setting off a “bond crash” comparable to 1994 and triggering a string of upsets across the world, Bank of America has warned.

Taxis drive past a Bank of America branch in New York on February 23, 2009

Bank of America said the “Great Rotation” under way from bonds into equities closely tracks the pattern of 1994, with bank stocks leading the way. Photo: AFP

Ambrose Evans-Pritchard

By Ambrose Evans-Pritchard

7:32PM GMT 24 Jan 2013

The US lender said investors face a treacherous moment as central banks start fretting about inflation and shift gears, threatening a surge in bond yields.

This happened in 1994 under Federal Reserve chief Alan Greenspan when yields on US 30-year Treasuries jumped 240 basis points over a nine-month span, setting off a “savage reversal of fortune in leveraged areas of fixed income markets”.

A similar shock this year is “likely” if the US economy continues to gather strength. “The moment we hear the first rhetorical talk of exit strategies by central banks this could turn,” said chief investment strategist, Michael Hartnett. There was already a whiff of this in the most recent Fed minutes.

“The period of Maximum Liquidity is close to an end. Yes, the Japanese reflation is gaining steam in 2013 but we regard this as the last of the great reflations. The big picture is a transition from deflation to normal growth and rates,” he said.

The 1994 bond shock - and seared in the memories of bond-holders - ricocheted through global markets. It bankrupted Orange Country, California, which was caught flat-footed with large bond positions. It set off the Tequila Crisis in Mexico as the cost of rolling over `tesobonos’ linked to the US dollar suddenly jumped.

Most emerging markets now raise debt in their own currency but the effect of a worldwide tightening cycle could expose a host of problems. “Frontier markets are attracting tremoundous capital inflows and this new carry trade could reverse quite violently. The risk of local bubbles bursting is high,” said Mr Hartnett.

Bank of America said the “Great Rotation” under way from bonds into equities closely tracks the pattern of 1994, with bank stocks leading the way.

Over the past seven years US investors have pulled $600bn from US equity funds and poured $800bn instead into bond funds. This process is going into reverse. Equity funds have drawn $35bn over the last 13 trading days alone, creating the risk of an unstable “melt-up” in stocks over coming months.

The Bank for International Settlements has issued an alert on the high-yield `junk’ bonds and mortgage debt, currently trading at record lows. The Swiss-based watchdog said parts of the credit market credit are “highly valued in a historical context relative to indicators of their riskiness.”

The European Central Bank’s Mario Draghi warned earlier this month that leveraged buyouts and private equtiy deals are becoming frothy again.

Wall Street’s veteran technical analyst Louise Yamada said a whole generation of small investors has been lured into bonds since the stock market crash in 2008 in the belief that is a safe strore of wealth, seemingly unaware of the risk once inflation returns. “I am quite concerned. It’s distrubing to see a lot of retirees who got stuck at the top of the stock market, now got stuck at the top of the bond market,” she said.

She says the world may be at a turning point comparable to 1946 when deflation was defeated and the last bear market in bonds began, though it is likely to be a slow process. She advises people to switch into shorter term maturities, citing a “bottoming process in rates rates, which means a topping process in price”.

The great question is whether the world economy really is at the start of a fresh cycle of growth, or whether the roaring asset rally of the last few months is another false dawn driven by central bank liquidity that is failing to gain economic traction.

The International Monetary Fund’s said this week that the world economy is not yet out of the woods. “It is clear that financial markets are ahead of the real economy. The question is whether they are too much ahead or not, whether we are seeing a bubble,” said chief economist Olivier Blanchard.

Albert Edwards from Societe Generale said the bullish mood has returned to the “heights of optimism last seen in mid-2007” even though the global and US profit cycles have both peaked, and some shipping indicators point to a further economic relapse.

Mr Edwards said the markets will be caught out yet again as the West slides deeper into into the same deflationary trap as Japan and bond yields fall to historic lows.

Investors will have to wait a little longer for a “once in a life-time” chance to buy stocks dirt cheap, he said.

Comment