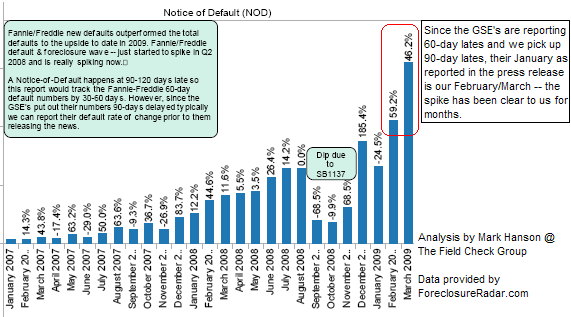

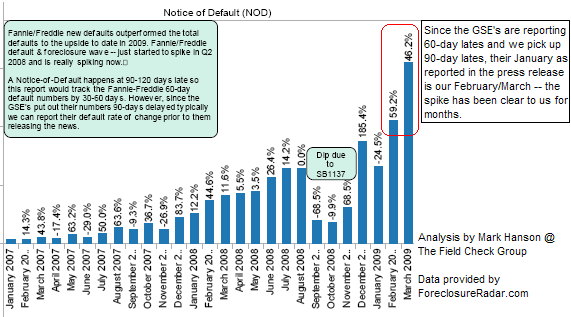

Delinquencies Rising at Fannie & Freddie

No surprise here: Even amongst the most credit worthy borrowers — aka “Prime” — defaults are rising rapidly. Job losses, debt problems, loss of income are the primary causes.

.

.

.

.

Note once again these are not Sub-prime or alt-A — they are Prime, the highest quality borrowers possible.

.

.

.

.

Note once again these are not Sub-prime or alt-A — they are Prime, the highest quality borrowers possible.

Comment