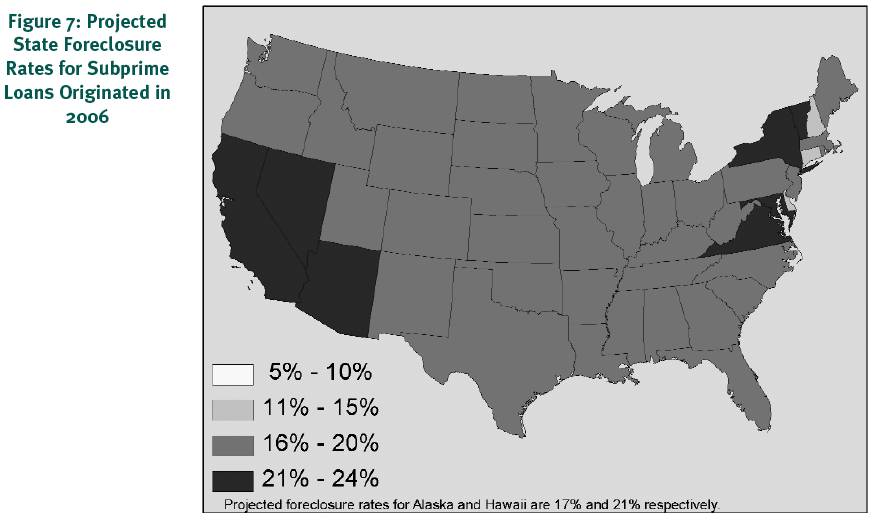

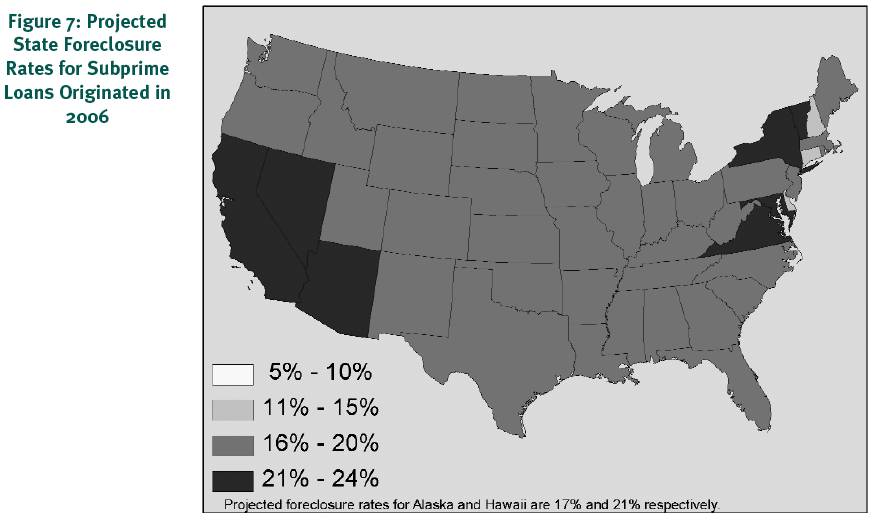

On December 19, 2006, iTulip covered the announcement of a report issued by the Center for Responsible Lending (CLR), Losing Ground: Foreclosures in the Subprime Market and Their Cost to Homeowners. The report is now available in full, here (PDF), with a summary, below. Next week, we will publish an interview with hedge fund manager Jim Finkel who feels that the risks, as expressed in this kind of report, may be overstated, that lenders during this real estate correction versus previous ones will tend to restructure loans versus take back properties. "A rolling loan gathers no loss," Jim tells us. That's not what iTulip's Sean O'Toole is finding in California, one of the states projected in the CLR report as due to suffer a 21% to 25% subprime foreclosure rate. More next week.

Losing Ground: Foreclosures in the Subprime Market and Their Cost to Homeowners

Executive Summary

In this report, the Center for Responsible Lending presents research on how homeowners have fared with subprime mortgages. Analyzing the performance of more than six million subprime mortgages made from 1998 through the third quarter of 2006 and taking into account changes in housing prices, we find that foreclosure risk in the subprime market has escalated in recent years, and is likely to grow even worse in many areas.

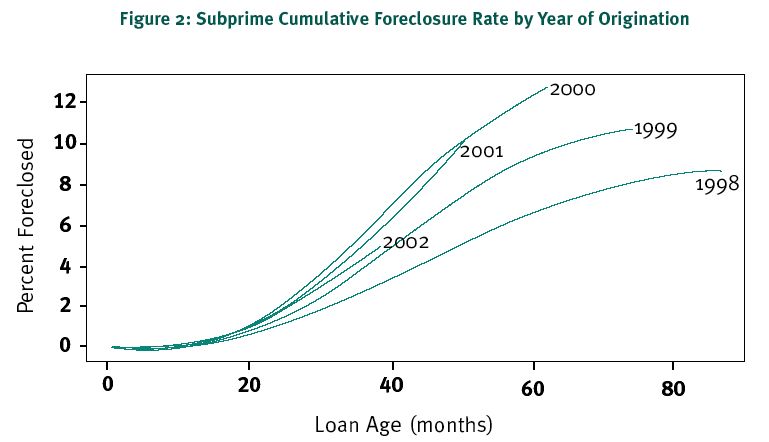

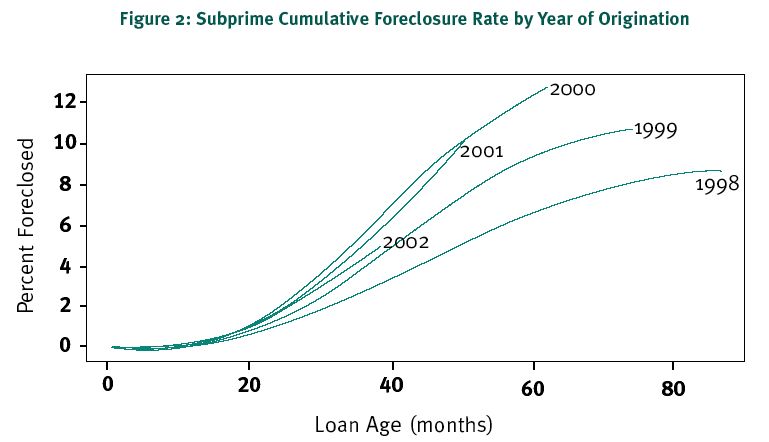

As this year ends, 2.2 million households in the subprime market either have lost their homes to foreclosure or hold subprime mortgages that will fail over the next several years. These foreclosures will cost homeowners as much as $164 billion, primarily in lost home equity. We project that one out of five (19 percent) subprime mortgages originated during the past two years will end in foreclosure. This rate is nearly double the projected rate of subprime loans made in 2002, and it exceeds the worst foreclosure experience in the modern mortgage market, which occurred during the "Oil Patch" disaster of the 1980s.

In brief, these are the key findings:

Even during the recent period of strong housing appreciation, subprime foreclosures have been high. As many as one in eight (13 percent) subprime home loans ended in foreclosure within five years of origination.

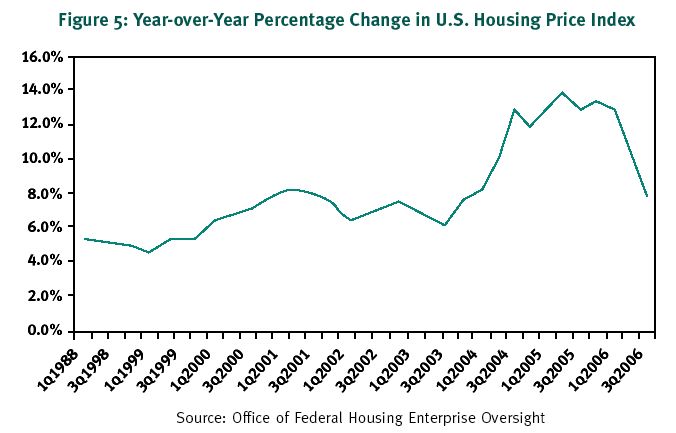

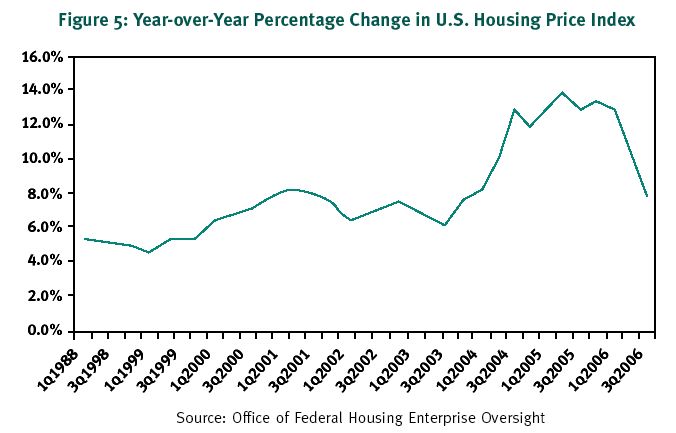

The past housing boom masked the high proportion of homeowners who have struggled with subprime loans. For many borrowers, strong house price growth increased the amount of equity in their homes and enabled them to refinance their mortgages despite being behind on the monthly payments. When these distressed prepayments are added to the foreclosure rates, the total "failure rate" for subprime loans approaches 25 percent.

Key Findings

The chance of foreclosure on a subprime loan doubled between 2002 and 2005. Subprime loans originated in 2002 have a one-in-ten lifetime chance of foreclosing. For loans originated in 2005 and 2006, the probability shoots up to one in five.

Multiple subprime loans boost foreclosure risk even higher. Lenders often portray subprime loans as a stepping-stone to a prime loan. In reality, many borrowers in the subprime market refinance from one subprime loan to another, losing equity each time to cover the cost of getting a new loan. When we analyze the likelihood of foreclosure for borrowers who repeatedly refinance, we find that the risk of losing the home climbs to 36 percent. While more research is needed, this estimate relies on assumptions drawn directly from refinance patterns in the subprime market.

Why Subprime Foreclosures Matter

The report describes the first comprehensive research on foreclosures in the subprime market, assessing how frequently subprime mortgages fail and the associated costs to homeowners. The loss of home equity is significant because, for most families, the value of this ownership is their greatest financial asset. The performance of the subprime market is significant because it has rapidly grown from a niche market into a major economic force, now representing roughly one quarter of all home loans made in the United States. Our research shows that subprime foreclosure levels have been extraordinarily high even during the recent past. As housing appreciation slows, subprime foreclosures will rise even higher in the future. The losses will inevitably have ripple effects throughout the economy and our society as over two million families lose their physical shelter, their major source of financial security, and the social benefits of homeownership.

Losing Ground: Foreclosures in the Subprime Market and Their Cost to Homeowners

Executive Summary

In this report, the Center for Responsible Lending presents research on how homeowners have fared with subprime mortgages. Analyzing the performance of more than six million subprime mortgages made from 1998 through the third quarter of 2006 and taking into account changes in housing prices, we find that foreclosure risk in the subprime market has escalated in recent years, and is likely to grow even worse in many areas.

As this year ends, 2.2 million households in the subprime market either have lost their homes to foreclosure or hold subprime mortgages that will fail over the next several years. These foreclosures will cost homeowners as much as $164 billion, primarily in lost home equity. We project that one out of five (19 percent) subprime mortgages originated during the past two years will end in foreclosure. This rate is nearly double the projected rate of subprime loans made in 2002, and it exceeds the worst foreclosure experience in the modern mortgage market, which occurred during the "Oil Patch" disaster of the 1980s.

In brief, these are the key findings:

Even during the recent period of strong housing appreciation, subprime foreclosures have been high. As many as one in eight (13 percent) subprime home loans ended in foreclosure within five years of origination.

The past housing boom masked the high proportion of homeowners who have struggled with subprime loans. For many borrowers, strong house price growth increased the amount of equity in their homes and enabled them to refinance their mortgages despite being behind on the monthly payments. When these distressed prepayments are added to the foreclosure rates, the total "failure rate" for subprime loans approaches 25 percent.

Key Findings

- 2.2 million subprime home loans made in recent years have already failed or will end in foreclosure.

- These foreclosures will cost homeowners as much as $164 billion.

- One out of five subprime mortgages originated during the past two years will end in foreclosure.

The chance of foreclosure on a subprime loan doubled between 2002 and 2005. Subprime loans originated in 2002 have a one-in-ten lifetime chance of foreclosing. For loans originated in 2005 and 2006, the probability shoots up to one in five.

Multiple subprime loans boost foreclosure risk even higher. Lenders often portray subprime loans as a stepping-stone to a prime loan. In reality, many borrowers in the subprime market refinance from one subprime loan to another, losing equity each time to cover the cost of getting a new loan. When we analyze the likelihood of foreclosure for borrowers who repeatedly refinance, we find that the risk of losing the home climbs to 36 percent. While more research is needed, this estimate relies on assumptions drawn directly from refinance patterns in the subprime market.

Why Subprime Foreclosures Matter

The report describes the first comprehensive research on foreclosures in the subprime market, assessing how frequently subprime mortgages fail and the associated costs to homeowners. The loss of home equity is significant because, for most families, the value of this ownership is their greatest financial asset. The performance of the subprime market is significant because it has rapidly grown from a niche market into a major economic force, now representing roughly one quarter of all home loans made in the United States. Our research shows that subprime foreclosure levels have been extraordinarily high even during the recent past. As housing appreciation slows, subprime foreclosures will rise even higher in the future. The losses will inevitably have ripple effects throughout the economy and our society as over two million families lose their physical shelter, their major source of financial security, and the social benefits of homeownership.

Comment