The Bubble Meter Capitulates! (http://bubblemeter.blogspot.com/2011...ng-bubble.html)

What do you doomers think of Shadow Stats when framed this way?

For almost six years, Bubble Meter has been trying to warn people about the housing bubble. Unfortunately, we were wrong all along. There never was a housing bubble. I apologize for the error.

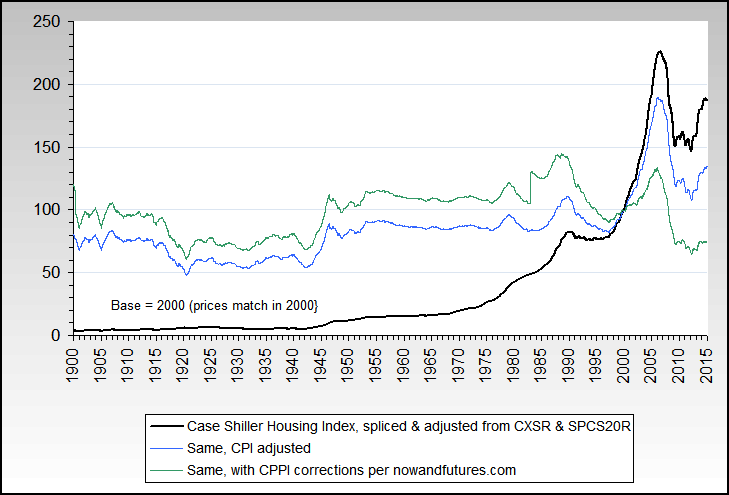

You might think I'm being sarcastic, but I'm not. You see, the belief in a housing bubble rests on housing prices substantially outpacing inflation. If housing prices don't outpace inflation, there can be no bubble. I foolishly assumed that I could trust the inflation numbers published by the U.S. Bureau of Labor Statistics. Bubble Meter's readers have informed me that doing so is pure ignorance.

I admit was wrong. The army of economists crunching the inflation numbers at the BLS are just tools of a corrupt and wicked government. The true inflation numbers come from a guy with no graduate degree in economics who is chief economist at the Shadow Stats website. He sells the true numbers for $175 per year. You know he's not a snake oil salesman or a con artist because he tells you what you already believe. Con artists would never do that. This guy says the government is under-reporting the real inflation numbers. The real inflation numbers are much higher, and have been for decades.

If the true inflation numbers are much higher, then inflation-adjusted housing prices must therefore be much lower. It's a simple rule: higher inflation = lower inflation-adjusted housing prices = much smaller or non-existent housing bubble.

For example, in 2001 when I first spotted what I thought was a housing bubble (silly me), nominal home prices had increased about 8.5% from the year before. But, according to Shadow Stats, inflation was 9.1%. Real home prices actually fell 0.6% that year! What a fool I was for thinking housing prices were rising too fast. They were actually falling!

If the Shadow Stats inflation numbers are right, then home prices must now be deeply undervalued. I say buy, buy, buy!

What do you doomers think of Shadow Stats when framed this way?

For almost six years, Bubble Meter has been trying to warn people about the housing bubble. Unfortunately, we were wrong all along. There never was a housing bubble. I apologize for the error.

You might think I'm being sarcastic, but I'm not. You see, the belief in a housing bubble rests on housing prices substantially outpacing inflation. If housing prices don't outpace inflation, there can be no bubble. I foolishly assumed that I could trust the inflation numbers published by the U.S. Bureau of Labor Statistics. Bubble Meter's readers have informed me that doing so is pure ignorance.

I admit was wrong. The army of economists crunching the inflation numbers at the BLS are just tools of a corrupt and wicked government. The true inflation numbers come from a guy with no graduate degree in economics who is chief economist at the Shadow Stats website. He sells the true numbers for $175 per year. You know he's not a snake oil salesman or a con artist because he tells you what you already believe. Con artists would never do that. This guy says the government is under-reporting the real inflation numbers. The real inflation numbers are much higher, and have been for decades.

If the true inflation numbers are much higher, then inflation-adjusted housing prices must therefore be much lower. It's a simple rule: higher inflation = lower inflation-adjusted housing prices = much smaller or non-existent housing bubble.

For example, in 2001 when I first spotted what I thought was a housing bubble (silly me), nominal home prices had increased about 8.5% from the year before. But, according to Shadow Stats, inflation was 9.1%. Real home prices actually fell 0.6% that year! What a fool I was for thinking housing prices were rising too fast. They were actually falling!

If the Shadow Stats inflation numbers are right, then home prices must now be deeply undervalued. I say buy, buy, buy!

Comment