Re: The Elusive Canadian Housing Bubble

And The Economist mag weighs in with an update. It often pays to bet against the verdicts of The Economist, such as in the late 1990s during the New Economy frenzy when it declared oil prices 'dead forever'. Oil went on to double and double again the next few years, and has never revisited the price at the time of the article since. But I am not so sure Canadian real estate prices are poised to double, and double again, in the next few years. But then what the hell do I know...

Global house prices

Mixed messages

|From the print edition

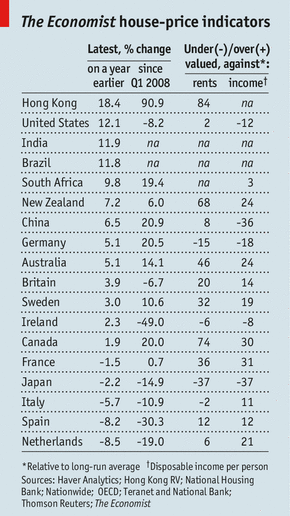

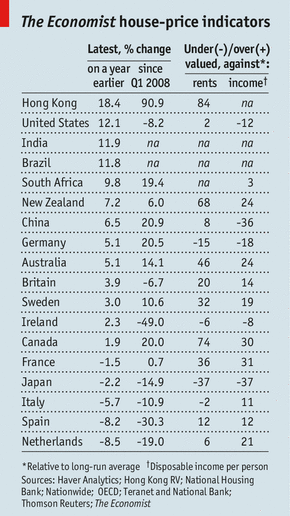

HOUSING markets are prone to boom-and-bust cycles, with prices overshooting then undershooting sustainable levels. To work out whether they are over- or undervalued,The Economist uses two gauges. One assesses affordability by comparing prices with disposable income. The other considers the case for investing in housing by comparing prices with rents. If these ratios are higher than their historical averages (since the mid-1970s) property is overvalued; if they are lower it is undervalued. On this basis, Canada’s house prices are bubbly whereas Japan’s are undeservedly flat (see table)...

And The Economist mag weighs in with an update. It often pays to bet against the verdicts of The Economist, such as in the late 1990s during the New Economy frenzy when it declared oil prices 'dead forever'. Oil went on to double and double again the next few years, and has never revisited the price at the time of the article since. But I am not so sure Canadian real estate prices are poised to double, and double again, in the next few years. But then what the hell do I know...

Global house prices

Mixed messages

|From the print edition

HOUSING markets are prone to boom-and-bust cycles, with prices overshooting then undershooting sustainable levels. To work out whether they are over- or undervalued,The Economist uses two gauges. One assesses affordability by comparing prices with disposable income. The other considers the case for investing in housing by comparing prices with rents. If these ratios are higher than their historical averages (since the mid-1970s) property is overvalued; if they are lower it is undervalued. On this basis, Canada’s house prices are bubbly whereas Japan’s are undeservedly flat (see table)...

Comment