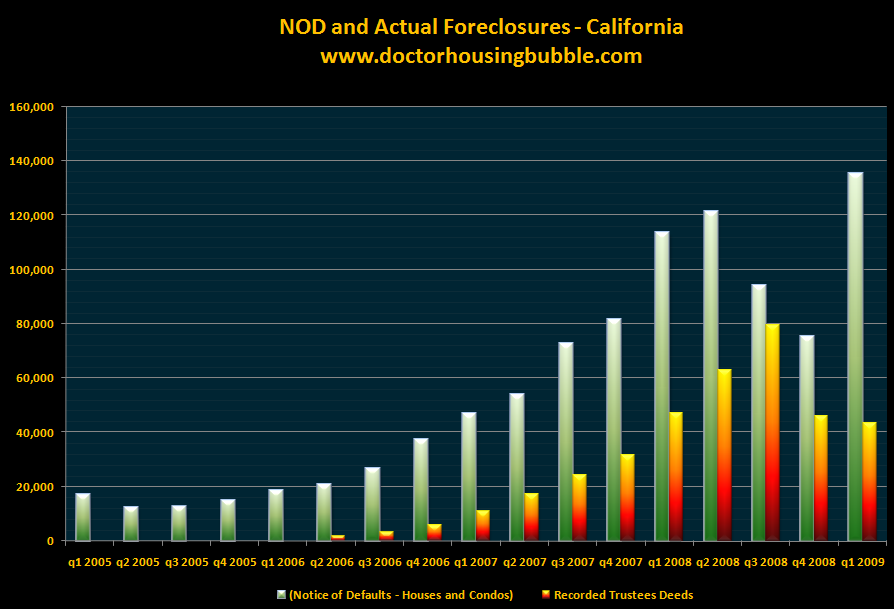

Despite moratoria and what not, economic gravity still asserting itself in the Fruit, Nut, and Flake state

http://blogs.wsj.com/developments/20...-in-california

http://blogs.wsj.com/developments/20...-in-california

The 90-day delinquency rate on dues for the 260 homeowner associations in California managed by Merit Property Management jumped to 5.3% in March from 2.8% last June. Delinquencies first spiked to 2.6% in December 2007 from 0.8% in March 2007.

Comment