Kucinich: Federal Reserve No More "Federal" Than Federal Express! On the floor of Congress

Announcement

Collapse

No announcement yet.

Kucinich: Federal Reserve No More "Federal" Than Federal Express!

Collapse

X

-

Re: Kucinich: Federal Reserve No More "Federal" Than Federal Express!

Are Kucinich and Paul the only two members of Congress who understand the fallacy of the Federal Reserve Bank and the current monetary system? I suspect every time either of them gets the floor the other members glance at one another and roll their eyes in a gesture of "here we go again, more of that Federal Reserve Act mumbo jumbo stuff".

-

Re: Kucinich: Federal Reserve No More "Federal" Than Federal Express!

It would appear they keep not getting the memo.

Why do we go through these political events every 4 years and nobody discusses the handling of the problems?

My conclusion several years ago.

They are not talking about it, becuase they don't plan on fixing it.

Those SSI statements you get annually are worth nothing, because all those amounts that are printed won't be enough to live on where we are going.

Go Badgers at Purdue today!!

Comment

-

Re: Kucinich: Federal Reserve No More "Federal" Than Federal Express!

Senator Jim Bunning.Originally posted by swgprop View PostAre Kucinich and Paul the only two members of Congress who understand the fallacy of the Federal Reserve Bank and the current monetary system? I suspect every time either of them gets the floor the other members glance at one another and roll their eyes in a gesture of "here we go again, more of that Federal Reserve Act mumbo jumbo stuff".

Not only a hall of fame level, flamethrower starting pitcher for the Tigers and Phillies.

http://www.youtube.com/watch?v=paG-PawqWHM

Comment

-

Re: Kucinich: Federal Reserve No More "Federal" Than Federal Express!

This is, really, argument about nothing. So what, if the FED becomes *really* federal, i.e. a government agency instead of banking cartel? Britain and Japan have central banks controlled by the government. Are they much better off? It is be the same Keynesian manipulation supported by the banksters, and all the officials involved in it are purchased by them too.Originally posted by swgprop View PostAre Kucinich and Paul the only two members of Congress who understand the fallacy of the Federal Reserve Bank and the current monetary system? I suspect every time either of them gets the floor the other members glance at one another and roll their eyes in a gesture of "here we go again, more of that Federal Reserve Act mumbo jumbo stuff".

The *really* free financial system can only be based on gold-backed currency. I would even accept some amount of Keynesian tricks, if they don't push the system off the gold standard.медведь

Comment

-

Re: Kucinich: Federal Reserve No More "Federal" Than Federal Express!

Me too. The thing is they know they will run out of gold so they will close it eventually.Originally posted by medved View PostI would even accept some amount of Keynesian tricks, if they don't push the system off the gold standard.

That is the beauty of the gold standard: self-discipline due to honest money.

Comment

-

Re: Kucinich: Federal Reserve No More "Federal" Than Federal Express!

Actually, the only free system is a non-interest based financial setup. The instant that it becomes profitable to get people into debt, then that's the moment that people actually start encouraging others to get into debt. Since banks create the principle, but not the interest, in their loans this system is unsustainable and that's why were having a huge wave of bankruptcies.Originally posted by medved View PostThe *really* free financial system can only be based on gold-backed currency. I would even accept some amount of Keynesian tricks, if they don't push the system off the gold standard.Every interest bearing loan is mathematically impossible to pay back.

Comment

-

Re: Kucinich: Federal Reserve No More "Federal" Than Federal Express!

ricket, I believe your statement is not accurate.Originally posted by ricket View PostActually, the only free system is a non-interest based financial setup. The instant that it becomes profitable to get people into debt, then that's the moment that people actually start encouraging others to get into debt. Since banks create the principle, but not the interest, in their loans this system is unsustainable and that's why were having a huge wave of bankruptcies.

"Interest returns" is necessary to attract capital for new business ventures, ideas, etc. Who would lend without interests? Why take the risks? No lenders taking risks + no ideas being put in practice = no improvements.

Also, I am against inflation as it is a tax on savers, promotes speculation among other things (see Grapejelly's brilliant posts on this).

What I am trying to say, is that inflation and "interest" or "returns" (whatever you want to call it) are two different things.

Comment

-

Re: Kucinich: Federal Reserve No More "Federal" Than Federal Express!

Non-interest based financial setup means:Originally posted by ricket View PostActually, the only free system is a non-interest based financial setup. The instant that it becomes profitable to get people into debt, then that's the moment that people actually start encouraging others to get into debt. Since banks create the principle, but not the interest, in their loans this system is unsustainable and that's why were having a huge wave of bankruptcies.

a) no credit at all, or

b) the savers have to lend their money at no interest.

If I was a saver in this kind of environment (and I tend to spend less, then I earn), I would not lend my money to anybody, period.

Of course, Mr. Kucinich would not tolerate it, and he would force me to lend my money to the state the same way Mr. Stalin did by selling un-redeemable government bonds.медведь

Comment

-

Re: Kucinich: Federal Reserve No More "Federal" Than Federal Express!

Only people who are expecting to make money from having money would not issue any credit at all. Those that couldnt care less will still lend money. If you loan money to a friend, really, all you should care about, is getting the amount owed back. Nothing more, but also nothing less.Originally posted by medved View PostNon-interest based financial setup means:

a) no credit at all, or

b) the savers have to lend their money at no interest.

If I was a saver in this kind of environment (and I tend to spend less, then I earn), I would not lend my money to anybody, period.

Of course, Mr. Kucinich would not tolerate it, and he would force me to lend my money to the state the same way Mr. Stalin did by selling un-redeemable government bonds.

What's so wrong about savers lending money at no interest? If the use of the money has the potential to have big rewards and could lead to a better society for all, then who loses? The "interest" that is gained are those endeavors which the money is used to produce goods that benefit others.

Expecting a return on something and not actually working for it yourself is immoral, because it is usurious. Also called "welfare".Every interest bearing loan is mathematically impossible to pay back.

Comment

-

Re: Kucinich: Federal Reserve No More "Federal" Than Federal Express!

ricket, I still respectfully disagree with you.Originally posted by ricket View PostOnly people who are expecting to make money from having money would not issue any credit at all. Those that couldnt care less will still lend money. If you loan money to a friend, really, all you should care about, is getting the amount owed back. Nothing more, but also nothing less.

What's so wrong about savers lending money at no interest? If the use of the money has the potential to have big rewards and could lead to a better society for all, then who loses? The "interest" that is gained are those endeavors which the money is used to produce goods that benefit others.

Expecting a return on something and not actually working for it yourself is immoral, because it is usurious. Also called "welfare".

First, in a free market environment, the borrower is usually not your brother (or family members) and you do care very much to be compensated fairly for the risk you are taking. So, I suggest steering clear of incorrect and far-fetched assumptions.

You seem to view "interests" as a bad thing; it is not: you can call it "reward for risks and costs" if you will. In a free market, interests are an indicator of risks/rewards associated with a transaction.

This has nothing to do with usury (a totally different topic) since in a free market system, the borrower does not have to borrow and the lender does not have to lend. No one is forcing them. The market will force the "interest costs" or "rewards" towards equilibrium for a given loan.

The "better society" as you say, is derived from successful risk taking ventures, which is only possible precisely if you have lenders willing to take a lot of risks, but also a lot of "rewards" or "interests". This is what drives progress in a society: successful risky endavors.

Again, I would like to repeat that the issue above is also different than the concept of inflation.

Comment

-

Re: Kucinich: Federal Reserve No More "Federal" Than Federal Express!

Largo - I'm not in a position at the moment to argue the point but as a devoted iTulip reader my eyes are constantly being opened to views that I'd not previously considered. Sapiens and Rajiv have posted interesting information sources regarding money. Here is one such document.Originally posted by LargoWinch View Postricket, I still respectfully disagree with you.

First, in a free market environment, the borrower is usually not your brother (or family members) and you do care very much to be compensated fairly for the risk you are taking. So, I suggest steering clear of incorrect and far-fetched assumptions.

Specifically starting at page 37 addressing the concept of interest.

Cheers.

Comment

-

Re: Kucinich: Federal Reserve No More "Federal" Than Federal Express!

swgprop, thanks for the link! I will print and read this week in full.Originally posted by swgprop View PostLargo - I'm not in a position at the moment to argue the point but as a devoted iTulip reader my eyes are constantly being opened to views that I'd not previously considered. Sapiens and Rajiv have posted interesting information sources regarding money. Here is one such document.

Specifically starting at page 37 addressing the concept of interest.

Cheers.

Please remember that my comments are in the context of "business investments" or "risk capital" and not about inflation which I despise.

-W.

Comment

-

Re: Kucinich: Federal Reserve No More "Federal" Than Federal Express!

interest free lending is not what it appears to state prima facae. It does not mean that there are no charges for lending money -- there are charges -- look again at Silvio Gisel's work -- also Margrit Kennedy's -- All it means it that in long term lending, charges cannot accumulate beyond a certain point.

It also forces savers to enter into profit sharing partnerships with entrepreneurs -- profit sharing partnerships are not "interest" -- Successful ventures result in profits, while unsuccessful ones lead to losses for both the investor and the entrepreneur.

Margrit Kennedy

Four Basic Misconceptions About Money

First Misconception

THERE IS ONLY ONE TYPE OF GROWTH

The first misconception relates to growth. We tend to believe that there is only one type of growth, that is, the growth pattern of nature which we have experienced ourselves. Figure 1, however, shows three generically different patterns:

Curve A represents an idealized form of the normal physical growth pattern in nature which our bodies follow, as well as those of plants and animals. We grow fairly quickly during the early stages of our lives, then begin to slow down in our teens, and usually stop growing physically when we are about twenty-one. This, however, does not preclude us from growing further - "qualitatively" instead of "quantitatively."

Curve B represents a mechanical or linear growth pattern, e.g., more machines produce more goods, more coal produces more energy. It comes to an end when the machines are stopped, or no more coal is added.

Curve C represents an exponential growth pattern which may be described as the exact opposite to curve A in that it grows very slowly in the beginning, then continually faster, and finally in an almost vertical fashion. In the physical realm, this growth pattern usually occurs where there is sickness or death. Cancer, for instance, follows an exponential growth pattern. It grows slowly first, although always accelerating, and often by the time it has been discovered it has entered a growth phase where it cannot be stopped. Exponential growth in the physical realm usually ends with the death of the host and the organism on which it depends.

Based on interest and compound interest, our money doubles at regular intervals, i.e., it follows an exponential growth pattern. This explains why we are in trouble with our monetary system today. Interest, in fact, acts like

cancer in our social structure.

Figure 2 shows the time periods needed for our money to double at compound interest rates:

at 3%, 24 years;

at 6%, 12 years;

at 12%, 6 years.

Even at 1% compound interest, we have an exponential growth curve, with a doubling time of 72 years.

Through our bodies we have only experienced the physical growth pattern of nature which stops at an optimal size (Curve A). Therefore, it is difficult for human beings to understand the full impact of the exponential growth pattern in the physical realm.

This phenomenon can best be demonstrated by the famous story of the Persian emperor who was so enchanted with a new chess game that he wanted to fulfill any wish the inventor of the game had. This clever mathematician decided to ask for one seed of grain on the first square

of the chess board doubling the amounts on each of the following squares. The emperor, at first happy about such modesty, was soon to discover that the total yield of his entire empire would not be sufficient to fulfill the "modest" wish. The amount needed on the 64th square of the chess board equals 440 times the yield of grain of the entire planet. (1)

A similar analogy, directly related to our topic, is that one penny invested at the birth of Jesus Christ at 4% interest would have bought in 1750 one ball of gold equal to the weight of the earth. In 1990, however, it would buy

8,190 balls of gold. At 5 % interest it would have bought one ball of gold by the year 1466. By 1990, it would buy 2,200 billion balls of gold equal to the weight of the earth. (2)

The example shows the enormous difference 1 % makes. It also proves that the continual payment of interest and compound interest is arithmetically, as well as practically, impossible. The economic necessity and the mathematical impossibility create a contradiction which - in order to be resolved - has led to innumerable feuds, wars and revolutions in the past.

The solution to the problems caused by present exponential growth is to create a money system which follows the natural growth curve. That requires the replacement of interest by another mechanism to keep money in circulation. This will be discussed in detail in Chapter 2.

Second Misconception

WE PAY INTEREST ONLY IF WE BORROW MONEY

A further reason why it is difficult for us to understand the full impact of the interest mechanism on our monetary system is that it works in a concealed way. Thus the second common misconception is that we pay interest only when we borrow money, and, if we want to avoid paying

interest, all we need to do is avoid borrowing money.

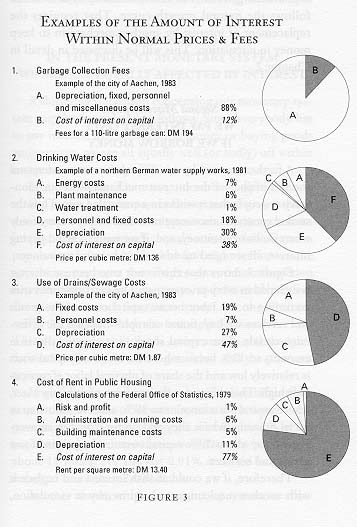

Figure 3 shows that this is not true because interest is included in every price we pay. The exact amount varies according to the labor versus capital costs of the goods and services we buy. Some examples indicate the difference clearly. The capital share in garbage collection amounts to 12 % because here the share of capital costs is relatively low and the share of physical labor is particularly high. This changes in the provision of drinking water, where capital costs amount to 38 %, and even more so in social housing, where they add up to 77 %. On an average we pay about 50% capital costs in the prices of our goods and services.

Therefore, if we could abolish interest and replace it with another mechanism to keep money in circulation, most of us could either be twice as rich or work half of the time to keep the same standard of living we have now.

Third Misconception

IN THE PRESENT MONETARY SYSTEM

WE ARE ALL EQUALLY AFFECTED BY INTEREST

A third misconception concerning our monetary system may be formulated as follows: Since everybody has to pay interest when borrowing money or buying goods and services, we are all equally well (or badly) off within

our present monetary system.

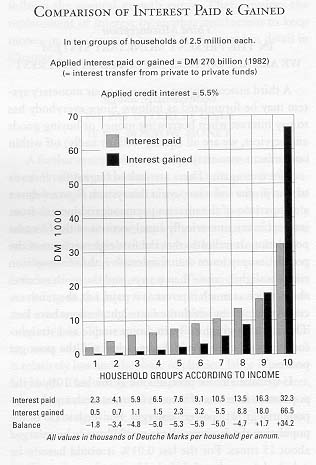

Not true again. There are indeed huge differences as to who profits and who pays in this system. Figure 4 shows a comparison of the interest payments and income from interest in ten numerically equal sections of the German

population. It indicates that the first eight sections of the population pay more than they receive, the ninth section receives slightly more than it pays, and the tenth receives about twice as much interest as it pays, i.e., the tenth receives the interest which the first eight sections have lost. This explains graphically, in a very simple and straight-forward way, why "the rich get richer and the poor get poorer."

If we take a more precise look at the last 10% of the population in terms of income from interest, another exponential growth pattern emerges. For the last 1 % of the population the income column would have to be enlarged

about 15 times. For the last 0.01 % it would have to be enlarged more than 2,000 times.

In other words, within our monetary system we allow the operation of a hidden redistribution mechanism which constantly shuffles money from those who have less money than they need to those who have more money than they need. This is a different and far more subtle and effective form of exploitation than the one Marx tried to overcome. There is no question, that he was right in pointing to the source of the "added value" in the production sphere. The distribution of the "added value," however, happens to a large extent in the circulation sphere. This can be seen more clearly today than in his time. Ever larger amounts of money are concentrated in the hands of ever fewer individuals and corporations. For instance, the cash flow surplus, which refers to money floating around the world to wherever gains may be expected from changes in national currency or stock exchange rates, has more than doubled since 1980. The daily exchange of currencies in New York alone grew from $18 billion to $50 billion between 1980 and 1986. (3) The World Bank has estimated that money transactions on a world wide scale are from 15 to 20 times greater than necessary for financing world trade. (4)

The interest and compound interest mechanism not only creates an impetus for pathological economic growth but, as Dieter Suhr has pointed out, it works against the constitutional rights of the individual in most countries. (5)

If a constitution guarantees equal access by every individual to government services - and the money system may be defined as such - then it is illegal to have a system in which 10% of the people continually receive more than they pay for that service at the expense of 80% of the people who receive less than they pay.

It may seem as if a change in our monetary system would serve "only" 80% of the population, i.e., those who at present pay more than their fair share. However, I will show in Chapter 3 that everybody profits from a cure, even those who profit from the cancerous system we have now.

Fourth Misconception

INFLATION IS AN INTEGRAL PART OF FREE MARKET ECONOMIES

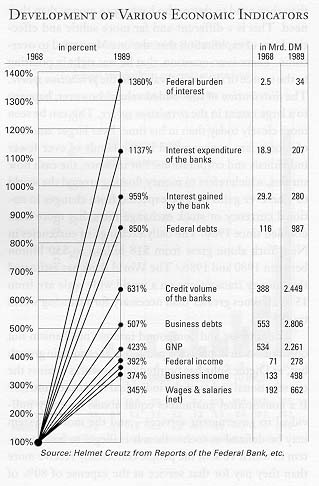

A fourth misconception relates to the role of inflation in our economic system. Most people see inflation as an integral part of any money system, almost "natural," since there is no capitalist country in the world with a free market economy without inflation. Figure 5, Development of Various Economic Indicators, shows some of the factors that may cause inflation. While the governmental income, the Gross National Product, and the salaries and wages of the average income earner "only" rose by about 400% between 1968 and 1989, the interest payments of the government rose by 1,360%.

The tendency is clear - government debts will sooner or later outgrow government income, even in the industrialized nations. If a child grew three times its size, say, between the ages of one and nine, but its feet grew to eleven times their size, we would call it sick. The problem here is that very few people care to see the signs of sickness in the monetary system, even fewer people know a remedy, and nobody has been able to set up a "healthy" working model which has lasted.

Few realize that inflation is just another form of taxation through which governments can somewhat overcome the worst problems of increasing debt. Obviously, the larger the gap between income and debt, the higher the inflation needed. Allowing the central banks to print money enables governments to reduce debts. Figure 6 shows the reduction of the value of the DM between 1950 and 1989. This devaluation hit that 80% of the people hardest who pay more most of time. They usually cannot withdraw their assets into "inflation-resistant" stocks, real estate or other investments like those who are in the highest 10% income bracket.

Economic historian, John L. King, links inflation to the interest paid for the "credit balloon." In a private letter to me, dated January 8, 1988, he states:

I have written extensively about interest being the major cause of rising prices now since it is buried in the price of all that we buy, but this idea, though true, is not well accepted. $9 trillion in domestic U.S. debt, at 10% interest, is $900 billion paid in rising prices and this equates to the current 4% rise in prices experts perceive to be inflation. I have always believed the compounding of interest to be an invisible wrecking machine, and it is hard at work right now.

So we must get rid of this mindless financial obsession.

A 1,000% expansion of private and public debt occurred in the U.S.A. during the last 33 years, the largest share coming from the private sector. But every resource of the Federal Government was utilized to spur this growth: loan guarantees, subsidized mortgage rates, low down-payments, easy terms, tax credits, secondary markets, deposit insurances, etc. The reason for this policy is that the only way to make the consequences of the interest system bearable for the large majority of the population is to create an economic growth which follows the exponential growth rate of money - a vicious circle with an accelerating, spiraling effect.

Whether we look at inflation, social equity, or environmental consequences, it would seem sensible from many points of view to replace the "mindless financial obsession" with a more adequate mechanism to keep money in circulation.

Comment

Comment