Re: Global Monetary Breakdown: Part I

After endless delays, a gigantic, boil the ocean iTulip article is published tomorrow, with a wart or two, but we got to get it out. It's driving us crazy!

Relevant to this topic:

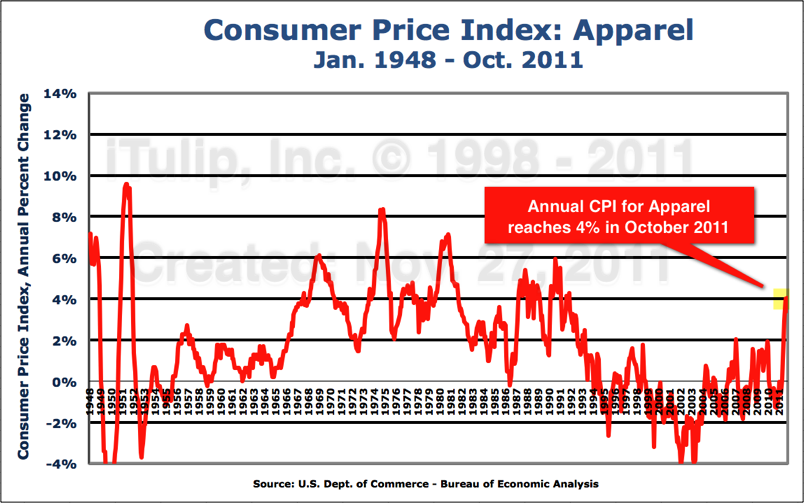

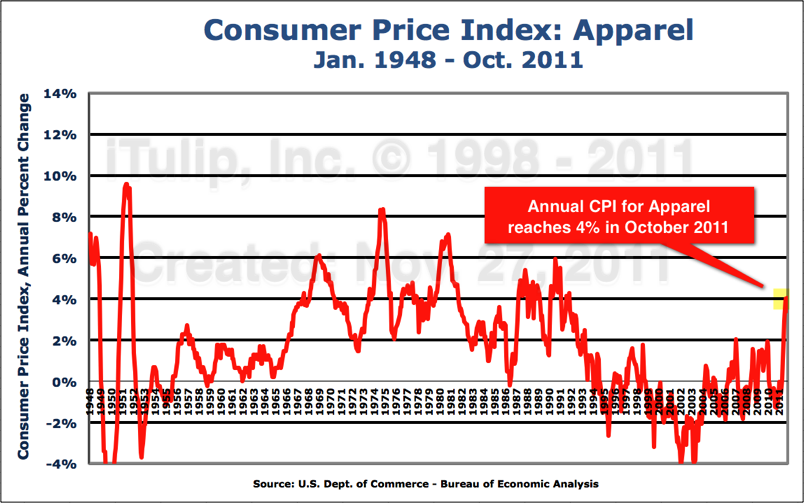

Across the board, including traditionally low inflation items, we found inflation. For example, apparel.

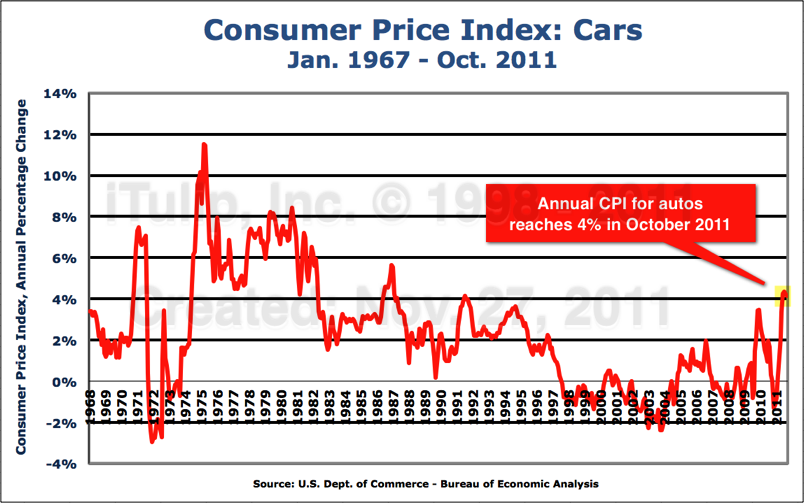

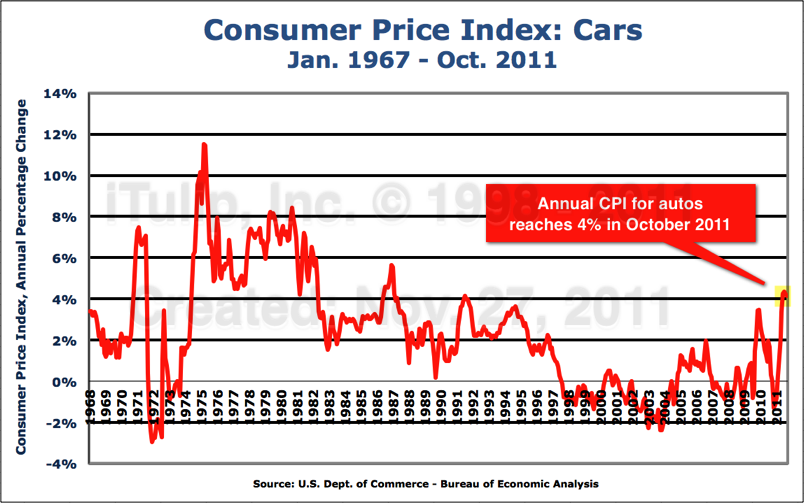

Auto consumer price index jumps more than at any point during The Great Inflation of 1975 to 1980.

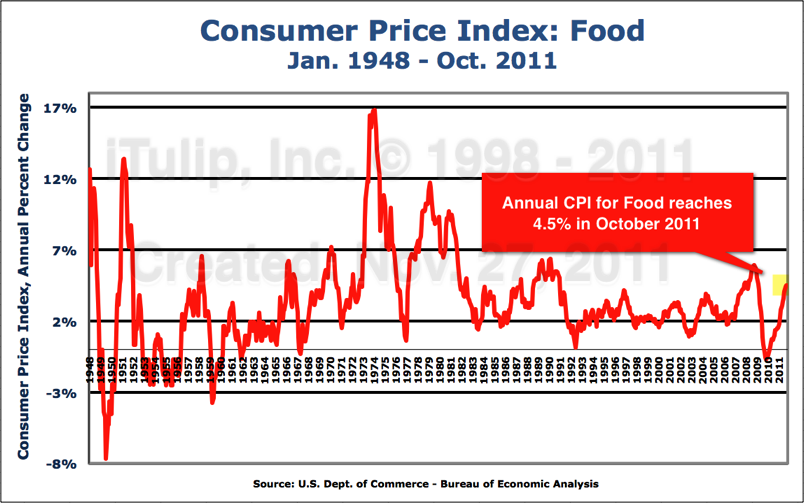

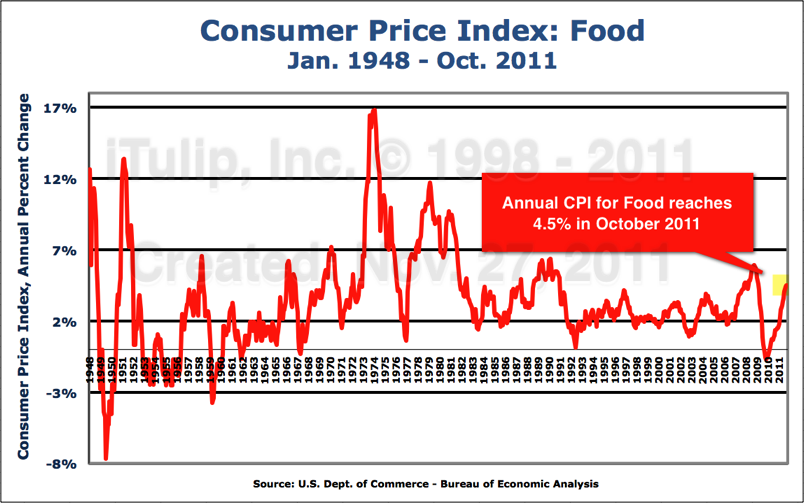

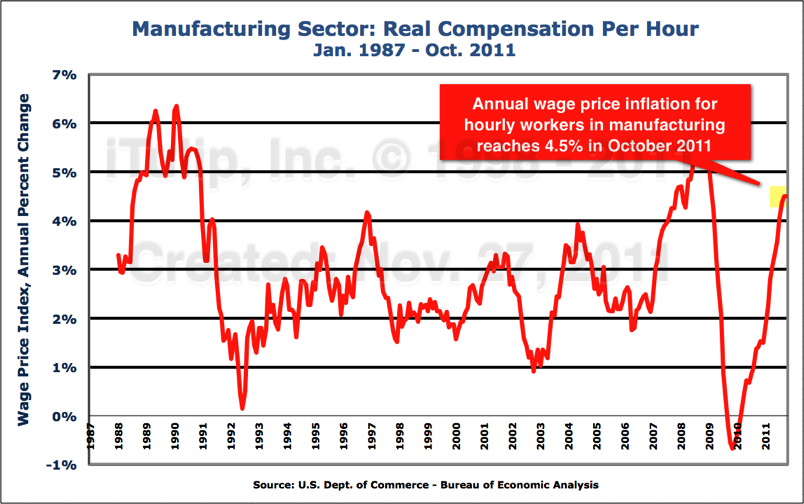

Is wage price inflation keeping up with food, apparel, cars, and other goods price inflation? Nominal wages cannot rise with an output gap stuck at 7%. Due to rising inflation, they are falling rapidly in real terms.

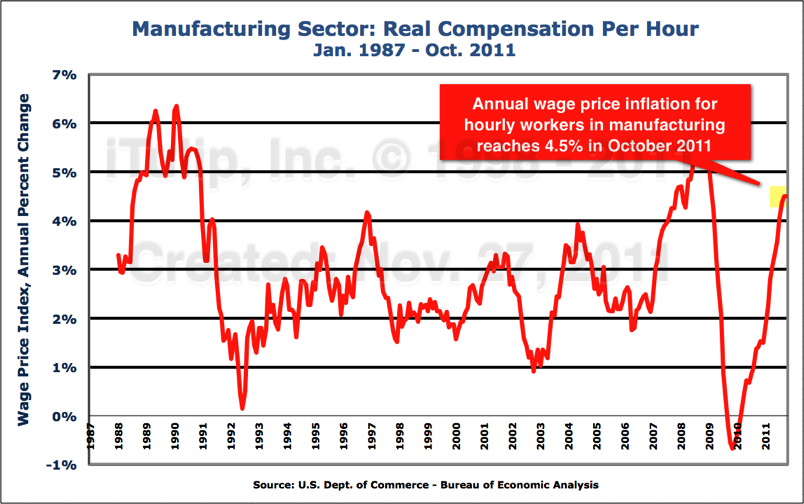

The only sector where wage inflation is keeping up with goods price inflation is, ironically, in the manufacturing sector.

Final push to birth this bad boy tomorrow AM!

Originally posted by raja

View Post

Relevant to this topic:

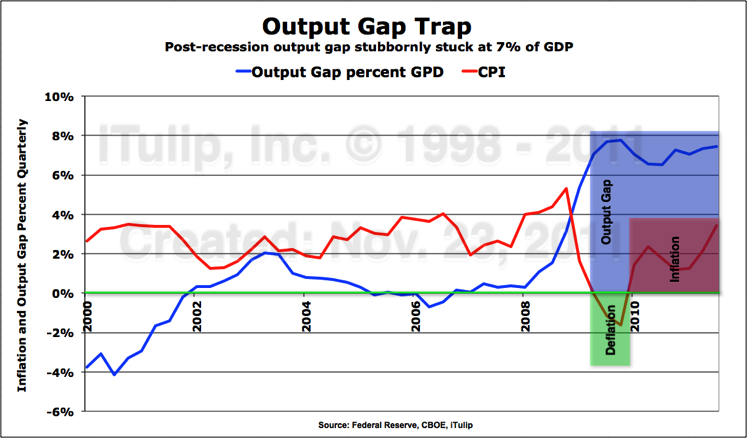

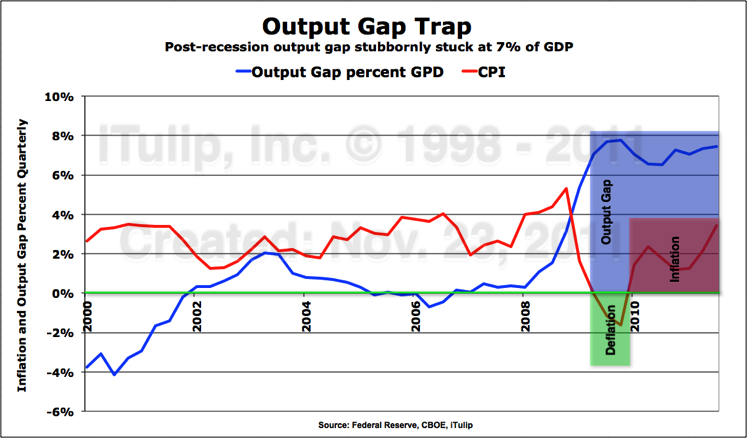

As the chart below shows, a two year, 7% of GDP output gap has not kept inflation from rising beyond the Fed's 3% comfort zone.

Output Gap + Inflation = Stagflation

Output Gap + Inflation = Stagflation

Across the board, including traditionally low inflation items, we found inflation. For example, apparel.

Auto consumer price index jumps more than at any point during The Great Inflation of 1975 to 1980.

Is wage price inflation keeping up with food, apparel, cars, and other goods price inflation? Nominal wages cannot rise with an output gap stuck at 7%. Due to rising inflation, they are falling rapidly in real terms.

The only sector where wage inflation is keeping up with goods price inflation is, ironically, in the manufacturing sector.

Final push to birth this bad boy tomorrow AM!

Comment