Our opinion isn't that the Fed is an inherently bad institution any more than is the European Central Bank, the Bank of Japan, the People's Bank of China, or any other central bank.

The principle here is that the concept of free and efficient markets needs apply evenly not selectively. If it's okay for a business such as US auto parts company that fail because it bet the wrong way on the US auto industry, financial companies that make losing market bets should also be allowed to fail. Even the Japanese, famous for using public funds to support corrupt banks that made uneconomic loans to favored bank clients, allowed their second largest financial firm to go under in the early 1990s after their credit bubble popped. The head of the Japanese Ministry of Finance put it well when asked why the firm was allowed to fail: "Easy come, easy go."

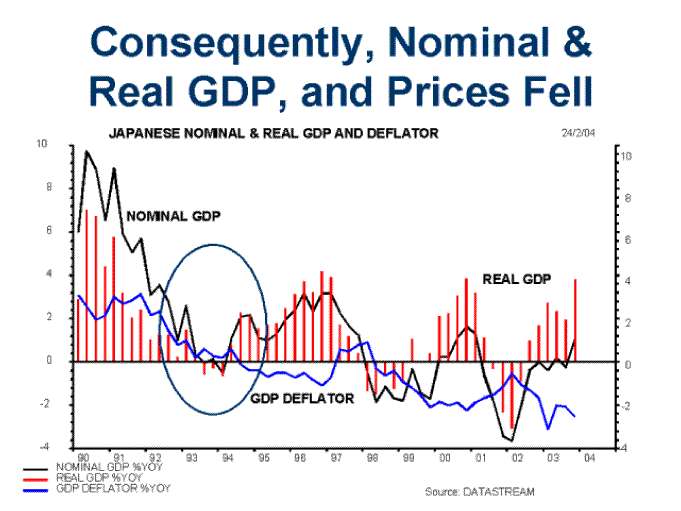

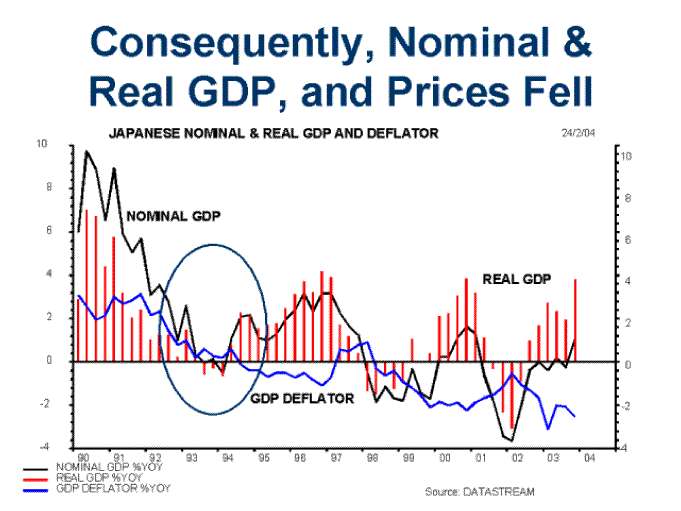

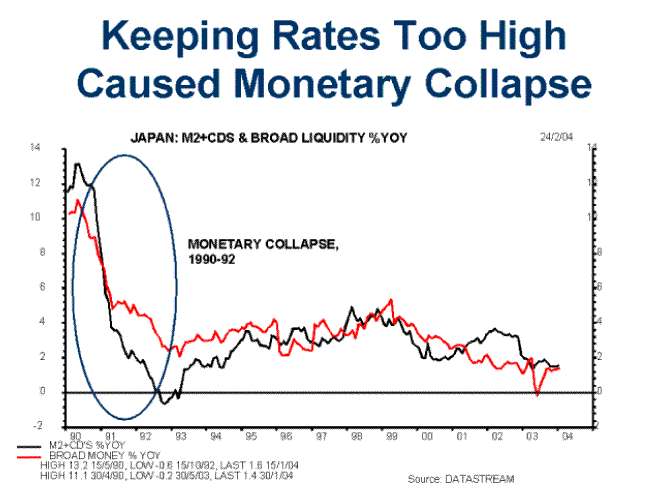

Of course, the Fed will need to step in at some point. We don't want our collapsing credit bubble to go the way the Japanese bubble went, like this...

... followed by this...

On a personal note, we feel bad for Cramer. His people are not managing him appropriately. Perhaps they are aware that his mental health is suffering under the stress of being on the wrong side of the market and they are exploiting this for the entertainment value.

We'll update you with some of the more amusing comments we're getting on the video from other sites, such as this one from the UK:

The US Recession: ARMAGEDDON IT!

LOL-worthy bit where argues with the host about the nature of "Armageddon".

Is this the same Cramer that was ramping up the market not six months ago?

Still, better late than never.

Man, I wish we had entertaining financial coverage like this, it is a huge gap in the British media. The BBC just have a succession of boring people who offer commentary, but never really any opinions or analysis (I suppose a public sector broadcaster has problems going there). The UK version of this is some guy saying "There are limited reasons for concern at the present time" and blinking a lot. The rest don't even bother.

The principle here is that the concept of free and efficient markets needs apply evenly not selectively. If it's okay for a business such as US auto parts company that fail because it bet the wrong way on the US auto industry, financial companies that make losing market bets should also be allowed to fail. Even the Japanese, famous for using public funds to support corrupt banks that made uneconomic loans to favored bank clients, allowed their second largest financial firm to go under in the early 1990s after their credit bubble popped. The head of the Japanese Ministry of Finance put it well when asked why the firm was allowed to fail: "Easy come, easy go."

Of course, the Fed will need to step in at some point. We don't want our collapsing credit bubble to go the way the Japanese bubble went, like this...

... followed by this...

On a personal note, we feel bad for Cramer. His people are not managing him appropriately. Perhaps they are aware that his mental health is suffering under the stress of being on the wrong side of the market and they are exploiting this for the entertainment value.

We'll update you with some of the more amusing comments we're getting on the video from other sites, such as this one from the UK:

The US Recession: ARMAGEDDON IT!

LOL-worthy bit where argues with the host about the nature of "Armageddon".

Is this the same Cramer that was ramping up the market not six months ago?

Still, better late than never.

Man, I wish we had entertaining financial coverage like this, it is a huge gap in the British media. The BBC just have a succession of boring people who offer commentary, but never really any opinions or analysis (I suppose a public sector broadcaster has problems going there). The UK version of this is some guy saying "There are limited reasons for concern at the present time" and blinking a lot. The rest don't even bother.

Comment