Re: Steve Keen talk at Google

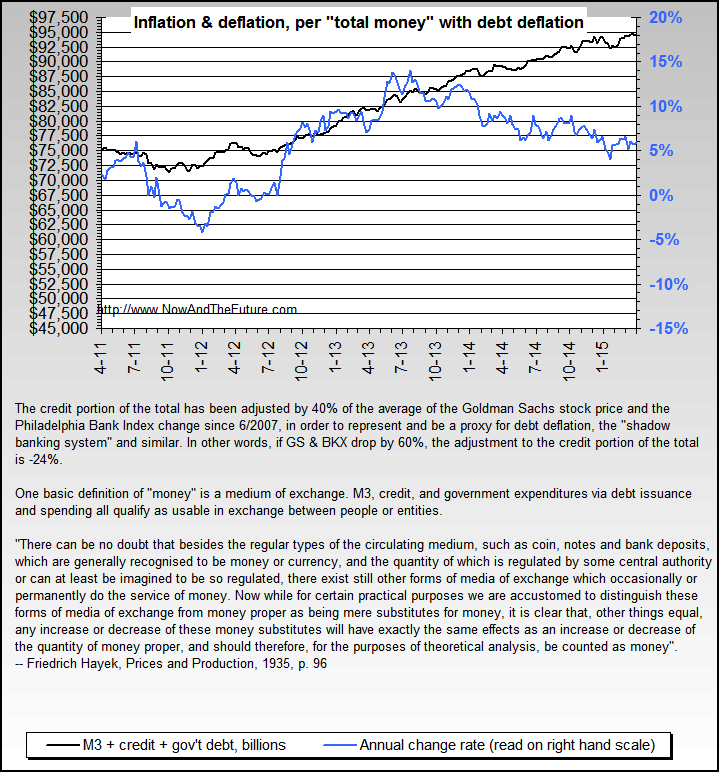

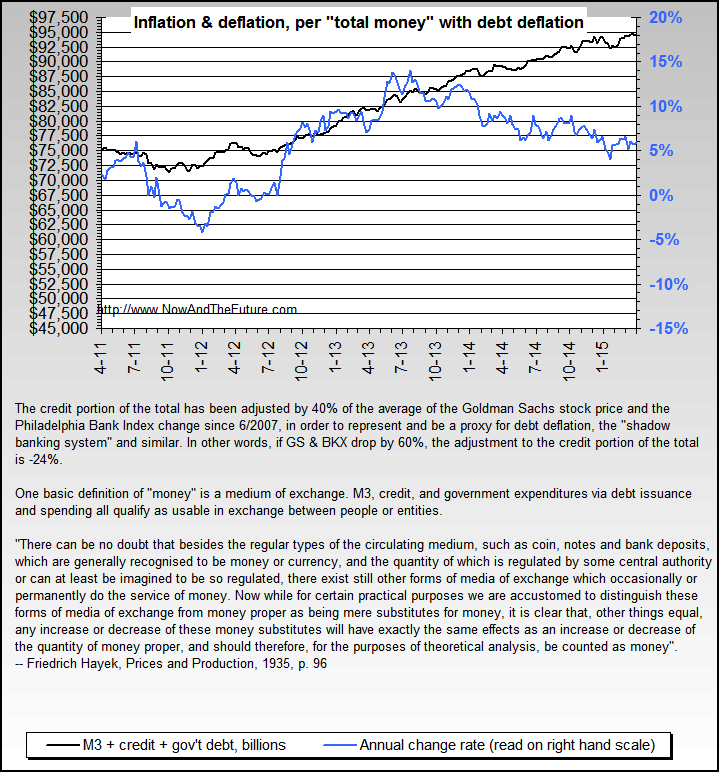

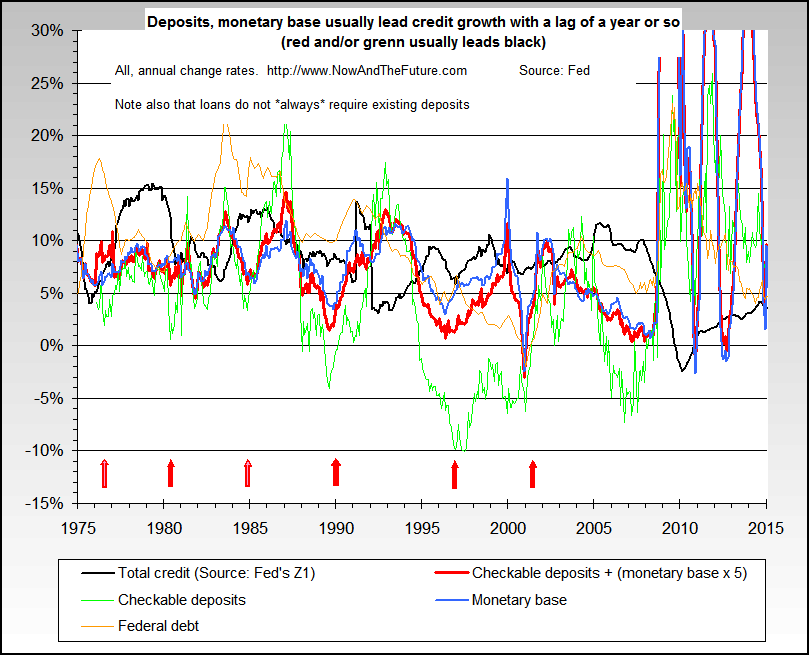

Throughout my various research efforts, I've found so many ways to try and get a handle on the big inflation vs. deflation question that my mind has been known to boggle... and here's my best shot so far, and even it does not include anything about velocity or monetary lags.

Throughout my various research efforts, I've found so many ways to try and get a handle on the big inflation vs. deflation question that my mind has been known to boggle... and here's my best shot so far, and even it does not include anything about velocity or monetary lags.

Comment