Unlike the US and the EU, there's no need to go through congress or parliament for money to be printed, just one phone call from the politburo to the central bank governor is enough.

We've read some articles that says China has stopped purchasing US debt (US dollar) for almost a year, as less dollar flow into China due to US recession - perhaps C1ue can elaborate on this.

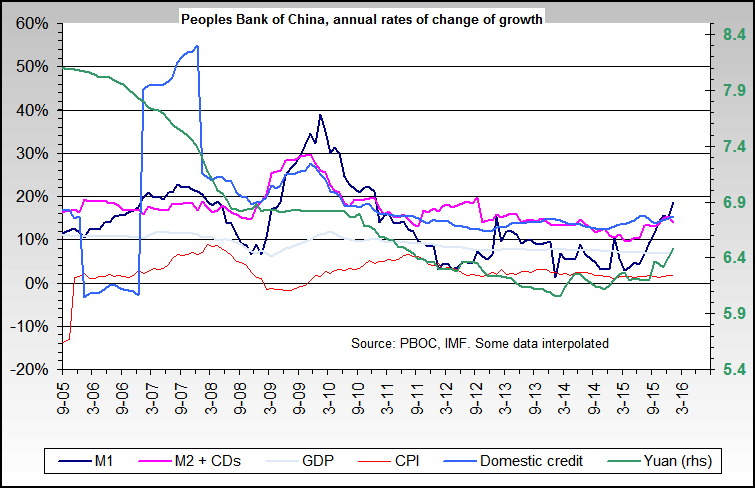

Since the US is busily printing money, the RMB should rise if the Chinese government stopped buying US dollars (and sell RMB). But the RMB did not rise, and is at parity with the dollar (even falling against many Asian currencies and the Euro). Such a situation can occur if China is printing huge quantities of RMB though bank loans, depressing the RMB. If this is true, China banks have lent out a few trillion yuan in new bank loans, much of which has gone into property, stock and commodity markets.

If the US Fed starts withdrawing liquidity from the market and raising rates, China may have to recall the bank loans if the huge liquidity would make the RMB depreciate against the dollar - a political embarrassing situation that must not happen, particularly so when the US and Europe is asking China to let the RMB appreciate.

So a rising US interest rate may create a double whammy for Asian markets. First, a rising interest rate may mean higher holding costs for speculators, Second, as China banks withdraw credit, Chinese state companies that used bank overdraft to speculate will now have to dump their property purchases financed (probably illegally) using state bank loans. Individuals tight on credit will also be affected.

We've know what will happen to the market when banks stop lending out money to home buyers, but have we seen what happens when banks start canceling loans that went into real estate?

Disclaimer - I'm no economist grad or expert, this is my simplistic view, please correct me if I'm wrong.

We've read some articles that says China has stopped purchasing US debt (US dollar) for almost a year, as less dollar flow into China due to US recession - perhaps C1ue can elaborate on this.

Since the US is busily printing money, the RMB should rise if the Chinese government stopped buying US dollars (and sell RMB). But the RMB did not rise, and is at parity with the dollar (even falling against many Asian currencies and the Euro). Such a situation can occur if China is printing huge quantities of RMB though bank loans, depressing the RMB. If this is true, China banks have lent out a few trillion yuan in new bank loans, much of which has gone into property, stock and commodity markets.

If the US Fed starts withdrawing liquidity from the market and raising rates, China may have to recall the bank loans if the huge liquidity would make the RMB depreciate against the dollar - a political embarrassing situation that must not happen, particularly so when the US and Europe is asking China to let the RMB appreciate.

So a rising US interest rate may create a double whammy for Asian markets. First, a rising interest rate may mean higher holding costs for speculators, Second, as China banks withdraw credit, Chinese state companies that used bank overdraft to speculate will now have to dump their property purchases financed (probably illegally) using state bank loans. Individuals tight on credit will also be affected.

We've know what will happen to the market when banks stop lending out money to home buyers, but have we seen what happens when banks start canceling loans that went into real estate?

Disclaimer - I'm no economist grad or expert, this is my simplistic view, please correct me if I'm wrong.

Comment