The idea of this thread is to simply post graphs and charts of interest without necessarily providing much context or clarification. That way we can get a lot of relevant data out there without obsessing over whether the post meets some kind of quality standard. I've had threads like these on other forums and they tend to be very successful.

I'll kick off the thread with these three:

http://www.theoildrum.com/node/9583

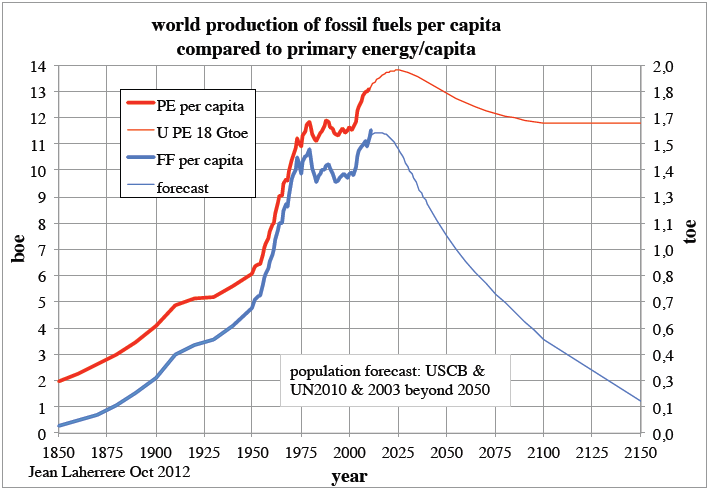

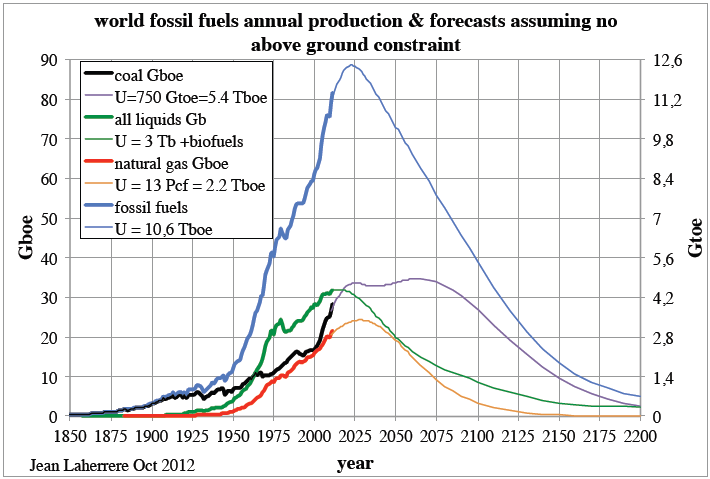

I like the first two for their historical data more so than for their forecasts because I don't really know enough about the model they are generated from to cast judgment. Notice that the development of energy usage changed radically somewhere in the 1970s. Is it a coincidence that the gold standard was dropped around the same time and massive changes to the US monetary regime took place?

I'll kick off the thread with these three:

http://www.theoildrum.com/node/9583

I like the first two for their historical data more so than for their forecasts because I don't really know enough about the model they are generated from to cast judgment. Notice that the development of energy usage changed radically somewhere in the 1970s. Is it a coincidence that the gold standard was dropped around the same time and massive changes to the US monetary regime took place?

Comment