Webster Tarpley has an article at online journal

Fed attempts to bail out bankrupt Wall Street speculators; Cheney demands staged terror attacks, war with Iran -- part 1

Fed attempts to bail out bankrupt Wall Street speculators; Cheney demands staged terror attacks, war with Iran -- part 2

Fed attempts to bail out bankrupt Wall Street speculators; Cheney demands staged terror attacks, war with Iran -- part 1

On August 9-10, the European Central Bank, the Bank of Japan, the Federal Reserve, plus the central banks of Australia, Norway, Switzerland, and other countries “injected” the equivalent about a third of a trillion dollars ($325 billion) into the money systems of the world. The Bank of Japan handed out a dramatic ¥1 trillion, about $8.5 billion. The European Central Bank showed signs of panic, or of realism, by spewing out about €160 billion over two days. Their goal was to stave off a spreading panic at bond trading desks and in the capital markets of the world about junk bonds, collateralized debt obligations (CDOS), mortgage backed securities, and other paper debt instruments.

At about 9 AM on Friday August 10, the Chicago futures markets suggested that the Dow Jones Industrial average would open down about 190 points. That meant the potential for spreading stock market panic, with the DJIA closing down 1,000 to 2,000 points or more by the end of the day, quite possibly pitching more banks and hedge funds into bankruptcy. Such an event would also tend to awaken the US middle class to the fact that their 401 (K) and IRA pension plans were being liquidated. This would make the financial crisis a political crisis as well, and perhaps stoke the fires of impeachment. Helicopter Ben therefore followed his predecessor, Bubbles Greenspan, on the path of bailout, although on a larger scale than what Greenspan had ever attempted in public. Bernanke and the New York Fed bought up $38 billion of toxic mortgage-backed securities from the principal hyenas of Wall Street -- led, we can be sure, by Goldman Sachs, Bear Stearns, Lehman Brothers, J.P. Morgan Chase, Merrill Lynch, and Citibank. For bailout purposes, the banks were given a sweetheart interest rate, just 4 percent, less than the 5.25 percent target Fed funds rate used for interbank lending, and much less than the 6.25 percent the Fed requires from banks coming to its own discount window under normal circumstances. The $38 billion, injected in three doses during the course of the day, in addition to other Fed measures, was almost enough to prop the market up for eight hours -- the Dow closed with a loss of 31 points. So the central banks will need to provide more fixes, sooner rather than later.

.

.

.

Wall Street derivatives monsters -- too big to bail out

It would take more than $38 billion to bail out Goldman, Bear, Merrill, and the rest. The bonds of the firms just mentioned are already rated as high-risk junk. The Wall Street banks and investment banks represent a black hole into which literally trillions of dollars could disappear without a trace -- it is enough to cite the derivatives holdings of JP Morgan Chase and Citibank, who are listed in the spring 2007 report of the Controller of the Currency as having $105 trillion in derivatives between them, and the reality is a multiple of that. In addition, there is fear of the unknown. This past week traders from Rick Santelli in Chicago to London stock touts have reported that a large financial entity -- something probably bigger than Goldman Sachs -- has been selling off a portfolio of some $10 to $15 billion in value. No one has said publicly what this entity is, or what this “unprecedented event” might represent. A few days ago, oil hit an all-time high of $78 per barrel. It then fell back 10 percent, because so much of the price of oil -- at least $30 at present levels -- is pure hedge fund speculation. And these hedge funds, as they near bankruptcy, massively sell off oil futures. Gold has taken some nasty dips for the same reason.

At about 9 AM on Friday August 10, the Chicago futures markets suggested that the Dow Jones Industrial average would open down about 190 points. That meant the potential for spreading stock market panic, with the DJIA closing down 1,000 to 2,000 points or more by the end of the day, quite possibly pitching more banks and hedge funds into bankruptcy. Such an event would also tend to awaken the US middle class to the fact that their 401 (K) and IRA pension plans were being liquidated. This would make the financial crisis a political crisis as well, and perhaps stoke the fires of impeachment. Helicopter Ben therefore followed his predecessor, Bubbles Greenspan, on the path of bailout, although on a larger scale than what Greenspan had ever attempted in public. Bernanke and the New York Fed bought up $38 billion of toxic mortgage-backed securities from the principal hyenas of Wall Street -- led, we can be sure, by Goldman Sachs, Bear Stearns, Lehman Brothers, J.P. Morgan Chase, Merrill Lynch, and Citibank. For bailout purposes, the banks were given a sweetheart interest rate, just 4 percent, less than the 5.25 percent target Fed funds rate used for interbank lending, and much less than the 6.25 percent the Fed requires from banks coming to its own discount window under normal circumstances. The $38 billion, injected in three doses during the course of the day, in addition to other Fed measures, was almost enough to prop the market up for eight hours -- the Dow closed with a loss of 31 points. So the central banks will need to provide more fixes, sooner rather than later.

.

.

.

Wall Street derivatives monsters -- too big to bail out

It would take more than $38 billion to bail out Goldman, Bear, Merrill, and the rest. The bonds of the firms just mentioned are already rated as high-risk junk. The Wall Street banks and investment banks represent a black hole into which literally trillions of dollars could disappear without a trace -- it is enough to cite the derivatives holdings of JP Morgan Chase and Citibank, who are listed in the spring 2007 report of the Controller of the Currency as having $105 trillion in derivatives between them, and the reality is a multiple of that. In addition, there is fear of the unknown. This past week traders from Rick Santelli in Chicago to London stock touts have reported that a large financial entity -- something probably bigger than Goldman Sachs -- has been selling off a portfolio of some $10 to $15 billion in value. No one has said publicly what this entity is, or what this “unprecedented event” might represent. A few days ago, oil hit an all-time high of $78 per barrel. It then fell back 10 percent, because so much of the price of oil -- at least $30 at present levels -- is pure hedge fund speculation. And these hedge funds, as they near bankruptcy, massively sell off oil futures. Gold has taken some nasty dips for the same reason.

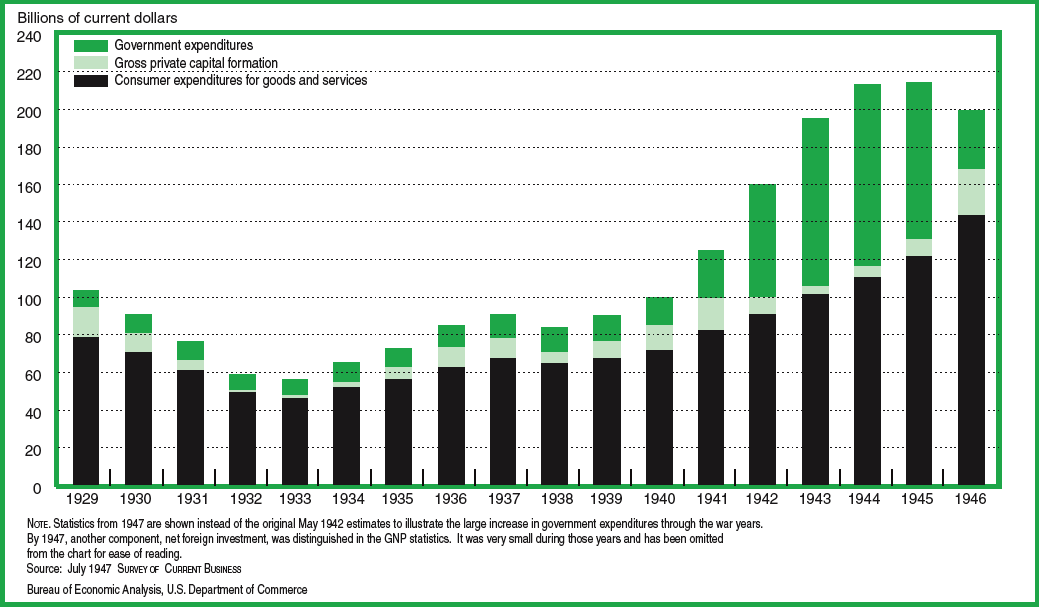

In Surviving the Cataclysm, my 1999 study of the world financial crisis, I developed the distinction between collapse and disintegration. A collapse can be very serious, like the Wall Street crash of 1929. Prices plummet, but the exchange still remains open for business. Disintegration is much more serious, like the British default of September 1931 that swept away the only monetary system the world had in those days, or the German hyperinflation of 1923, which wiped out the entire German middle class.

The US crash of 1987 was a classic collapse, and it was followed by a short recovery of sorts. What is happening today looks much more like disintegration, meaning that credit markets, including bond and junk bond markets, have partly ceased to function as far as non-government securities are concerned.

.

.

.

Not just one bankrupt hedge fund, but two dozen -- for starters

Back in September 1998, at the time of the Russian state bankruptcy around bonds called GKOs, Long Term Capital Management (LTCM), a Connecticut hedge fund, went bankrupt, blowing a hole of several hundred billion dollars in the world banking system. LTCM used high leverage and the Black-Scholes model to place gigantic bets on currency movements. If Greenspan had not rushed in with billions of Fed money to carry out a backdoor crony bailout, the interbank clearing systems of the US, UK, and perhaps Japan -- known as CHIPS, CHAPS, and BoJ Net -- would have jammed up, and the hearts of the financier universe would have ceased to beat, leading swiftly to world economic chaos and depression.

But this time it is not one LTCM, but two dozen highly-leveraged hedge funds which have blown up or are about to. Prominent among them are the so-called quant funds, which bet $10 billion and up on financial fluctuations using computerized predictive models. Prominent among these is Renaissance. The quants complain that their models, which are supposed to incorporate 45 years of market history and experience, are now failing to forecast what will happen next, and losses are mounting. The reason is that we have now encountered a cataclysmic singularity which has not been seen in more than half a century -- the beginning of the end of the US dollar. To find a financial earthquake comparable to the present one touching the leading currency of the world, we must in fact go back to the disintegration of the British pound in September 1931.

In recent days, reality has filtered through, even on CNBC. Commentators have warned of “systemic risk if a big bank blows,” “the end of the world,” “depression,” “Armageddon,” “panic,” “the Hindenburg” (the dirigible, not the signal), “a return to 1990” (when Citibank was bankrupt and secretly seized by the Controller of the Currency), the crash of 1987, the hedge fund crisis of 1998, and a “credit crunch.” “Bond traders are afraid.” “Wall Street is afraid.” Led by Jim Cramer with his celebrated on-air psychotic episode on the afternoon of Friday, August 3, Wall Street has been heaping insults on Helicopter Ben and demanding that he open the cash spigots, cut the fed funds and discount rates drastically and quickly, and reassure the stockjobbers that backdoor crony bailouts will be available for all, starting with the too big to fail, like JP Morgan Chase and Citibank.

The tip of the iceberg: Financial institutions in trouble

3 Bear Stearns hedge funds

3 BNP Parisbas funds

3 Goldman Sachs funds: Global Alpha, North American Equity Opportunities, North American Equity Opportunities

Sowood hedge fund -- absorbed by Citadel to mask impact

Bowa Commercial Bank, Taiwan -- seized by regulators

Renaissance (quant)

Luminent

Westdeutsche Landesbank hedge fund

IKB Industriebank, Germany

Deutsche Bank ABS hedge fund

AQR Capital Management (quant)

Washington Mutual

Countrywide

American Home Mortgage

Basis Capital

Absolute Capital

Macquarie Bank of Australia

Homebanc

Man Group (UK)

The US crash of 1987 was a classic collapse, and it was followed by a short recovery of sorts. What is happening today looks much more like disintegration, meaning that credit markets, including bond and junk bond markets, have partly ceased to function as far as non-government securities are concerned.

.

.

.

Not just one bankrupt hedge fund, but two dozen -- for starters

Back in September 1998, at the time of the Russian state bankruptcy around bonds called GKOs, Long Term Capital Management (LTCM), a Connecticut hedge fund, went bankrupt, blowing a hole of several hundred billion dollars in the world banking system. LTCM used high leverage and the Black-Scholes model to place gigantic bets on currency movements. If Greenspan had not rushed in with billions of Fed money to carry out a backdoor crony bailout, the interbank clearing systems of the US, UK, and perhaps Japan -- known as CHIPS, CHAPS, and BoJ Net -- would have jammed up, and the hearts of the financier universe would have ceased to beat, leading swiftly to world economic chaos and depression.

But this time it is not one LTCM, but two dozen highly-leveraged hedge funds which have blown up or are about to. Prominent among them are the so-called quant funds, which bet $10 billion and up on financial fluctuations using computerized predictive models. Prominent among these is Renaissance. The quants complain that their models, which are supposed to incorporate 45 years of market history and experience, are now failing to forecast what will happen next, and losses are mounting. The reason is that we have now encountered a cataclysmic singularity which has not been seen in more than half a century -- the beginning of the end of the US dollar. To find a financial earthquake comparable to the present one touching the leading currency of the world, we must in fact go back to the disintegration of the British pound in September 1931.

In recent days, reality has filtered through, even on CNBC. Commentators have warned of “systemic risk if a big bank blows,” “the end of the world,” “depression,” “Armageddon,” “panic,” “the Hindenburg” (the dirigible, not the signal), “a return to 1990” (when Citibank was bankrupt and secretly seized by the Controller of the Currency), the crash of 1987, the hedge fund crisis of 1998, and a “credit crunch.” “Bond traders are afraid.” “Wall Street is afraid.” Led by Jim Cramer with his celebrated on-air psychotic episode on the afternoon of Friday, August 3, Wall Street has been heaping insults on Helicopter Ben and demanding that he open the cash spigots, cut the fed funds and discount rates drastically and quickly, and reassure the stockjobbers that backdoor crony bailouts will be available for all, starting with the too big to fail, like JP Morgan Chase and Citibank.

The tip of the iceberg: Financial institutions in trouble

3 Bear Stearns hedge funds

3 BNP Parisbas funds

3 Goldman Sachs funds: Global Alpha, North American Equity Opportunities, North American Equity Opportunities

Sowood hedge fund -- absorbed by Citadel to mask impact

Bowa Commercial Bank, Taiwan -- seized by regulators

Renaissance (quant)

Luminent

Westdeutsche Landesbank hedge fund

IKB Industriebank, Germany

Deutsche Bank ABS hedge fund

AQR Capital Management (quant)

Washington Mutual

Countrywide

American Home Mortgage

Basis Capital

Absolute Capital

Macquarie Bank of Australia

Homebanc

Man Group (UK)

Comment