Re: How I learned to love the economic crisis: 2010 edition

Indeed

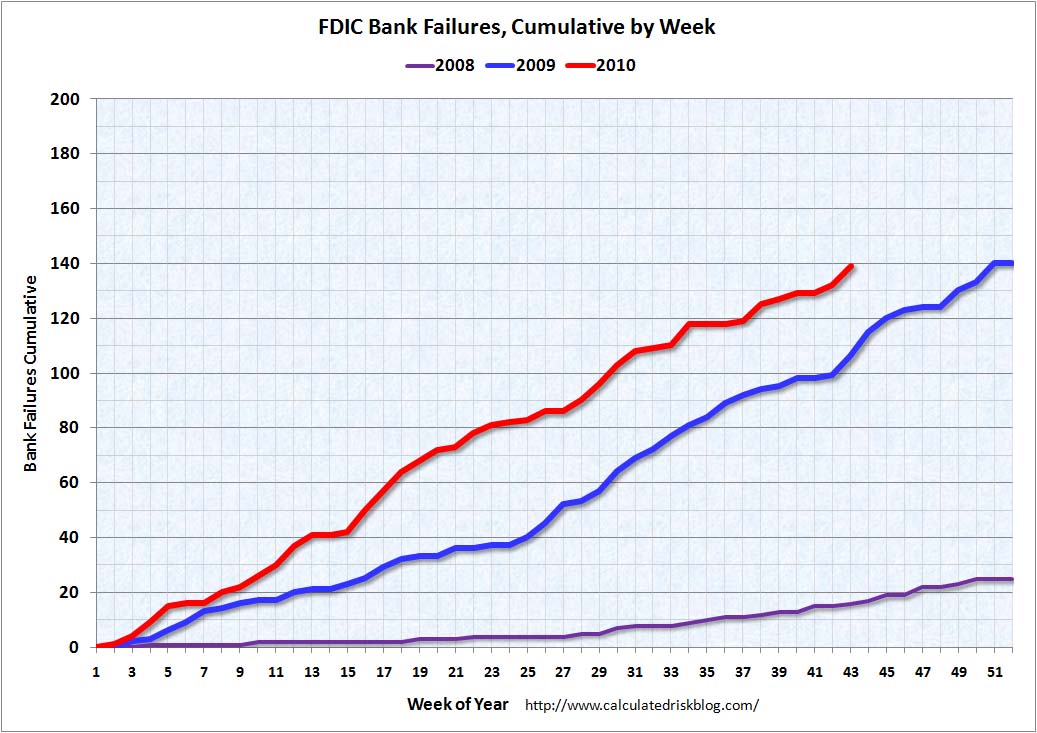

139 vs. 106

Originally posted by GRG55

| First Arizona Savings, A FSB | Scottsdale | AZ | 32582 | October 22, 2010 | October 22, 2010 |

| Hillcrest Bank | Overland Park | KS | 22173 | October 22, 2010 | October 22, 2010 |

| First Suburban National Bank | Maywood | IL | 16089 | October 22, 2010 | October 22, 2010 |

| The First National Bank of Barnesville | Barnesville | GA | 2119 | October 22, 2010 | October 22, 2010 |

| The Gordon Bank | Gordon | GA | 33904 | October 22, 2010 | October 22, 2010 |

| Progress Bank of Florida | Tampa | FL | 32251 | October 22, 2010 | October 22, 2010 |

| First Bank of Jacksonville | Jacksonville | FL | 27573 | October 22, 2010 | October 22, 2010 |

Comment