Re: 2/27/07--Beginning of a Bear Market?

http://www.nowandfutures.com/grins/kinky.wav ;)

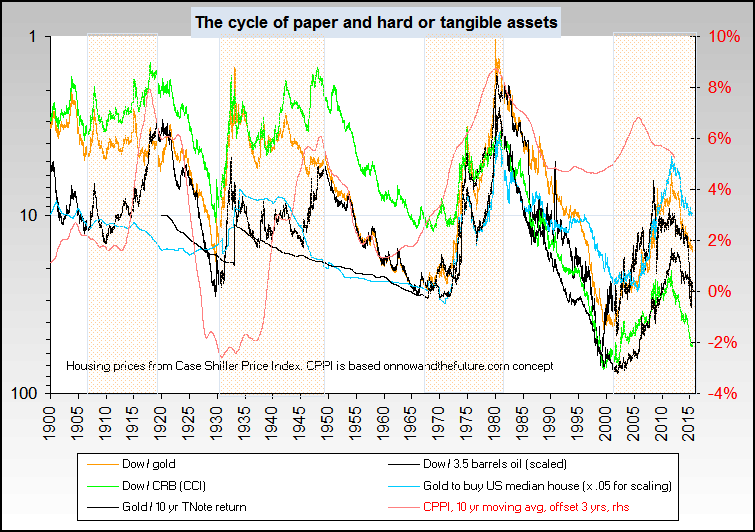

I'm a little hesitant to plot stuff in terms of gold since it doesn't hold well over the last 35 years or so, but it sure is true since the markets started to turn back towards hard assets. One of these days, I'll run across some decent long term PPP data and maybe then I can do it more fairly.

I should note and agree with you that it was EJ who originally brought up the whole area here some months ago.

Originally posted by Finster

I'm a little hesitant to plot stuff in terms of gold since it doesn't hold well over the last 35 years or so, but it sure is true since the markets started to turn back towards hard assets. One of these days, I'll run across some decent long term PPP data and maybe then I can do it more fairly.

I should note and agree with you that it was EJ who originally brought up the whole area here some months ago.

Comment