Re: More leaks - Toxic Asset plan could be announced by Geithner on Monday

This $84 figure is most likely too high. What happens when the FDIC forces some of these banks to take lower offers than they like. Mark to market is now back on, because we have a market to mark to.

Balance sheets get wacked again. Let me see if I've got it right. Force banks to take low offers. Put the taxpayer on the hook for losses. Is this a real market?

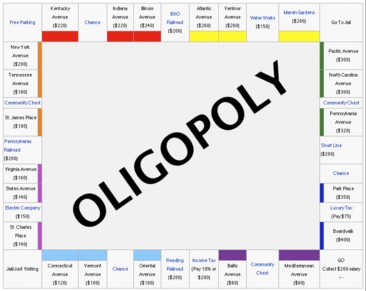

Btw: I'm sure there will be NO collusion between the bidders.

This $84 figure is most likely too high. What happens when the FDIC forces some of these banks to take lower offers than they like. Mark to market is now back on, because we have a market to mark to.

Balance sheets get wacked again. Let me see if I've got it right. Force banks to take low offers. Put the taxpayer on the hook for losses. Is this a real market?

Btw: I'm sure there will be NO collusion between the bidders.

Comment