I've read conflicting reports -

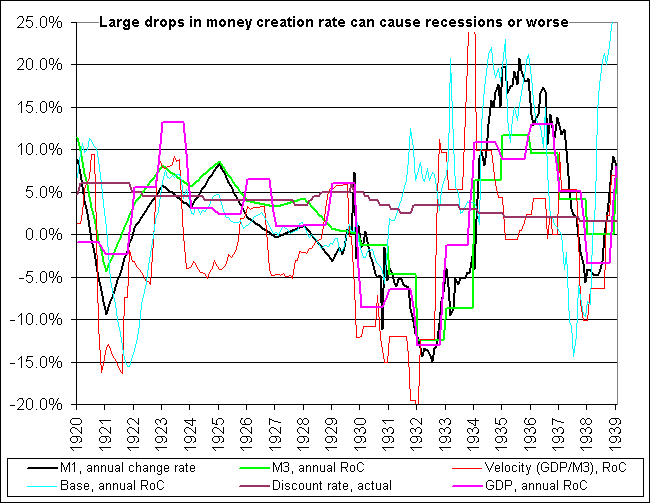

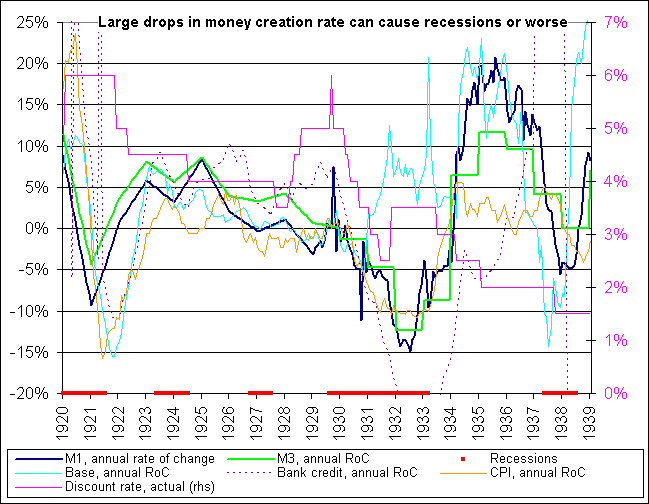

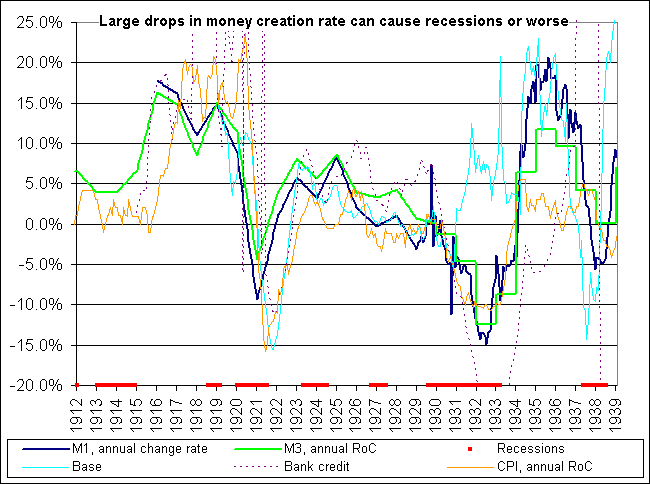

some are simply claiming that the FED did not try very hard,

and others claim the FED tried very hard, but banks would not lend and borrowers would not borrow.

I'm leaning toward this latter scenario just because the credit numbers I've seen have always been consistent - people were very slow to start trusting credit again, and talking with people one knows that that generation was extremely distrustful of borrowing.

And this leads naturally to an question for Eric, what specific measures, in which markets (mortgage, bond, stock, commodities, etc ...) could the FED and the government take to ignite inflation if we return to a debt-averse mass psychology?

some are simply claiming that the FED did not try very hard,

and others claim the FED tried very hard, but banks would not lend and borrowers would not borrow.

I'm leaning toward this latter scenario just because the credit numbers I've seen have always been consistent - people were very slow to start trusting credit again, and talking with people one knows that that generation was extremely distrustful of borrowing.

And this leads naturally to an question for Eric, what specific measures, in which markets (mortgage, bond, stock, commodities, etc ...) could the FED and the government take to ignite inflation if we return to a debt-averse mass psychology?

. I will be dropping this pupper to a 10 yr note , and have no monthly bills by the time I hit 50 . Sell out and then retire to some other country with my gold stash, and spend the rest of my life drunk at the beach :eek:

. I will be dropping this pupper to a 10 yr note , and have no monthly bills by the time I hit 50 . Sell out and then retire to some other country with my gold stash, and spend the rest of my life drunk at the beach :eek:

Comment