Inflation Isn't Inevitable

Jeremy J. Siegel, Contributing Editor,

Kiplinger.com

Wednesday, March 11, 2009; 12:00 AM

...

Warning signals. Although deflation is in the headlines today, the Fed has to be alert to inflationary pressures in the future. The value of the dollar, the price of gold and, most important, commodity prices have historically been early signals of inflationary pressures. Commodity prices -- particularly oil prices -- are depressed now due to the worldwide recession. But traders expect the price of oil to top $60 a barrel by the end of 2010. So once confidence returns, the Fed must act to withdraw excess liquidity and raise interest rates.

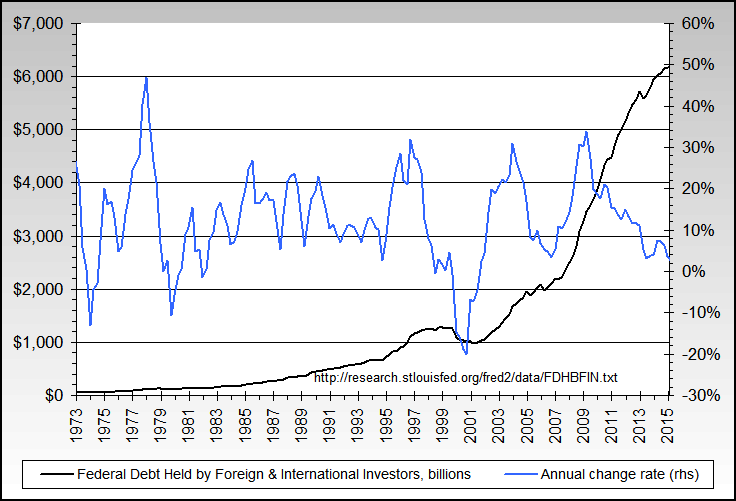

Those large projected federal deficits are manageable for now. As the economy recovers, they should be reduced by increasing tax revenues and the winding down of support programs, such as unemployment insurance. The federal government's debt-to-GDP ratio is now about 70%, not much different than the post–World War II average.

Japan offers a good example of how much debt a developed country can handle without succumbing to inflation. Over the past ten years, Japan has doubled its debt-to-GDP ratio, to 180%, more than twice the average of other developed countries. Nevertheless, by reining in its money supply, Japan has not only avoided inflation but has actually experienced deflation. And the Japanese yen has been the world's strongest currency over the past decade.

....

What are the numbers for debt to GDP in the US for private and government debt ?

It looks like Credit Suisse thinks it's all right

http://www.businessinsider.com/2009/...nd-meaningless

http://www.businessinsider.com/yes-w...in-debt-2009-2

Comment