http://www.minyanville.com/articles/index.php?a=11850

Five Themes You Need to Know for 2007

Kevin Depew

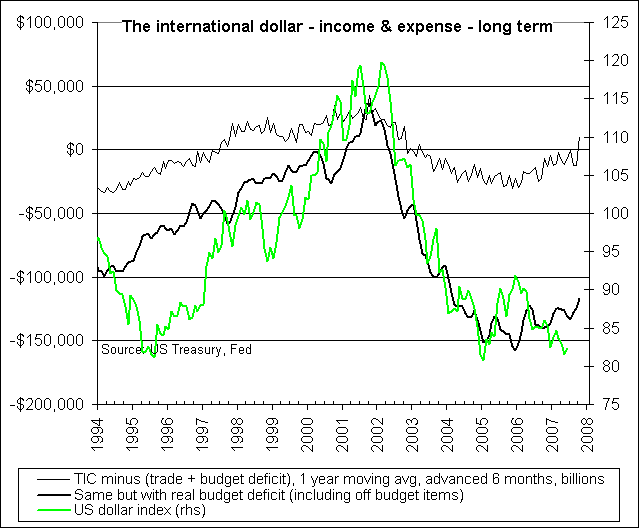

1. U.S. Dollar

In 2007 the U.S. dollar will rise.

* C'mon. It just can't happen. The dollar is doomed. Everyone knows this, right?

* Well, one would think that we would know this because we see and hear it every day; in the financial media, in analyst reports, and because even as the Federal Reserve claims to be "fighting inflation," money supply growth has actually been accelerating over the past three months.

* The rapid stimulation since August that has been able to maintain M2 growth near 5%.

* So what bizarre factors might interact to cause a rise in the U.S. dollar in 2007?

* We essentially see two potential paths toward a higher dollar this year.

* One, and least unlikely, monetary expansion by the Fed actually does begin to tighten and the dollar rises.

* Two, and more likely, economic activity in the U.S. slows, imports slow and exports rise as U.S. consumers cut back, the dollar rises and the trade deficit declines.

* Why would this benefit the dollar? See Theme Number Two...

2. Personal Savings

The Personal Savings Rate will rise in 2007.

* Americans have been spending more than they have been saving for 20 consecutive months.

* This unsustainable behavior will likely change in 2007; rapidly if the economy slows more than expected due to housing.

* For most Americans housing has been the source of liquidity necessary to consume.

* As access to mortgage markets diminishes, consumption will necessarily decline.

* Unlike the Federal government, consumers cannot simply maintain consumption by borrowing forever.

* Eventually, someone calls in that debt, or servicing it becomes too burdensome.

* Importantly, debt service is as much psychological as material. In other words, consumers must not necessarily "go the brink" financially before cutting back.

* So, somewhat paradoxically, heavy debt loads in an expanding economy can seem less problematic than lighter debt loads in a slowing economy.

* We are beginning already to see signs of a shift in consumer sentiment toward debt loads.

* Just as condo flipping and real estate speculation, fine living and "how to spend it" shows, flooded television networks over the past five years, now we are seeing a sentiment shift toward debt.

* The latest reality show? "Maxed Out."

- In each episode of Maxed Out, finance coach Ayse Hogan gets to the root of what is causing one woman's unhealthy relationship with money. Observing the subject's behavior and putting her on a strict budget, Hogan helps the cash-stressed gal by demonstrating the basic tenets of wealth-building: debt reduction, savings and investment.

* A larger pool of national savings would reduce demand for foreign capital because we're not buying as many imported goods.

* With less foreign capital flowing into the country, the gap between what we buy from abroad and what we sell would shrink. In other words, the trade deficit would diminish.

* And this leads us to Theme Number Three...

3. Protectionism

Expect Protectionist policies to worm their way to the top in Washington.

* Remember the trade deficit, the one that will likely diminish as a natural result of higher savings and lower consumption in the U.S.?

* Well, far be it from Washington to allow nature to take its course.

* One of the key things to understand about the trade deficit is it has very little to do with "trade policy."

* The trade deficit is actually determined by the flow of investment funds in and out of the country.

* Meanwhile, we're not even out of 2006 and protectionist talk from Washington is rampant.

* And just a few weeks ago Caterpillar (CAT) CEO Jim Owens warned that international trade "has become a bad word" as a result of a "pronounced shift toward protectionism" in the U.S.

* Sure, trade policies such as "emergency tariffs" is one way to reduce the U.S. traded deficit, but fewer imports would mean fewer dollars flowing into international currency markets, which means (back to Theme Number One) increasing the value of the dollar relative to other currencies.

* But wait, wouldn't that make imports more attractive to Americans? It would make imports less expensive for U.S. consumers, but as far as attractive... well, that leads us to Theme Number Four...

4. Deflation

Look for deflation to become a key theme by the end of the year in 2007.

* Deflation gets a bad rap. And we've actually experienced structural deflation for nearly a decade. So what are we so worried about?

* Because right now the consensus (at least as shown by the increase in asset prices) is that we continue to live in a world with benign, supply-driven deflation, not the collapse in aggregate demand that Fed policymakers fear so deeply, and which is most often associated with the word "deflation."

* The view least shared by market participants is that the structural deflationary environment we are in, and during which a bout of cyclical inflation has already peaked, is poised to suffer from a collapse in aggregate demand.

* Of course, just as no one predicted how far consumers would really go during their 25-year consumption binge, we're going to go out on a limb and suggest no one is now accurately predicting how far consumers will go in the opposite direction, which leads us to Theme Number Five...

5. A Tale of Two Standards of Living

"It was the best of times, it was the worst of times, it was the age of wisdom, it was the age of foolishness, it was the epoch of belief, it was the epoch of incredulity," wrote Charles Dickens in "A Tale of Two Cities." Man, is it just me or does that sentence resonate loudly today?

* Well, if it's not just me then that's too bad.

* The plot of Dickens's novel centers around the years leading up to the French Revolution.

* The material (as opposed to socionomic) origins of the French Revolution were rooted in fiscal crisis... as are nearly all revolutions.

* High unemployment, low wages and sharp divisions between classes, from the Clergy (First Estate) to the Nobility (Second Estate) and the middle class and peasants (Third Estate) were all factors in the social unrest that exploded on Bastille Day, considered the beginning of the French Revolution.

* Are we on the verge of our own "French Revolution"? Not hardly, and that's beside the point.

* Rather, the theme we are focused on here is that we are operating under economic conditions that are in a relative sense quite similar to those leading up to the French Revolution.

* Keep in mind that what is important here is that the economic disparity between haves and have nots is growing in a relative sense.

* Just about everyone's standard of living now is better than it was in 1789. But economic disparity is not about absolute conditions. It is about relative conditions.

* As we enter 2007, it is worth considering the economic results of popular movements toward a reduction in economic disparity.

* Whether one believes such movements are worthwhile or justified is also beside the point.

* What is important is that such movements can produce important and dramatic economic changes, and it's always better to be ahead of economic changes than behind them.

Five Themes You Need to Know for 2007

Kevin Depew

1. U.S. Dollar

In 2007 the U.S. dollar will rise.

* C'mon. It just can't happen. The dollar is doomed. Everyone knows this, right?

* Well, one would think that we would know this because we see and hear it every day; in the financial media, in analyst reports, and because even as the Federal Reserve claims to be "fighting inflation," money supply growth has actually been accelerating over the past three months.

* The rapid stimulation since August that has been able to maintain M2 growth near 5%.

* So what bizarre factors might interact to cause a rise in the U.S. dollar in 2007?

* We essentially see two potential paths toward a higher dollar this year.

* One, and least unlikely, monetary expansion by the Fed actually does begin to tighten and the dollar rises.

* Two, and more likely, economic activity in the U.S. slows, imports slow and exports rise as U.S. consumers cut back, the dollar rises and the trade deficit declines.

* Why would this benefit the dollar? See Theme Number Two...

2. Personal Savings

The Personal Savings Rate will rise in 2007.

* Americans have been spending more than they have been saving for 20 consecutive months.

* This unsustainable behavior will likely change in 2007; rapidly if the economy slows more than expected due to housing.

* For most Americans housing has been the source of liquidity necessary to consume.

* As access to mortgage markets diminishes, consumption will necessarily decline.

* Unlike the Federal government, consumers cannot simply maintain consumption by borrowing forever.

* Eventually, someone calls in that debt, or servicing it becomes too burdensome.

* Importantly, debt service is as much psychological as material. In other words, consumers must not necessarily "go the brink" financially before cutting back.

* So, somewhat paradoxically, heavy debt loads in an expanding economy can seem less problematic than lighter debt loads in a slowing economy.

* We are beginning already to see signs of a shift in consumer sentiment toward debt loads.

* Just as condo flipping and real estate speculation, fine living and "how to spend it" shows, flooded television networks over the past five years, now we are seeing a sentiment shift toward debt.

* The latest reality show? "Maxed Out."

- In each episode of Maxed Out, finance coach Ayse Hogan gets to the root of what is causing one woman's unhealthy relationship with money. Observing the subject's behavior and putting her on a strict budget, Hogan helps the cash-stressed gal by demonstrating the basic tenets of wealth-building: debt reduction, savings and investment.

* A larger pool of national savings would reduce demand for foreign capital because we're not buying as many imported goods.

* With less foreign capital flowing into the country, the gap between what we buy from abroad and what we sell would shrink. In other words, the trade deficit would diminish.

* And this leads us to Theme Number Three...

3. Protectionism

Expect Protectionist policies to worm their way to the top in Washington.

* Remember the trade deficit, the one that will likely diminish as a natural result of higher savings and lower consumption in the U.S.?

* Well, far be it from Washington to allow nature to take its course.

* One of the key things to understand about the trade deficit is it has very little to do with "trade policy."

* The trade deficit is actually determined by the flow of investment funds in and out of the country.

* Meanwhile, we're not even out of 2006 and protectionist talk from Washington is rampant.

* And just a few weeks ago Caterpillar (CAT) CEO Jim Owens warned that international trade "has become a bad word" as a result of a "pronounced shift toward protectionism" in the U.S.

* Sure, trade policies such as "emergency tariffs" is one way to reduce the U.S. traded deficit, but fewer imports would mean fewer dollars flowing into international currency markets, which means (back to Theme Number One) increasing the value of the dollar relative to other currencies.

* But wait, wouldn't that make imports more attractive to Americans? It would make imports less expensive for U.S. consumers, but as far as attractive... well, that leads us to Theme Number Four...

4. Deflation

Look for deflation to become a key theme by the end of the year in 2007.

* Deflation gets a bad rap. And we've actually experienced structural deflation for nearly a decade. So what are we so worried about?

* Because right now the consensus (at least as shown by the increase in asset prices) is that we continue to live in a world with benign, supply-driven deflation, not the collapse in aggregate demand that Fed policymakers fear so deeply, and which is most often associated with the word "deflation."

* The view least shared by market participants is that the structural deflationary environment we are in, and during which a bout of cyclical inflation has already peaked, is poised to suffer from a collapse in aggregate demand.

* Of course, just as no one predicted how far consumers would really go during their 25-year consumption binge, we're going to go out on a limb and suggest no one is now accurately predicting how far consumers will go in the opposite direction, which leads us to Theme Number Five...

5. A Tale of Two Standards of Living

"It was the best of times, it was the worst of times, it was the age of wisdom, it was the age of foolishness, it was the epoch of belief, it was the epoch of incredulity," wrote Charles Dickens in "A Tale of Two Cities." Man, is it just me or does that sentence resonate loudly today?

* Well, if it's not just me then that's too bad.

* The plot of Dickens's novel centers around the years leading up to the French Revolution.

* The material (as opposed to socionomic) origins of the French Revolution were rooted in fiscal crisis... as are nearly all revolutions.

* High unemployment, low wages and sharp divisions between classes, from the Clergy (First Estate) to the Nobility (Second Estate) and the middle class and peasants (Third Estate) were all factors in the social unrest that exploded on Bastille Day, considered the beginning of the French Revolution.

* Are we on the verge of our own "French Revolution"? Not hardly, and that's beside the point.

* Rather, the theme we are focused on here is that we are operating under economic conditions that are in a relative sense quite similar to those leading up to the French Revolution.

* Keep in mind that what is important here is that the economic disparity between haves and have nots is growing in a relative sense.

* Just about everyone's standard of living now is better than it was in 1789. But economic disparity is not about absolute conditions. It is about relative conditions.

* As we enter 2007, it is worth considering the economic results of popular movements toward a reduction in economic disparity.

* Whether one believes such movements are worthwhile or justified is also beside the point.

* What is important is that such movements can produce important and dramatic economic changes, and it's always better to be ahead of economic changes than behind them.

Comment