I was reviewing a chart on John William's shadowstats site:

http://www.shadowstats.com/cgi-bin/sgs/data

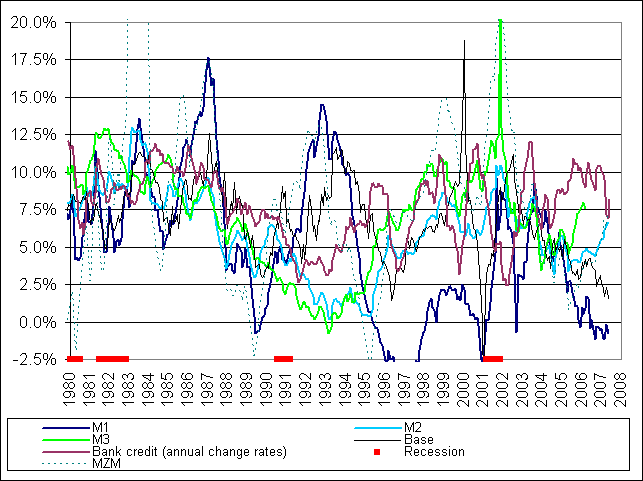

Many people in these forums suggest that inflation is the greater threat, which follows a breif period of disinflation or outright deflation. But this chart shows M1 (cash, etc) dropping alot with M3 (all measures of money) blowing up... they are diverging, at the same time!

My question is, how can M1 be deflationary while M3 is inflationary?

-436

http://www.shadowstats.com/cgi-bin/sgs/data

Many people in these forums suggest that inflation is the greater threat, which follows a breif period of disinflation or outright deflation. But this chart shows M1 (cash, etc) dropping alot with M3 (all measures of money) blowing up... they are diverging, at the same time!

My question is, how can M1 be deflationary while M3 is inflationary?

-436

Comment