The New Deal was not initially an attempt to stimulate the economy and generate recovery through government spending, an idea that was scarcely present in the early 1930s. Rather it consisted of ad hoc salvage or bailout measures, principally aimed at helping business, coupled with work relief programs. The lion’s share of New Deal expenditures at the outset were devoted to salvage operations. As Harvard economist Alvin Hansen, Keynes’s leading early follower in the United States, explained in 1941 in his Fiscal Policy and Business Cycles,

It was only later on in the depression decade, in what historians have called the “second New Deal,” culminating in Roosevelt’s landslide 1936 election victory, that the emphasis shifted decisively from salvage operations to work relief programs, and other measures that directly benefited the working class. This was the era of the Works Progress Administration, headed by Harry Hopkins, along with other progressive programs and measures, such as unemployment insurance, Social Security, and the Wagner Act (giving the de jure right to organize). These advances were made possible by the great “revolt from below” of organized labor in the 1930s.4 The WPA spent $11 billion and employed 8.5 million people. It paid for the building of roads, highways, and bridges. But it did much more than that. The federal school lunch program got its start with WPA dollars. Indeed, what distinguished the WPA from other work programs was that it employed people to do the things that were needed in all areas of society, working at jobs they were already equipped to do.

None of this conformed to the later precepts of Keynesian economics. As late as 1937, Roosevelt’s New Deal administration had still not given up the goal of balancing the federal budget—a core aim of Secretary of the Treasury Henry Morgenthau Jr.—even in the midst of the Great Depression. It thus clamped down on federal spending, with expenditures being reduced in the budgets for fiscal years 1937 and 1938. Meanwhile the new Social Security program, passed in 1935, began taxing workers in fiscal year 1936 based on regressive payroll taxes, with no payouts for old age insurance supposed to occur until 1941, thereby generating a massive deflationary effect.6

These and other contradictions came to a head in the recession of 1937–38, during which the recovery that had been taking place since 1933 suddenly came to a halt prior to a full recovery, with unemployment jumping from 14 to 19 percent. It was only in response to deepening economic stagnation that the Roosevelt administration was at last induced to move decisively away from its attempt to balance the federal budget, turning to the strategy promoted by Federal Reserve Board Chairman Marriner Eccles of utilizing strong government spending and deficit financing to lift the economy. These actions corresponded to the publication of An Economic Program for American Democracy, signed by Richard V. Gilbert, George H. Hildebrand Jr., Arthur W. Stuart, Maxine Y. Sweezy, Paul M. Sweezy, Lorie Tarshis, and John D. Wilson—a group of young Harvard and Tufts economists representing the Keynesian revolution. This work was a Washington D.C. bestseller and immediately became the intellectual defense after the fact for the New Deal expansionary policies of 1938–39.7 Nevertheless, the stimulus measures adopted at this stage were too meager to counter the conditions of depression that prevailed at the time. What rescued the capitalist economy was the Second World War. “The Great Depression of the thirties,” John Kenneth Galbraith wrote, “never came to an end. It merely disappeared in the great mobilization of the forties.”8

But this raises further questions. As Paul Baran and Paul Sweezy asked in Monopoly Capital in 1966: “Why was such an increase [in government spending] not forthcoming during the whole depressed decade? Why did the New Deal fail to attain what the war proved to be within easy reach? The answer to these questions,” they contended, “is that, given the power structure of United States monopoly capitalism, the increase of civilian [government] spending had about reached its outer limits by 1939. The forces opposing further expansion were too strong to be overcome.”

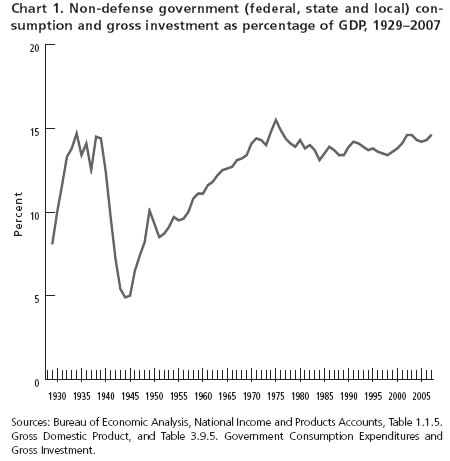

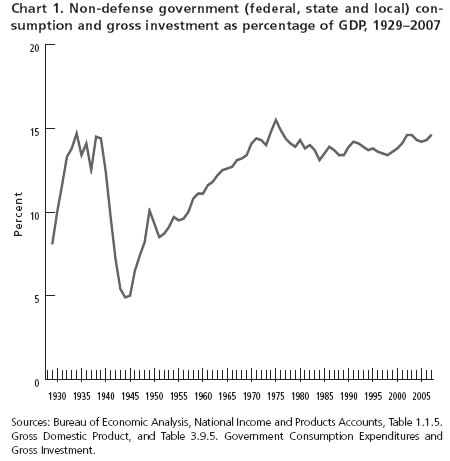

Baran and Sweezy’s thesis that civilian government spending had “about reached its outer limits” by the end of the New Deal was directed primarily at total non-defense government purchases as a percentage of GDP. This constitutes almost the entire direct contribution of government to the welfare of the population, encompassing public education, roads and highways, health, sanitation, water and electric services, commerce, conservation, recreation, police and fire protection, courts, prisons, legislators, the executive branch, etc. By 1939, Baran and Sweezy contended, these critical elements of government taken together had reached their maximum share of GDP, given the power structure of U.S. monopoly capitalism.9

Remarkably, Baran and Sweezy’s civilian government ceiling thesis has been borne out in the more than forty years since it was formulated (see chart 1). Civilian government consumption and investment purchases as a percentage of GDP rose to 14.5 percent of GDP in 1938 (14.4 percent in 1939), fell during the 1940s due to the great expansion of military spending during the Second World War, and then regained their lost ground in the 1950s, 1960s, and early ’70s. Civilian government spending on consumption and investment reached its highest point of 15.5 percent of national income in 1975 (dropping in 1976 to its second highest level of 14.9 percent), and then stabilized at around 14 percent from the late 1970s to the present. In 2007 non-defense government consumption and investment purchases constituted 14.6 percent of GDP, almost exactly the same level as in 1938–39!

The reasons for this are straightforward. Beyond some minimal level, real estate interests oppose public housing; private health care interests and medical professionals oppose public health care; insurance companies oppose public insurance programs; private education interests oppose public education; and so on. The big exceptions to this are highways and prisons within civilian government spending, together with military spending.

John Bellamy Foster and Robert W. McChesney

For the most part, the federal government [in the New Deal era] engaged in a salvaging program and not in a program of positive expansion. The salvaging program took the form of refinancing urban and rural debt, rebuilding the weakened capital structure of the banks, and supporting railroads at or near bankruptcy… [T]he Reconstruction Finance Corporation, the Home Owners’ Loan Corporation, and the Farm Credit Administration poured $18 billions into these salvaging operations. The federal government stepped into the breach and supported the hard-pressed state and local governments—again a salvage operation…

That a salvaging program of this magnitude was necessary was, of course, due to the unprecedented depth of the depression reached by early 1933....Under such circumstances the economy dries up like a sponge. Vast governmental expenditures, designed to float the “sponge” to a high level of prosperity, are instead absorbed by the sponge itself. The expenditures seemingly run to waste. This is the salvaging operation. Only when the economy has become thoroughly liquid can further funds float it to higher income levels. A deep depression requires vast salvaging expenditures before a vigorous expansionist process can develop.3

Federal spending on public works, which has become almost synonymous with the New Deal in popular culture, expanded nearly every year from 1929 to 1938 (see table 1). Yet, total government spending on public works did not regain its 1929 level until 1936, due to drops in state and local public works spending that undercut the federal increases. At first, state and local governments had responded to the deep slump by increasing their public works outlays. However, within a couple of years their resources were largely exhausted and their spending on public works dropped below that of 1929. By 1936, state and local public works expenditures were less than half their 1929 level. Hence, for most of the depression decade “the federal government,” as Hansen observed, “only helped to hold back the receding tide.” Despite the fact that federal outlays in this area had increased by almost 500 percent, total government public works expenditures rose only 12 percent over the period, not enough to offer much of a stimulus to the overall economy. That a salvaging program of this magnitude was necessary was, of course, due to the unprecedented depth of the depression reached by early 1933....Under such circumstances the economy dries up like a sponge. Vast governmental expenditures, designed to float the “sponge” to a high level of prosperity, are instead absorbed by the sponge itself. The expenditures seemingly run to waste. This is the salvaging operation. Only when the economy has become thoroughly liquid can further funds float it to higher income levels. A deep depression requires vast salvaging expenditures before a vigorous expansionist process can develop.3

It was only later on in the depression decade, in what historians have called the “second New Deal,” culminating in Roosevelt’s landslide 1936 election victory, that the emphasis shifted decisively from salvage operations to work relief programs, and other measures that directly benefited the working class. This was the era of the Works Progress Administration, headed by Harry Hopkins, along with other progressive programs and measures, such as unemployment insurance, Social Security, and the Wagner Act (giving the de jure right to organize). These advances were made possible by the great “revolt from below” of organized labor in the 1930s.4 The WPA spent $11 billion and employed 8.5 million people. It paid for the building of roads, highways, and bridges. But it did much more than that. The federal school lunch program got its start with WPA dollars. Indeed, what distinguished the WPA from other work programs was that it employed people to do the things that were needed in all areas of society, working at jobs they were already equipped to do.

None of this conformed to the later precepts of Keynesian economics. As late as 1937, Roosevelt’s New Deal administration had still not given up the goal of balancing the federal budget—a core aim of Secretary of the Treasury Henry Morgenthau Jr.—even in the midst of the Great Depression. It thus clamped down on federal spending, with expenditures being reduced in the budgets for fiscal years 1937 and 1938. Meanwhile the new Social Security program, passed in 1935, began taxing workers in fiscal year 1936 based on regressive payroll taxes, with no payouts for old age insurance supposed to occur until 1941, thereby generating a massive deflationary effect.6

These and other contradictions came to a head in the recession of 1937–38, during which the recovery that had been taking place since 1933 suddenly came to a halt prior to a full recovery, with unemployment jumping from 14 to 19 percent. It was only in response to deepening economic stagnation that the Roosevelt administration was at last induced to move decisively away from its attempt to balance the federal budget, turning to the strategy promoted by Federal Reserve Board Chairman Marriner Eccles of utilizing strong government spending and deficit financing to lift the economy. These actions corresponded to the publication of An Economic Program for American Democracy, signed by Richard V. Gilbert, George H. Hildebrand Jr., Arthur W. Stuart, Maxine Y. Sweezy, Paul M. Sweezy, Lorie Tarshis, and John D. Wilson—a group of young Harvard and Tufts economists representing the Keynesian revolution. This work was a Washington D.C. bestseller and immediately became the intellectual defense after the fact for the New Deal expansionary policies of 1938–39.7 Nevertheless, the stimulus measures adopted at this stage were too meager to counter the conditions of depression that prevailed at the time. What rescued the capitalist economy was the Second World War. “The Great Depression of the thirties,” John Kenneth Galbraith wrote, “never came to an end. It merely disappeared in the great mobilization of the forties.”8

But this raises further questions. As Paul Baran and Paul Sweezy asked in Monopoly Capital in 1966: “Why was such an increase [in government spending] not forthcoming during the whole depressed decade? Why did the New Deal fail to attain what the war proved to be within easy reach? The answer to these questions,” they contended, “is that, given the power structure of United States monopoly capitalism, the increase of civilian [government] spending had about reached its outer limits by 1939. The forces opposing further expansion were too strong to be overcome.”

Baran and Sweezy’s thesis that civilian government spending had “about reached its outer limits” by the end of the New Deal was directed primarily at total non-defense government purchases as a percentage of GDP. This constitutes almost the entire direct contribution of government to the welfare of the population, encompassing public education, roads and highways, health, sanitation, water and electric services, commerce, conservation, recreation, police and fire protection, courts, prisons, legislators, the executive branch, etc. By 1939, Baran and Sweezy contended, these critical elements of government taken together had reached their maximum share of GDP, given the power structure of U.S. monopoly capitalism.9

Remarkably, Baran and Sweezy’s civilian government ceiling thesis has been borne out in the more than forty years since it was formulated (see chart 1). Civilian government consumption and investment purchases as a percentage of GDP rose to 14.5 percent of GDP in 1938 (14.4 percent in 1939), fell during the 1940s due to the great expansion of military spending during the Second World War, and then regained their lost ground in the 1950s, 1960s, and early ’70s. Civilian government spending on consumption and investment reached its highest point of 15.5 percent of national income in 1975 (dropping in 1976 to its second highest level of 14.9 percent), and then stabilized at around 14 percent from the late 1970s to the present. In 2007 non-defense government consumption and investment purchases constituted 14.6 percent of GDP, almost exactly the same level as in 1938–39!

The reasons for this are straightforward. Beyond some minimal level, real estate interests oppose public housing; private health care interests and medical professionals oppose public health care; insurance companies oppose public insurance programs; private education interests oppose public education; and so on. The big exceptions to this are highways and prisons within civilian government spending, together with military spending.

John Bellamy Foster and Robert W. McChesney