Re: M1 Money Multiplier tanking

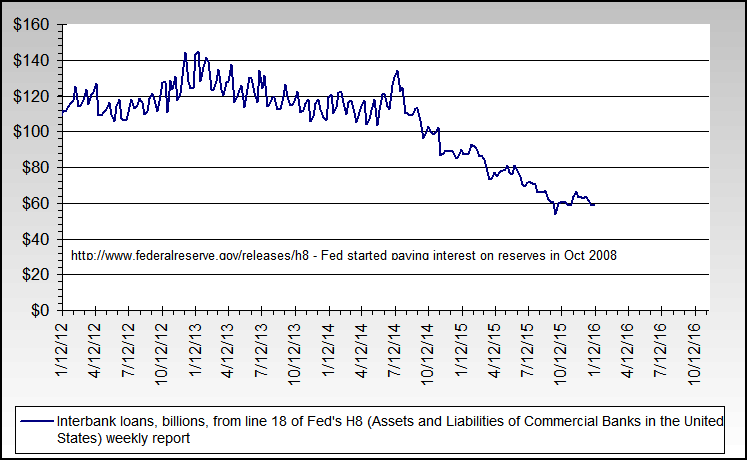

The FFR can be increased. Right now the FFR actually doesn't matter very much, because it is as important as determining the speed of a dead cat (not a bouncing one). Interbank lending now is chocked in many respects.

Currently the rate is zero and the risk perception is huge. There is no incentive whatsoever to give any loan. Only the goners need money while the healty/friendly banks sit on excess reserves and if they need more they can get anytime at little cost from the Fed.

Exactly, people are paying down debt, investors are out of the market waiting mostly in cash (as I do) ... why do you think the non borrowed reserves are increasing? Those CDO's didn't become overnight profitable.

Exactly, and all what the Fed did recently was actually reserve neutral (with few small exceptions). Basically everything the Fed did since last summer is to bring the banking system to the current situation, and letting Lehman fall was essential to stop interbank lending.

Exactly, and with this perception no wonder they just hoard reserves and M1 multiplier was tanking. Add to that the Circle Jerk Finance (TM) virtual technology and you have the complete picture.

I believe the people, investors and banks are already frighten creditless Maybe what they need is to calm them down, by making the FED take more risk. Remember that the high risk picture was manufactured and it not exactly real. The real effect is derived only by the self-reinforced perception of risk, doom and gllom. There are people who panic and drown in four feet of water. That can happen, although nobody should drown (or have a heart attack in fear of drowning) in waist deep water. One of the thing the FED can do is extending risk guarantees. So far they did that in a very selective way and with a lot of restraint.

Maybe what they need is to calm them down, by making the FED take more risk. Remember that the high risk picture was manufactured and it not exactly real. The real effect is derived only by the self-reinforced perception of risk, doom and gllom. There are people who panic and drown in four feet of water. That can happen, although nobody should drown (or have a heart attack in fear of drowning) in waist deep water. One of the thing the FED can do is extending risk guarantees. So far they did that in a very selective way and with a lot of restraint.

So far they hinted they are going to create inflation, when in fact they used largely only neutral operations, and those who believed the inflation line got cleaned during the last quarter. Maybe now they will hint they will create a huge inflation and they will inflate very little, just to get the FIRE started again.

Exactly That is why I believe a huge inflation is a no-go, at least in the next future, although the FED may want to create the artificial perception huge inflation is just over the corner.

Well, ... I don't think the normal mechanism of rates rising borrowing becoming costlier is entirely valid in the current paradigm. What the Fed actually did, was the borrowing rates arbitrage and they started with sectoral targeting in money markets (if you remember that funny 666 paper). Borrowing at 2-5% is much better and less deflationary than not being able to get one dollar at 0.25% and being forced to accept Uncle Warren's fondling at 12.5% interest.;)

Sishya thanks. That was very flattering, but i have to disappoint you. I'm struggling myself to understand what exactly is happening now and I'm not sure my hypothesis is correct. That's why I was trying to convince bart or anybody else with a good understanding of what is happening now to help me with some answers.

Right now we are almost like in China. Market fundamentals don't matter very much. What matters now is how the FED commies (as opposed to the Chinese commies) will intervene next. And guessing what the FED is going to do next (regardless of their official position) is more of an art than a science.

The end goal is clear: obtaining more power, more control and facilitating a larger targeted wealth transfer from everybody to those few that matter. The key to success this days is to be able to figure out how exactly are they going to achieve their goal and what intermediate steps will they take.

Originally posted by sishya

View Post

Originally posted by sishya

View Post

Originally posted by sishya

View Post

Originally posted by sishya

View Post

Originally posted by sishya

View Post

Originally posted by sishya

View Post

Maybe what they need is to calm them down, by making the FED take more risk. Remember that the high risk picture was manufactured and it not exactly real. The real effect is derived only by the self-reinforced perception of risk, doom and gllom. There are people who panic and drown in four feet of water. That can happen, although nobody should drown (or have a heart attack in fear of drowning) in waist deep water. One of the thing the FED can do is extending risk guarantees. So far they did that in a very selective way and with a lot of restraint.

Maybe what they need is to calm them down, by making the FED take more risk. Remember that the high risk picture was manufactured and it not exactly real. The real effect is derived only by the self-reinforced perception of risk, doom and gllom. There are people who panic and drown in four feet of water. That can happen, although nobody should drown (or have a heart attack in fear of drowning) in waist deep water. One of the thing the FED can do is extending risk guarantees. So far they did that in a very selective way and with a lot of restraint.

Originally posted by sishya

View Post

Originally posted by sishya

View Post

Originally posted by sishya

View Post

Originally posted by sishya

View Post

Right now we are almost like in China. Market fundamentals don't matter very much. What matters now is how the FED commies (as opposed to the Chinese commies) will intervene next. And guessing what the FED is going to do next (regardless of their official position) is more of an art than a science.

The end goal is clear: obtaining more power, more control and facilitating a larger targeted wealth transfer from everybody to those few that matter. The key to success this days is to be able to figure out how exactly are they going to achieve their goal and what intermediate steps will they take.

Comment