Re: M1 Money Multiplier tanking

This same topic came up on FreeRepublic.com a few days ago, when an article by Karl Denninger was posted with this same graph of a collapsing M1 Multiplier (MULT). You can read that tread at http://www.freerepublic.com/focus/f-.../2158062/posts .

In post 57 of that thread, I posted what I still suspect is the proper explanation of that graph [P.S. - submitted this iTulip post before reading the other replies ... oops. It seems that others have already said at least as much as the following, even more actually, and likely more accurately.]

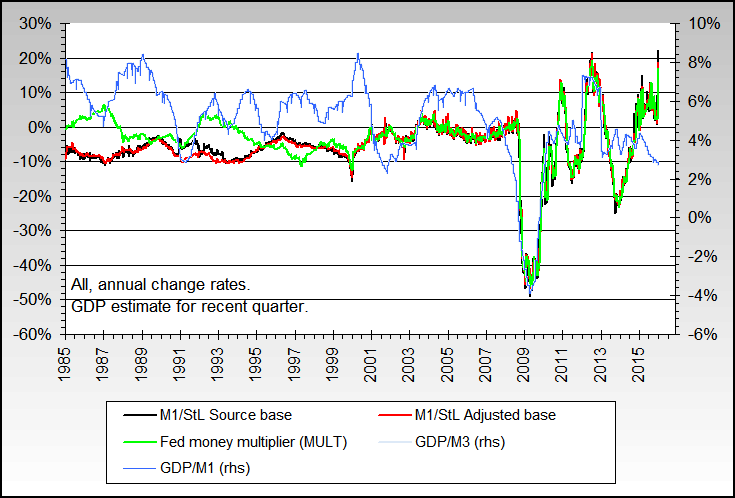

Karl D wrote:I am on uncertain ground at this point, because I am uncertain what the above means. However I won't let that stop me ;). As best as I can tell, the relevant difference between M1 and Adjusted Monetary Base is that M1 does not include money that banks have on deposit with the Fed, whereas Adjusted Monetary Base does include those deposits. From other charts I've seen, including another one from the Fed (all of which I am too lazy to track down at this time), the banks have dramatically increased their deposits at the Fed, far above their normal reserve requirements.

That's why (the immediate cause why) the M1 multiplier has fallen below 1.0. There is less money in circulation and more money in the Feds vaults, held as deposits from some (like just a few, big) banks.

Now ... here is where I am inclined to differ with Karl D's interpretation of this. I do not think that the M1 multiplier going below 1.0 means that "Bernanke has lost control." Rather I think it simply means banks (at least a few big ones) are depositing money with the Fed instead of lending it. That might actually be the intention of Ben Bernanke and Hank Paulson and their cohorts!

Such gross and excess deposits have a couple of advantages to our Big Bankers. Follow the money as they say:

In short, I am more paranoid than Karl D (ouch!). I don't think this means Ben has lost control, but rather that it means Ben and friends are succeeding, like the Russian oligarchs, in seizing even more control.

Originally posted by LargoWinch

View Post

In post 57 of that thread, I posted what I still suspect is the proper explanation of that graph [P.S. - submitted this iTulip post before reading the other replies ... oops. It seems that others have already said at least as much as the following, even more actually, and likely more accurately.]

Karl D wrote:

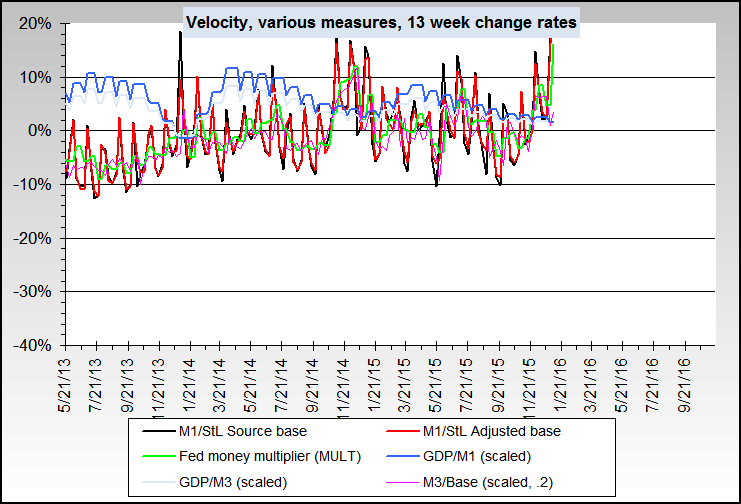

The important part of this graph is what it denotes. Bernanke has lost control of "N" (or velocity), which is the actual knob that he is trying to diddle when borrowing rates are changed (and in fact its the market that sets that, despite his protests.)

I'm not so sure I agree with Karl D on the above. First of all, lets examine what is actually being measure here. From the St Louis Fed page Series: MULT, M1 Money Multiplier: The M1 multiplier is the ratio of M1 to the St. Louis Adjusted Monetary Base. For further information on monetary aggregates, please refer to the Definitions, Notes, and Sources at http://research.stlouisfed.org/publications/mt/.(bold emphasis added)

Then, chasing down the afore mentioned Definitions, Notes and Sources, we see the following relevant definitions:- M1

- The sum of currency held outside the vaults of depository institutions, Federal Reserve Banks, and the U.S. Treasury; travelers checks; and demand and other checkable deposits issued by financial institutions (except demand deposits due to the Treasury and depository institutions), minus cash items in process of collection and Federal Reserve float.

- Adjusted Monetary Base

- The sum of currency in circulation outside Federal Reserve Banks and the U.S. Treasury, deposits of depository financial institutions at Federal Reserve Banks, and an adjustment for the effects of changes in statutory reserve requirements on the quantity of base money held by depositories.

That's why (the immediate cause why) the M1 multiplier has fallen below 1.0. There is less money in circulation and more money in the Feds vaults, held as deposits from some (like just a few, big) banks.

Now ... here is where I am inclined to differ with Karl D's interpretation of this. I do not think that the M1 multiplier going below 1.0 means that "Bernanke has lost control." Rather I think it simply means banks (at least a few big ones) are depositing money with the Fed instead of lending it. That might actually be the intention of Ben Bernanke and Hank Paulson and their cohorts!

Such gross and excess deposits have a couple of advantages to our Big Bankers. Follow the money as they say:

- The Big Bankers can stash away some reserves to cover some losses that are not yet accounted for (still kept hidden off the books or not yet marked to market).

- This money can be invested in Treasuries, thereby helping fuel the Treasury Bubble we entered, as of a few months ago. The Fed and the Treasury are great believers in funding asset price bubbles to "reflate" after the previous such bubble collapses.

- The Fed can avoid the obvious signs of inflation (actual excess of circulating money) that they seem so keen to avoid directly associating with all this bailout money.

- The money put aside can then be used by big banks to buy failing smaller banks, thereby furthering the "Bankers Consolidation Act of 2008", as I have taken to calling some of these financial shenanigans. In short, JPMorgan is looking to get bigger, by taking down and taking over some more banks.

Comment