So, I decided to try to really get a hold on what M1, M2, and M3 are.

It's still a whirlwind. What I found fascinating though was that on wikipedia, the money supply entry (based on the US dollar) is part of a larger Numismatic project. Just to make things even more confusing, I went over and read the numismatic page, and certain things began to make more sense, especially in terms of gold and silver.

Has platinum ever been used as a steady currency?

In any case, while I get the general concept of "money supply," it's still pretty hard to discern how the differences in M1, M2, and M3 affect the economy. It's somewhat intuitive to say "Money supply goes up, we have inflation, and the buying power of any unit of that currency goes down." But beyond that, I'm pretty damn lost. (Fortunately there seems to be a whole heaping of people out there who get it to help steer me in the right direction - thanks guys ;) ).

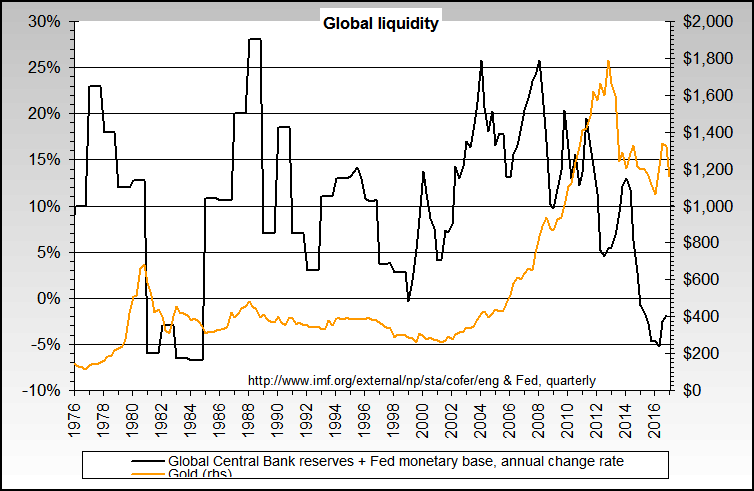

The one thing reading about M1 2 and 3 did though was make me realize what a bastard move the Fed made when it stopped publishing M3 material, and it's no wonder why Bart's M3 charts would be so popular.

The numismatic part to the currency equation has given me a bit more understanding of what EJ had posted a while back, in terms of putting coins in peoples hands and actually physically holding gold coins and getting the feel of it. Archeology meets psychology meets economics?

Personally I'm a functionalist. I don't like buying or collecting anything unless it has some utility. Money and wealth is never an end, but a means towards an end, and I could care less about what we use as money, what it looks like, feels like, etc. etc. I find myself ice cold when it comes to any type of money matter. Fundamentally, it would seem to me that oil would be a safer bet than any precious metal, as PM's have far less functional usage than oil, and in an stagflationary environment, PM's functional level goes down even worse. If manufacturing goes down, PM uses in manufacturing goes down with it. Found this little tidbit from http://www.halexandria.org/dward480.htm

So if Jewelry makes up 63% of gold demand, and we hit a big recession, wouldn't that put some downward pressure on gold?

Meanwhile, oil still moves all around us, in our cars, our water bottles, keeping the lights on in our big cities, etc.

I'm not sure I have a real solid point with this post, more just musings on some complex things I'm trying to make heads and tails of.

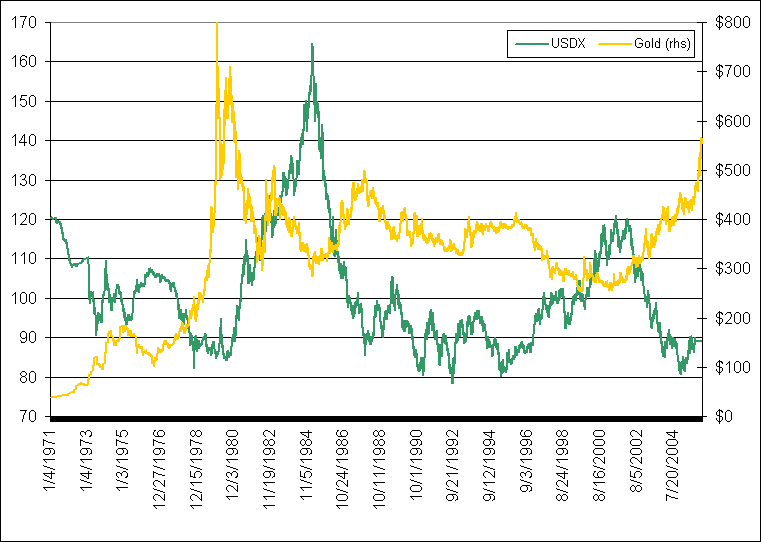

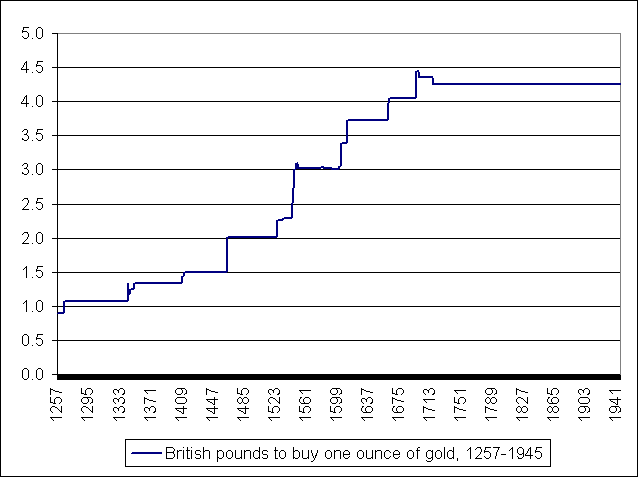

I think the biggest thing I wonder about gold bugs in specific is how much of the bullishness in gold is due to the dollar falling, how much is due to history, and how much is due to a closeness with the actual physical currency?

It's still a whirlwind. What I found fascinating though was that on wikipedia, the money supply entry (based on the US dollar) is part of a larger Numismatic project. Just to make things even more confusing, I went over and read the numismatic page, and certain things began to make more sense, especially in terms of gold and silver.

Has platinum ever been used as a steady currency?

In any case, while I get the general concept of "money supply," it's still pretty hard to discern how the differences in M1, M2, and M3 affect the economy. It's somewhat intuitive to say "Money supply goes up, we have inflation, and the buying power of any unit of that currency goes down." But beyond that, I'm pretty damn lost. (Fortunately there seems to be a whole heaping of people out there who get it to help steer me in the right direction - thanks guys ;) ).

The one thing reading about M1 2 and 3 did though was make me realize what a bastard move the Fed made when it stopped publishing M3 material, and it's no wonder why Bart's M3 charts would be so popular.

The numismatic part to the currency equation has given me a bit more understanding of what EJ had posted a while back, in terms of putting coins in peoples hands and actually physically holding gold coins and getting the feel of it. Archeology meets psychology meets economics?

Personally I'm a functionalist. I don't like buying or collecting anything unless it has some utility. Money and wealth is never an end, but a means towards an end, and I could care less about what we use as money, what it looks like, feels like, etc. etc. I find myself ice cold when it comes to any type of money matter. Fundamentally, it would seem to me that oil would be a safer bet than any precious metal, as PM's have far less functional usage than oil, and in an stagflationary environment, PM's functional level goes down even worse. If manufacturing goes down, PM uses in manufacturing goes down with it. Found this little tidbit from http://www.halexandria.org/dward480.htm

In one typical year gold consumption and its use was apportioned in the following manner: Jewelry 62.5%, electronics 5%, Dentistry 5%, other industrial 5%, coins (official, medals, medallions, etceteras) 15%, and increase in investments/holdings 7.5%.

Meanwhile, oil still moves all around us, in our cars, our water bottles, keeping the lights on in our big cities, etc.

I'm not sure I have a real solid point with this post, more just musings on some complex things I'm trying to make heads and tails of.

I think the biggest thing I wonder about gold bugs in specific is how much of the bullishness in gold is due to the dollar falling, how much is due to history, and how much is due to a closeness with the actual physical currency?

Comment