I'm not a tin-foil hat guy, but I found this an interesting article.

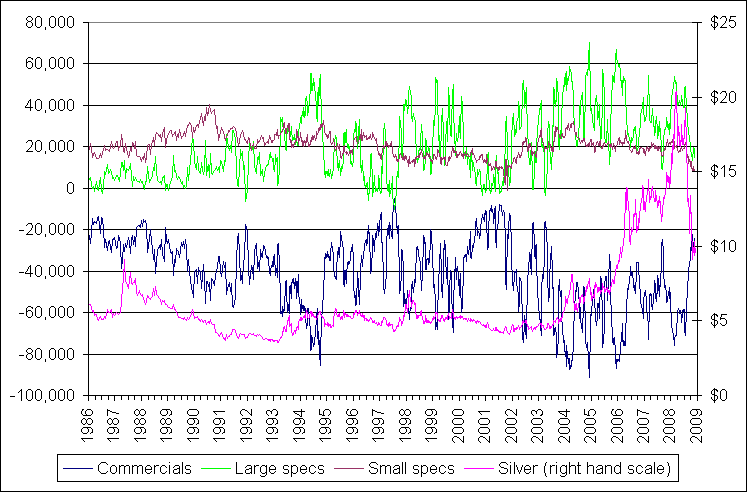

There is no other leveraged commodity market where short sellers increase their positions, materially, as the price rises, and increase them even more when prices are exploding, except gold and silver. The reason traders don’t normally do that is that it exposes short sellers to unlimited liability and risk. Yet, in both March and July 2008, and on countless occasions over the past 21 years, vast numbers of new gold and silver short positions were temporarily opened up, with the position holders seemingly unconcerned about the fact that precious metals had just risen exponentially, and that there was a very real potential they would bankrupt themselves with unlimited upside potential. Normal traders would not expose themselves to such unlimited risks.

I conclude, therefore, that over the last 21 years or so, “fake” precious metals supply in the form of promises of future delivery have habitually been increased when prices increase until increased “supply” managed to overwhelm increased demand, leading to a temporary price collapse. This is compounded by the fact that the futures prices on COMEX tend to dictate the “officially” report price for the precious metals elsewhere.

After the market is broken, shell-shocked leveraged long market participants have always been thrown out of their positions by margin calls, and/or have been happy to sell contracts back to the short sellers at much lower prices. This process has always allowed short sellers to cover short positions at a profit. If for some reason naked shorts needed to deliver, they could always count on various European central banks (and some say the Fed basement repository) to backstop them, releasing tons of physical gold into the market. It seemed that there were always another 34 tons or so of gold dumped at strategic times to bring down fast rising prices. Meanwhile, huge physical market demand in Asia and severe shortages buffered the downside. Because of the physical demand, prices steadily increased but, perhaps, at a much slower pace than would have been the case in the absence of market manipulation.

Rarely was there ever a serious short-squeeze. Rarely, that is, until Friday of last week when the deliveries demanded by non-leveraged long buyers reached record levels. In spite of an avalanche of complaints from gold and silver investors, the CFTC (Commodity Futures Trading Commission) has never bothered to audit even one vault to see if the short sellers really have the alleged gold and silver they claim to have. There is a legal requirement that, in every futures contract that promises to deliver a physical commodity, the short seller must be 90% covered by either a stockpile of the commodity or appropriate forward contracts with primary producers (such as miners). Inaction by CFTC, in the face of obvious market manipulation, implies a historical government endorsed price management.

Things, however, are changing fast. As previously stated, the first major mini-panic among COMEX gold short sellers happened last Friday. As of Wednesday morning, about 11,500 delivery demands for 100 ounce ingots were made at COMEX, which represents about 5% of the previous open interest. Another 2,000 contracts are still open, and a large percentage of those will probably demand delivery. These demands compare to the usual ½ to 1% of all contracts.

Rest here.

http://seekingalpha.com/article/1092...s?source=yahoo

There is no other leveraged commodity market where short sellers increase their positions, materially, as the price rises, and increase them even more when prices are exploding, except gold and silver. The reason traders don’t normally do that is that it exposes short sellers to unlimited liability and risk. Yet, in both March and July 2008, and on countless occasions over the past 21 years, vast numbers of new gold and silver short positions were temporarily opened up, with the position holders seemingly unconcerned about the fact that precious metals had just risen exponentially, and that there was a very real potential they would bankrupt themselves with unlimited upside potential. Normal traders would not expose themselves to such unlimited risks.

I conclude, therefore, that over the last 21 years or so, “fake” precious metals supply in the form of promises of future delivery have habitually been increased when prices increase until increased “supply” managed to overwhelm increased demand, leading to a temporary price collapse. This is compounded by the fact that the futures prices on COMEX tend to dictate the “officially” report price for the precious metals elsewhere.

After the market is broken, shell-shocked leveraged long market participants have always been thrown out of their positions by margin calls, and/or have been happy to sell contracts back to the short sellers at much lower prices. This process has always allowed short sellers to cover short positions at a profit. If for some reason naked shorts needed to deliver, they could always count on various European central banks (and some say the Fed basement repository) to backstop them, releasing tons of physical gold into the market. It seemed that there were always another 34 tons or so of gold dumped at strategic times to bring down fast rising prices. Meanwhile, huge physical market demand in Asia and severe shortages buffered the downside. Because of the physical demand, prices steadily increased but, perhaps, at a much slower pace than would have been the case in the absence of market manipulation.

Rarely was there ever a serious short-squeeze. Rarely, that is, until Friday of last week when the deliveries demanded by non-leveraged long buyers reached record levels. In spite of an avalanche of complaints from gold and silver investors, the CFTC (Commodity Futures Trading Commission) has never bothered to audit even one vault to see if the short sellers really have the alleged gold and silver they claim to have. There is a legal requirement that, in every futures contract that promises to deliver a physical commodity, the short seller must be 90% covered by either a stockpile of the commodity or appropriate forward contracts with primary producers (such as miners). Inaction by CFTC, in the face of obvious market manipulation, implies a historical government endorsed price management.

Things, however, are changing fast. As previously stated, the first major mini-panic among COMEX gold short sellers happened last Friday. As of Wednesday morning, about 11,500 delivery demands for 100 ounce ingots were made at COMEX, which represents about 5% of the previous open interest. Another 2,000 contracts are still open, and a large percentage of those will probably demand delivery. These demands compare to the usual ½ to 1% of all contracts.

Rest here.

http://seekingalpha.com/article/1092...s?source=yahoo

Comment