Re: Mental Experiment

In light of my unnatural fondness for nits, it is appropriate to open with a great big *bless you*! Such a rare treat of raw meat from our bartaceous buddy!

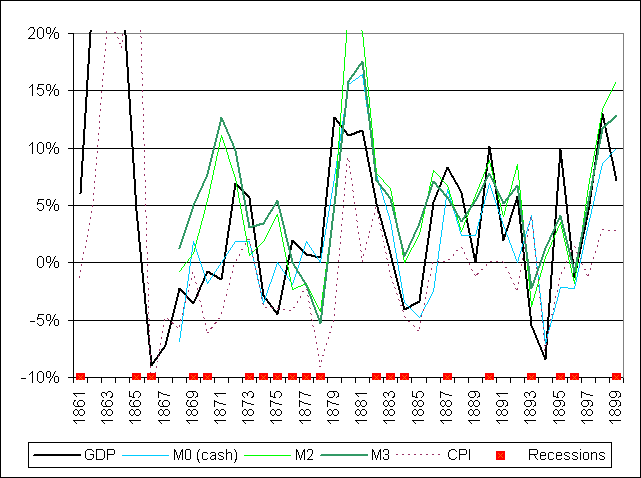

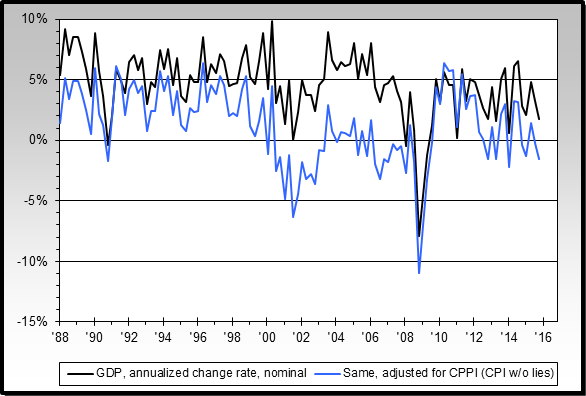

Behold, some charts to examine! But … what this? … alas, having had my finster fangs set atwitter, my gut calls out "Where’s the beef?" For in turning aside the garnish, all my beady, bloodshot, eyes can make out is an empty plate.

I find nothing in yonder charts to contradict my position. First, despite having had more or less routine "depressions" without benefit of a central bank, it took the creation of the Federal Reserve to give us a truly "Great" one. Just as we’d had inflations and deflations before, only in the wake of the monster inflation the Fed nursed into being in the 1920’s could we have a truly catastrophic deflation.

As for the micro-nit re the possibility of deflation occurring without first having had a prior inflation, I’d make two points. First, I did not quite say that inflation was a necessary precondition for deflation. Not even that it is a sufficient condition. Second, in the most fundamental sense, it nevertheless is true. Unless you are prepared to argue that credit has existed since the Big Bang, at some point in history credit would have had to expand to exist at all. From zero, credit must expand to reach any finite level, so without some inflation credit does not exist.

The problem is not the existence of some necessary and natural amount of credit expansion, but artificially - as a matter of public policy - trying to force it into existence. Only when, through the agency of some governmental intervention, it is determined to deliberately expand credit, and thus inflate, do we truly run into problems. When the amount of credit is in dynamic equilibrium with a free economy, it will naturally expand and contract in relation to the economy’s needs. But when it is driven above the natural level sought by the economy, it has a tendency to contract. This leaves the self-styled gods of money in the position of having to either redouble their efforts (and thus make the problem worse) or permit the body of credit to take its natural course and deflate.

There is no pain-free way out. No more than there is with someone addicted to hard drugs. The artificial inflation at first "feels good"; the economy gets euphoric … high. But eventually as the new credit saturates the economy, the economy develops a tolerance to it. It adapts to the artificial credit spigot. People find they have more debt than they are comfortable with, and the credit must be made cheaper still, else they will begin to shed the excess debt. One way or another they will do so, whether is through the agency of retiring debt in nominal terms, or through the agency of falling units of currency.

Either way, however, when the drug is withdrawn, the addict suffers withdrawal. The point I am arguing here is whether we should blame the addict’s troubles on the lack of drug, or his having become hooked on it in the first place. All too many economists are effectively in the position of arguing that since withdrawing the drug causes discomfort, then the drug must be good for the body. I say they are all wet; that they need to look deeper for the true original cause of the addict’s problem.

So if you are in the first camp, then indeed we do have a meaningful disagreement. If you are in the second, we will just have to find some other nits to pick … ;-)

Originally posted by bart

Behold, some charts to examine! But … what this? … alas, having had my finster fangs set atwitter, my gut calls out "Where’s the beef?" For in turning aside the garnish, all my beady, bloodshot, eyes can make out is an empty plate.

I find nothing in yonder charts to contradict my position. First, despite having had more or less routine "depressions" without benefit of a central bank, it took the creation of the Federal Reserve to give us a truly "Great" one. Just as we’d had inflations and deflations before, only in the wake of the monster inflation the Fed nursed into being in the 1920’s could we have a truly catastrophic deflation.

As for the micro-nit re the possibility of deflation occurring without first having had a prior inflation, I’d make two points. First, I did not quite say that inflation was a necessary precondition for deflation. Not even that it is a sufficient condition. Second, in the most fundamental sense, it nevertheless is true. Unless you are prepared to argue that credit has existed since the Big Bang, at some point in history credit would have had to expand to exist at all. From zero, credit must expand to reach any finite level, so without some inflation credit does not exist.

The problem is not the existence of some necessary and natural amount of credit expansion, but artificially - as a matter of public policy - trying to force it into existence. Only when, through the agency of some governmental intervention, it is determined to deliberately expand credit, and thus inflate, do we truly run into problems. When the amount of credit is in dynamic equilibrium with a free economy, it will naturally expand and contract in relation to the economy’s needs. But when it is driven above the natural level sought by the economy, it has a tendency to contract. This leaves the self-styled gods of money in the position of having to either redouble their efforts (and thus make the problem worse) or permit the body of credit to take its natural course and deflate.

There is no pain-free way out. No more than there is with someone addicted to hard drugs. The artificial inflation at first "feels good"; the economy gets euphoric … high. But eventually as the new credit saturates the economy, the economy develops a tolerance to it. It adapts to the artificial credit spigot. People find they have more debt than they are comfortable with, and the credit must be made cheaper still, else they will begin to shed the excess debt. One way or another they will do so, whether is through the agency of retiring debt in nominal terms, or through the agency of falling units of currency.

Either way, however, when the drug is withdrawn, the addict suffers withdrawal. The point I am arguing here is whether we should blame the addict’s troubles on the lack of drug, or his having become hooked on it in the first place. All too many economists are effectively in the position of arguing that since withdrawing the drug causes discomfort, then the drug must be good for the body. I say they are all wet; that they need to look deeper for the true original cause of the addict’s problem.

So if you are in the first camp, then indeed we do have a meaningful disagreement. If you are in the second, we will just have to find some other nits to pick … ;-)

Comment