Re: Bearish Information Re. Bonar is week's biggest turkey.

I can do better than scare about the Dow, and I don't even have to talk about the international value of the dollar/bonar. Inflation itself has been truly disgusting.

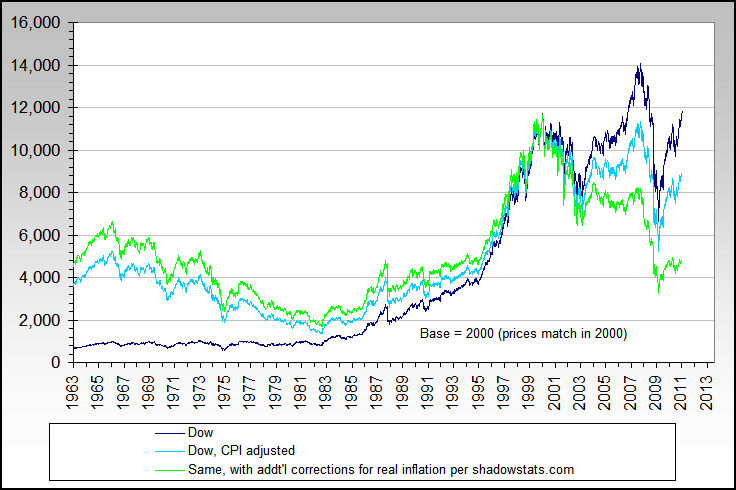

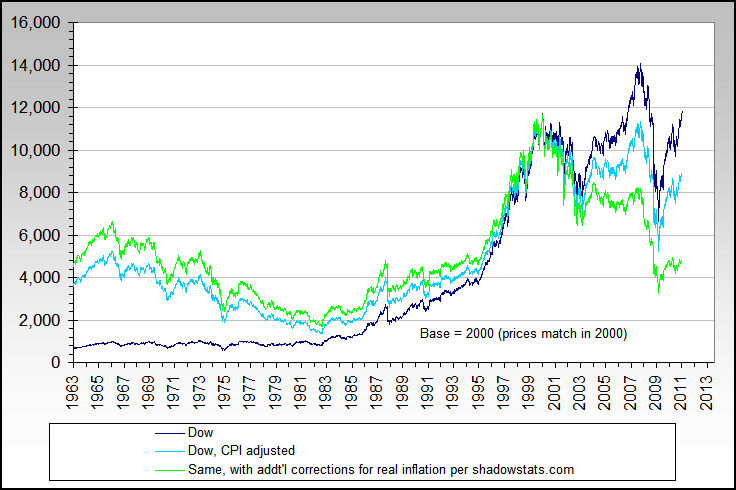

About a week ago, I put together a long term picture of a number of items like the Dow, gold, housing., etc. since the '60s. Here's the one for the Dow:

In 1963, the Dow was 700 --- just adjusting for CPI, its only at about 1750 today. If a more real CPI figure is used (shadowstats.com numbers), it's not even at 1100.

Originally posted by Jim Nickerson

About a week ago, I put together a long term picture of a number of items like the Dow, gold, housing., etc. since the '60s. Here's the one for the Dow:

In 1963, the Dow was 700 --- just adjusting for CPI, its only at about 1750 today. If a more real CPI figure is used (shadowstats.com numbers), it's not even at 1100.

Comment