Re: Bearish Information Re. Equity Markets Top

I suspect that its just that the TIF format is very unusual and most browsers will not resolve it. Try PNG or GIF and it should work.

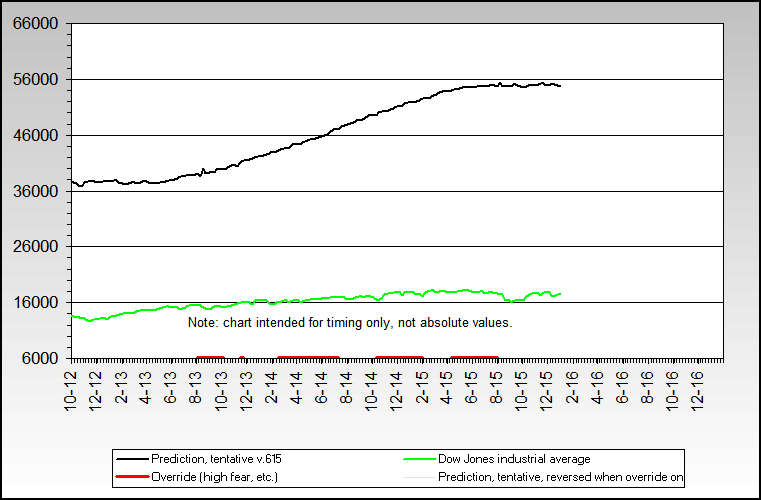

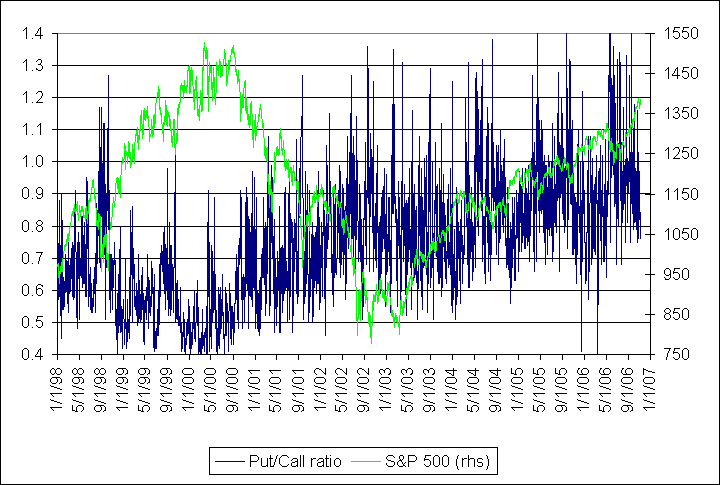

By the way, very nicely done on the analysis. I tend to agree that all the ducks aren't in a row yet for a top, and also think that the Jan 1-Mar 15, 2007 period is the most likely period for a top... and as usual YMMV - Your Mileage May Vary.

Originally posted by Jim Nickerson

I suspect that its just that the TIF format is very unusual and most browsers will not resolve it. Try PNG or GIF and it should work.

By the way, very nicely done on the analysis. I tend to agree that all the ducks aren't in a row yet for a top, and also think that the Jan 1-Mar 15, 2007 period is the most likely period for a top... and as usual YMMV - Your Mileage May Vary.

This is a pretty bearish board so when you post along those lines, its not very likely you'll get significant disagreements.

This is a pretty bearish board so when you post along those lines, its not very likely you'll get significant disagreements.

Comment