Re: Bullish Information Re. One guy says buy SPY.

metalman, what is your problem? Are you so freakin' close-minded that you think anyone who does NOT think and see things your way is wrong? That is the impression I get. Usually people that are so full of believing they are so right about markets get their asses handed to them at some point, do you think you'll live long enough to ever see that happen to yourself, or that you will necessarily be wise enough to recognize it?

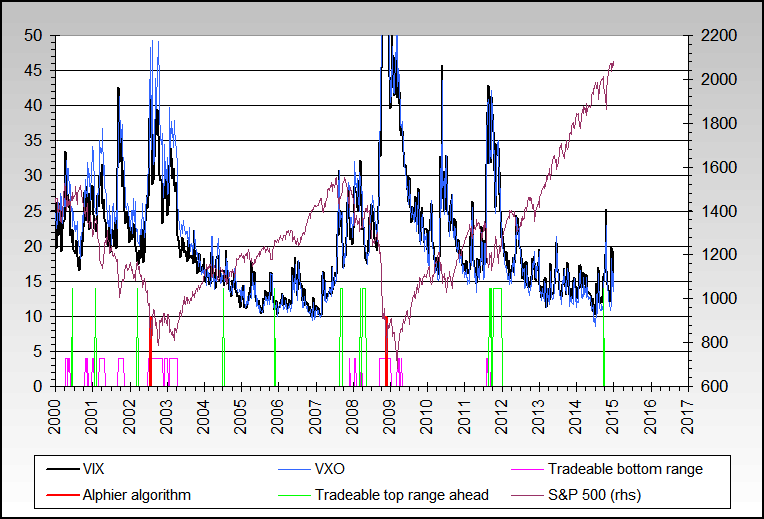

Charts certainly in the manner I use them predict nothing that is guaranteed. There have been any number of indications that the equity markets have either been very oversold and some sectors very overbought for at least the six market days prior to today. If you wish to ignore that, then fine--which you apparently do as a buy and hold investor. Not everyone is of your ilk. Why can't you come to acceptance of that fact?

Originally posted by metalman

View Post

metalman, what is your problem? Are you so freakin' close-minded that you think anyone who does NOT think and see things your way is wrong? That is the impression I get. Usually people that are so full of believing they are so right about markets get their asses handed to them at some point, do you think you'll live long enough to ever see that happen to yourself, or that you will necessarily be wise enough to recognize it?

Charts certainly in the manner I use them predict nothing that is guaranteed. There have been any number of indications that the equity markets have either been very oversold and some sectors very overbought for at least the six market days prior to today. If you wish to ignore that, then fine--which you apparently do as a buy and hold investor. Not everyone is of your ilk. Why can't you come to acceptance of that fact?

bull market in cash and bonds in a depression, gold in an inflationary recession, stocks in a general econ expansion, not stocks in an economic contraction, and just certain kinds of stocks in a transition to a new kind of economy. ej has promised to tell us what stocks will benefit from the next gov't sponsored boom, but at this point is still saying avoid stocks, last i checked...

bull market in cash and bonds in a depression, gold in an inflationary recession, stocks in a general econ expansion, not stocks in an economic contraction, and just certain kinds of stocks in a transition to a new kind of economy. ej has promised to tell us what stocks will benefit from the next gov't sponsored boom, but at this point is still saying avoid stocks, last i checked...

Comment