Re: Bullish Information

Drat... where Finster when he's needed... ;)

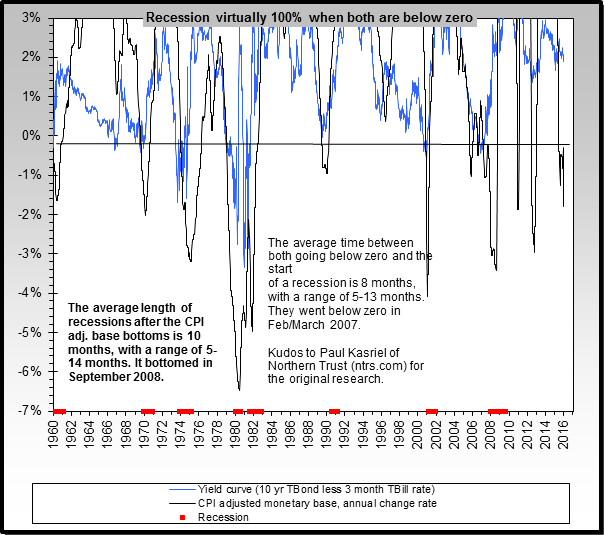

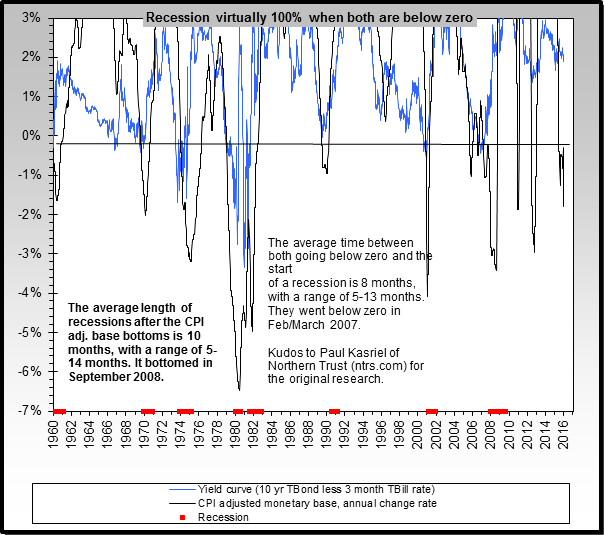

Here's the actual chart and the credit mostly belongs with Paul Kasriel of Northern Trust - a major straight shooter in my book.

Originally posted by Jim Nickerson

View Post

Here's the actual chart and the credit mostly belongs with Paul Kasriel of Northern Trust - a major straight shooter in my book.

Comment