Re: Bullish Information Re. II bearish sentiment.

metalman, I don't know if "predictive" is the best word or not. "Suggestive" of subsequent market direction is when extremes in investor sentiment seems at least to me to be useful, and my opinion is the extremes of lows are better near-term indicators than are extreme highs.

Another thing to consider is that betting (investing) is a piece of cake when one looks back at how things have gone--which your opening line seems to indicate. Knowing what to do tomorrow is the goddammed difficult part of my life, and I expect it is the same for most people, unless their bet is that regarding their opinion they believe they are right and choose to sit tight--to paraphase someone. For those who can do that, that is fine with me. I can't do that.

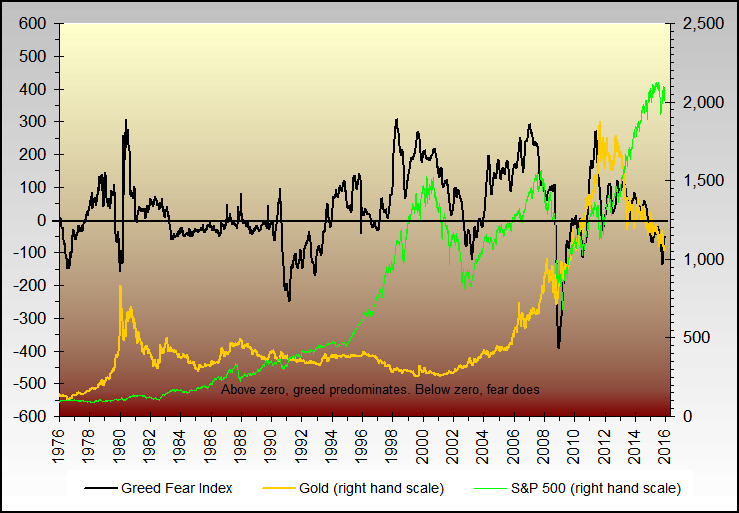

When I look at the bottom panel of the graph, it suggests to me that when the bull/bear difference is at or below zero, since 1998, it has been rewarding to be long the SPX, though not all the uptrends from those low indications were good for longterm buy and hold mentalities.

Right now, Friday, the DJI is near its 6-month lows, and as is posted elsewhere the other major equity indices are not so low as they were earlier this year.

I guess you read investment stuff as much or more than I do, but after reading for the past week, there is almost nothing I have encountered that suggests the markets are going anywhere but down.

This thread is open to all, including spooks like yourself, and it would be nice right now if anyone would put up some bullish arguments they are encountering if for no other reason than what might be the novelty of anyone venturing bullishness.

I definitely do not think anyone should act upon my opinions, but presently I expect the other indices are either going to correct mightily to bring them more in line with the DJI, or either there is going to be an upward bounce in here because of the rather extreme pessimism that currently is flourishing.

Originally posted by metalman

View Post

Another thing to consider is that betting (investing) is a piece of cake when one looks back at how things have gone--which your opening line seems to indicate. Knowing what to do tomorrow is the goddammed difficult part of my life, and I expect it is the same for most people, unless their bet is that regarding their opinion they believe they are right and choose to sit tight--to paraphase someone. For those who can do that, that is fine with me. I can't do that.

When I look at the bottom panel of the graph, it suggests to me that when the bull/bear difference is at or below zero, since 1998, it has been rewarding to be long the SPX, though not all the uptrends from those low indications were good for longterm buy and hold mentalities.

Right now, Friday, the DJI is near its 6-month lows, and as is posted elsewhere the other major equity indices are not so low as they were earlier this year.

I guess you read investment stuff as much or more than I do, but after reading for the past week, there is almost nothing I have encountered that suggests the markets are going anywhere but down.

This thread is open to all, including spooks like yourself, and it would be nice right now if anyone would put up some bullish arguments they are encountering if for no other reason than what might be the novelty of anyone venturing bullishness.

I definitely do not think anyone should act upon my opinions, but presently I expect the other indices are either going to correct mightily to bring them more in line with the DJI, or either there is going to be an upward bounce in here because of the rather extreme pessimism that currently is flourishing.

Comment