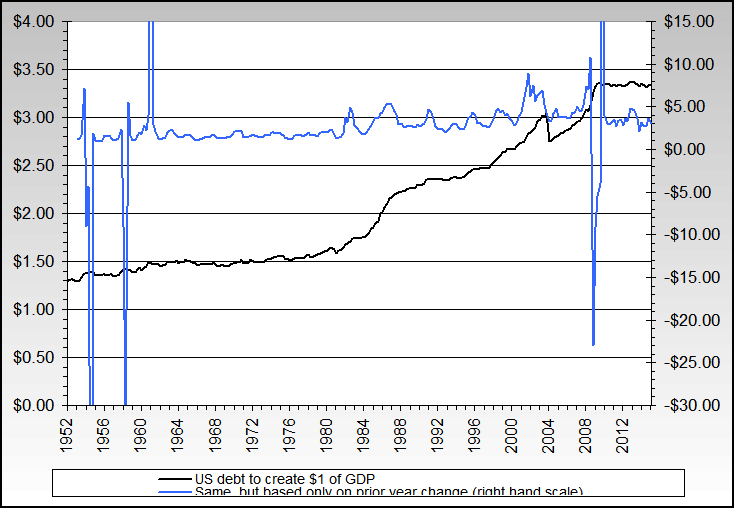

In short, it wouldn't have done anything because the economy only grows at a rate of about 20 cents for every dollar of debt taken on. That is, it takes five dollars of debt to generate one new dollar of GDP.

The bad news is that once you reach the "$1 for $1" level you are no longer able to finance growth with debt, and it becomes inevitable that you will begin to finance debt with debt.

That, of course generates no GDP at all but precipitously tightens the spiral.

The bad news is that once you reach the "$1 for $1" level you are no longer able to finance growth with debt, and it becomes inevitable that you will begin to finance debt with debt.

That, of course generates no GDP at all but precipitously tightens the spiral.

Note: I have no idea where the chart comes from.

debt-contribution.jpg

Comment