In following the current Financial crisis - Will the US Treasuries replace Gold as a the store of wealth among the World Central bankers ? I am just echoing the comments made by "$#*" in this forum. I think it can happen and Paul Krugman has also blogged about this in NYTimes.

http://krugman.blogs.nytimes.com/200...low-the-money/

[IMG]file:///C:/DOCUME%7E1/BIJUJO%7E1/LOCALS%7E1/Temp/moz-screenshot.jpg[/IMG][IMG]file:///C:/DOCUME%7E1/BIJUJO%7E1/LOCALS%7E1/Temp/moz-screenshot-1.jpg[/IMG]

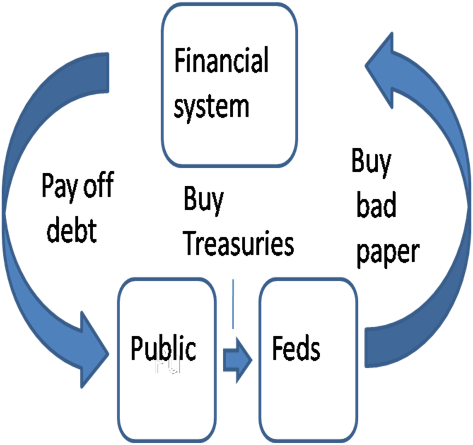

"$#*" used the analogy of a concrete driller. The US issues US Treasuries to write of the bad loans and recapitalize the financial gambers. The Central bankers know the consequence of this. If they do not buy them, this will lead to monetize them and cause dollar devaluation, which in turn causes the foreign currencies to appreciate and cause enormous hardship for their local economies and will not be able to export to US. Japan,China,Europe...cannot allow this to happen and so they will fund this bailout and recapitalize the failed US fianancials. Voila - the problem is solved. This is really a US blackmail with a Gun to the US dollar. If we fail, you also fail.

Now one thing I don't understand is why should the Oil Exporters be also long US Treasuries. Arab nations(Saudi,Kuwait..), Russia, Venezuela should all be short US Treasuries. Why are they still supporting the US treasuries instead of being net sellers ?

I think if Paulson's plan does goes through, US Treasuries will replace Gold, the new paper will replace the store of wealth since ancient times. Something really ambitious for Paulson to embark upon and that is why is putting foreign creditors to be repaid before anyone. The carrots before the donkeys.

Is this theory of "$#*" plausible ?

http://krugman.blogs.nytimes.com/200...low-the-money/

[IMG]file:///C:/DOCUME%7E1/BIJUJO%7E1/LOCALS%7E1/Temp/moz-screenshot.jpg[/IMG][IMG]file:///C:/DOCUME%7E1/BIJUJO%7E1/LOCALS%7E1/Temp/moz-screenshot-1.jpg[/IMG]

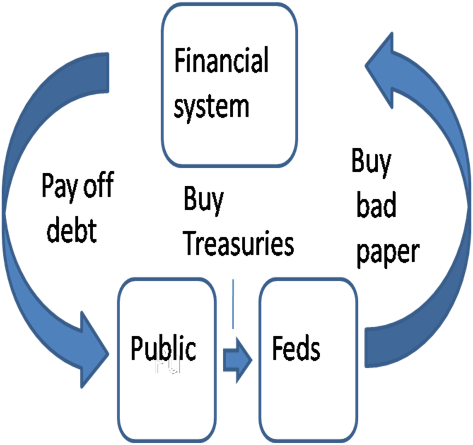

"$#*" used the analogy of a concrete driller. The US issues US Treasuries to write of the bad loans and recapitalize the financial gambers. The Central bankers know the consequence of this. If they do not buy them, this will lead to monetize them and cause dollar devaluation, which in turn causes the foreign currencies to appreciate and cause enormous hardship for their local economies and will not be able to export to US. Japan,China,Europe...cannot allow this to happen and so they will fund this bailout and recapitalize the failed US fianancials. Voila - the problem is solved. This is really a US blackmail with a Gun to the US dollar. If we fail, you also fail.

Now one thing I don't understand is why should the Oil Exporters be also long US Treasuries. Arab nations(Saudi,Kuwait..), Russia, Venezuela should all be short US Treasuries. Why are they still supporting the US treasuries instead of being net sellers ?

I think if Paulson's plan does goes through, US Treasuries will replace Gold, the new paper will replace the store of wealth since ancient times. Something really ambitious for Paulson to embark upon and that is why is putting foreign creditors to be repaid before anyone. The carrots before the donkeys.

Is this theory of "$#*" plausible ?

Comment