Re: Credit inflation, Deflation: Prechter Interview

Bart,

Earlier today, I posted this under Bullish Information. It seems to fit in with what you are saying.

Do you want to know what I would find interesting? I would find it highly interesting to know what some of you "heavy-weights" in the financial sense think will be the indicators of the "ka" in EJ's theory (and I write that with serious deference to your knowledge). Probably such has been alluded to already on this board, but I read so much and so little of all I read sticks in my mind. It would be nice to have a thread devoted to signs of impending "ka."

as an example, how is "the common reader" to best keep track of such occurring?

What other things are you watching, Bart and anyone else who finds EJ's theory tenable?

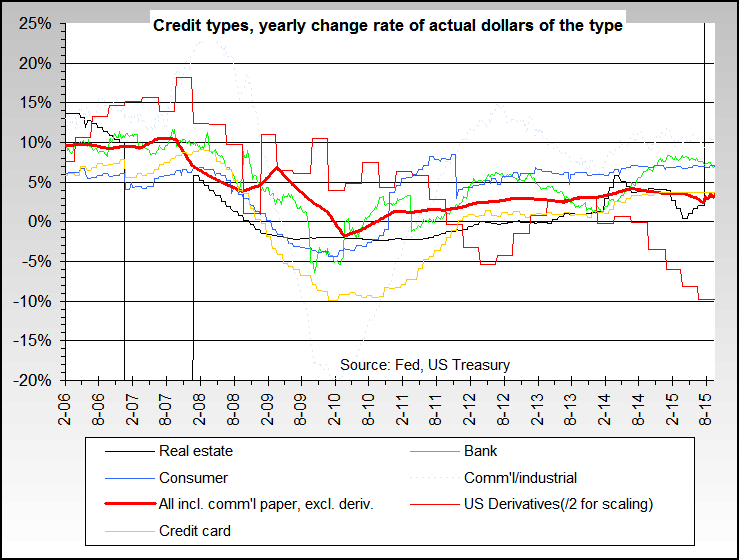

I continue to look at Finster's FDI rate of change graph and for over 3 years that has shown disinflation--which seems to me counter to all the talk of easy credit which I understand to be inflationary.

Bart,

Earlier today, I posted this under Bullish Information. It seems to fit in with what you are saying.

December 13, 2006

Why is Everyone So Bearish on Credit Markets, Economy?

by Clif Droke http://www.safehaven.com/article-6497.htm

"Based on the money supply and credit creation data we've talked about in recent newsletters, the economy has already landed and should see a gradual upturn over the next several months. Based on this assessment, the incessant talk among analysts of a "hard landing" versus "soft landing" is moot."

"When analyzing the U.S. economy it really comes down to this: one must always assume that Americans are constantly willing to spend money on consumer discretionary goods, and the only reason they don't always do so is because money supply/credit levels are too low. Period. That's really all you need to know about analyzing U.S. consumer spending habits. The American consumer is an extremely unique creature and unlike consumers of many other countries his first priority is to spend rather than to save. Consumer spending only takes a dive when the Fed severely restricts money supply and bank credit isn't readily available."

"Well it doesn't get any clearer than that from a contrarian standpoint! Indeed, the fact that Dresdner, Morgan Stanley and others have turned bearish on the credit outlook further underscores the upside potential of not only the credit markets (a leading indicator) but also of the U.S. stock market consumer economy in general. It's always good news when the investment banks and leading financial institutions openly announce a bearish outlook on the markets!"

Why is Everyone So Bearish on Credit Markets, Economy?

by Clif Droke http://www.safehaven.com/article-6497.htm

"Based on the money supply and credit creation data we've talked about in recent newsletters, the economy has already landed and should see a gradual upturn over the next several months. Based on this assessment, the incessant talk among analysts of a "hard landing" versus "soft landing" is moot."

"When analyzing the U.S. economy it really comes down to this: one must always assume that Americans are constantly willing to spend money on consumer discretionary goods, and the only reason they don't always do so is because money supply/credit levels are too low. Period. That's really all you need to know about analyzing U.S. consumer spending habits. The American consumer is an extremely unique creature and unlike consumers of many other countries his first priority is to spend rather than to save. Consumer spending only takes a dive when the Fed severely restricts money supply and bank credit isn't readily available."

"Well it doesn't get any clearer than that from a contrarian standpoint! Indeed, the fact that Dresdner, Morgan Stanley and others have turned bearish on the credit outlook further underscores the upside potential of not only the credit markets (a leading indicator) but also of the U.S. stock market consumer economy in general. It's always good news when the investment banks and leading financial institutions openly announce a bearish outlook on the markets!"

Originally posted by Bart

What other things are you watching, Bart and anyone else who finds EJ's theory tenable?

I continue to look at Finster's FDI rate of change graph and for over 3 years that has shown disinflation--which seems to me counter to all the talk of easy credit which I understand to be inflationary.

Comment