Re: Credit inflation, Deflation: Prechter Interview

Let me answer this way: Suppose you were correct - no, more than correct - and I actually created an index of inflation based solely on equities. Such that, rather than plot the value of equities in terms of currencies, I plotted the value of currency in terms of equities. But that through some strange metaphysical eventuality, it wound up looking like the real FDI.

Let's explore the impliciations.

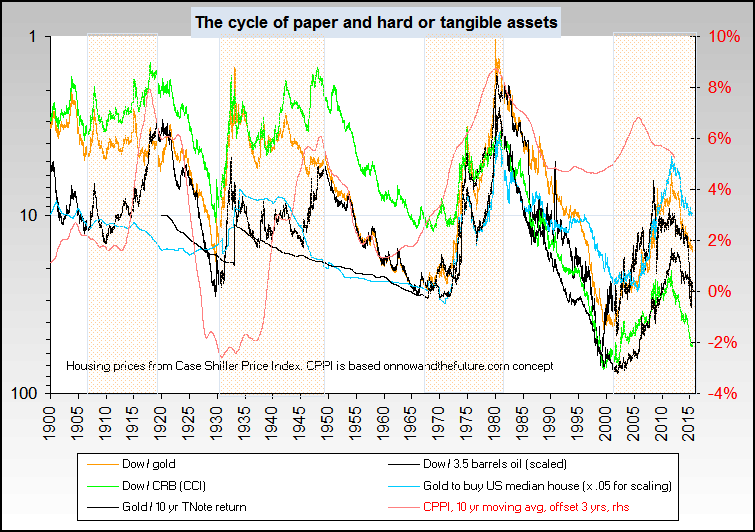

Below is a chart of the FDI. According to your premise, it plots currency against equites:

Next please recall that you assert that you have no equities, but instead emphasize currency in your investment portfolio. But wait ... according to your own assumption, the above chart shows a virtually perpetual decline of currency in relation to equity. The obvious conclusion is that your investment program provides greatly inferior returns, being practically guaranteed to underperform equites. Thus, by excluding the entire asset class of equities, you are underperforming while taking virtually certain risk.

Consequently, by purely logical deduction - from your own stated premises - my original assertion is proved correct.

Q.E.D.

Originally posted by jk

Let me answer this way: Suppose you were correct - no, more than correct - and I actually created an index of inflation based solely on equities. Such that, rather than plot the value of equities in terms of currencies, I plotted the value of currency in terms of equities. But that through some strange metaphysical eventuality, it wound up looking like the real FDI.

Let's explore the impliciations.

Below is a chart of the FDI. According to your premise, it plots currency against equites:

Next please recall that you assert that you have no equities, but instead emphasize currency in your investment portfolio. But wait ... according to your own assumption, the above chart shows a virtually perpetual decline of currency in relation to equity. The obvious conclusion is that your investment program provides greatly inferior returns, being practically guaranteed to underperform equites. Thus, by excluding the entire asset class of equities, you are underperforming while taking virtually certain risk.

Consequently, by purely logical deduction - from your own stated premises - my original assertion is proved correct.

Q.E.D.

.png)

Comment