Re: questions

I do understand about my site, its very condensed and doesn't have near the amount of explanations I'd like... but its mostly just me and I'm still more in research than maintanence & improvement mode.

EJ did a great article a while back which I think answers a number of your questions better than I - Ka-Poom is a Rhyme not a Repeat of History. There are a few links in it that even go deeper into the "how" and also what happened in Japan.

Do note that reserve requirements are not zero or close to it all *all* accounts too.

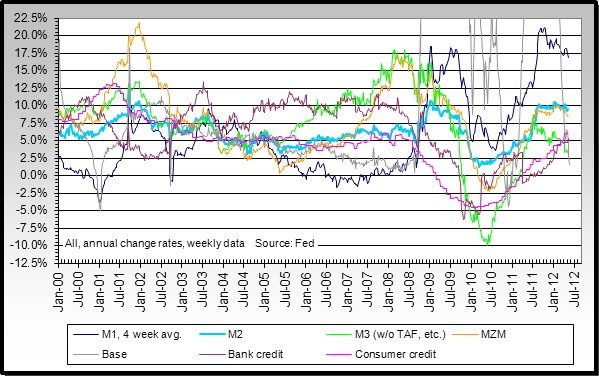

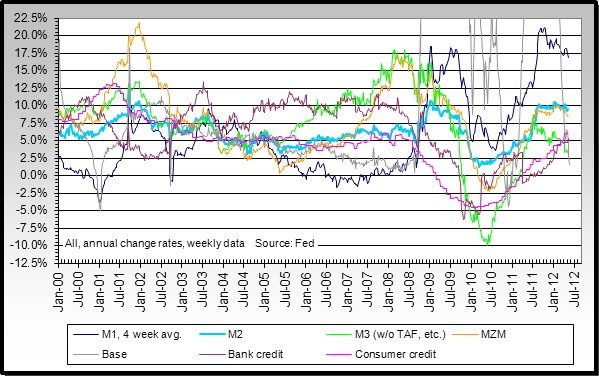

Its in no way a deflation guarantee too if credit drop a lots closer to zero than now - looks at how low bank credit (lime green line) dropped on an annual rate of change basis in 2004 for example:

True on the GDP to credit ratio - it has gone up a lot. I've seen numbers around 7:1... but do put it in perspective too. It was under 1 in the '50s and has gone up over 700% without super major messes. My point is that it may be 10:1 or 20:1 or more before all h*ll really does break loose - and it may be at 8:1 too. No one knows.

As far as tax cuts, there was that $300 rebate in 2003 and deficits were pretty bad then too. Its the same thing as with credit - who knows how much of a tax cut can be done. But it sure does appear to me right now that we're more likely to get a net tax increase, although it may not be done via income tax. Politics is not my strong suit though.

You're very braadly correct in my opinion on how money gets into the system... but do also consider the helo drop of that 2003 $300 tax rebate too. That injects it directly and where it will do more good too... except for inflationary effects of course.

I'm also not nearly as certain as you that willingness can not be managed too, at least for US consumers. If "you" noticed prices were going up at 15%+ per year and had available credit, wouldn't that at the very least have you thinking about borrowing more?

Keeping the flows coming in from Japan, China, etc. is definitely the big issue - the moment that they detect that the Fed is starting to inflate at a significantly higher rate, in my opinion that will mark the start of "poom".

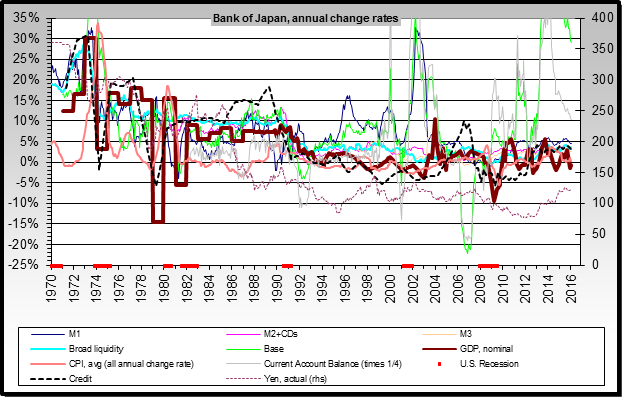

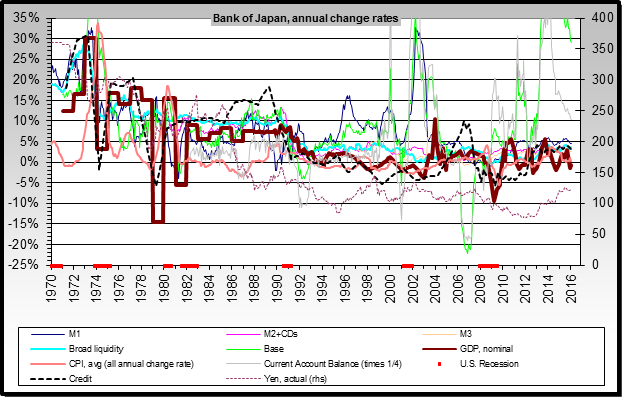

One of the issues that seldom comes up when the deflation in Japan is discussed is that the BoJ didn't seem to try very hard to me.

Check out this long term chart on the Bank of Japan's stats and notice the huge difference between annual change rates in the '70s (especially) & '80s versus the '90s and the last few years.

As an aside, it sure looks to me that the recent drops in the monetary base, etc. at the BoJ will have them heading back into relative deflation... aka the "ka" before the "poom".

Originally posted by PeterM

I do understand about my site, its very condensed and doesn't have near the amount of explanations I'd like... but its mostly just me and I'm still more in research than maintanence & improvement mode.

EJ did a great article a while back which I think answers a number of your questions better than I - Ka-Poom is a Rhyme not a Repeat of History. There are a few links in it that even go deeper into the "how" and also what happened in Japan.

Do note that reserve requirements are not zero or close to it all *all* accounts too.

Its in no way a deflation guarantee too if credit drop a lots closer to zero than now - looks at how low bank credit (lime green line) dropped on an annual rate of change basis in 2004 for example:

True on the GDP to credit ratio - it has gone up a lot. I've seen numbers around 7:1... but do put it in perspective too. It was under 1 in the '50s and has gone up over 700% without super major messes. My point is that it may be 10:1 or 20:1 or more before all h*ll really does break loose - and it may be at 8:1 too. No one knows.

As far as tax cuts, there was that $300 rebate in 2003 and deficits were pretty bad then too. Its the same thing as with credit - who knows how much of a tax cut can be done. But it sure does appear to me right now that we're more likely to get a net tax increase, although it may not be done via income tax. Politics is not my strong suit though.

You're very braadly correct in my opinion on how money gets into the system... but do also consider the helo drop of that 2003 $300 tax rebate too. That injects it directly and where it will do more good too... except for inflationary effects of course.

I'm also not nearly as certain as you that willingness can not be managed too, at least for US consumers. If "you" noticed prices were going up at 15%+ per year and had available credit, wouldn't that at the very least have you thinking about borrowing more?

Keeping the flows coming in from Japan, China, etc. is definitely the big issue - the moment that they detect that the Fed is starting to inflate at a significantly higher rate, in my opinion that will mark the start of "poom".

One of the issues that seldom comes up when the deflation in Japan is discussed is that the BoJ didn't seem to try very hard to me.

Check out this long term chart on the Bank of Japan's stats and notice the huge difference between annual change rates in the '70s (especially) & '80s versus the '90s and the last few years.

As an aside, it sure looks to me that the recent drops in the monetary base, etc. at the BoJ will have them heading back into relative deflation... aka the "ka" before the "poom".

Comment