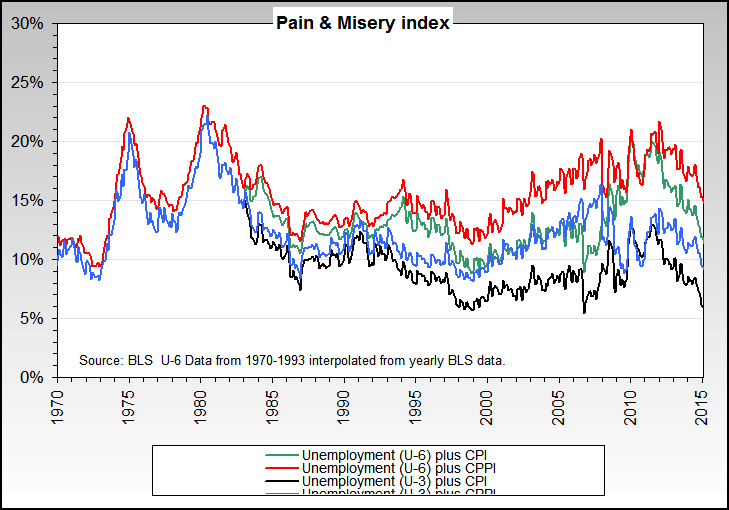

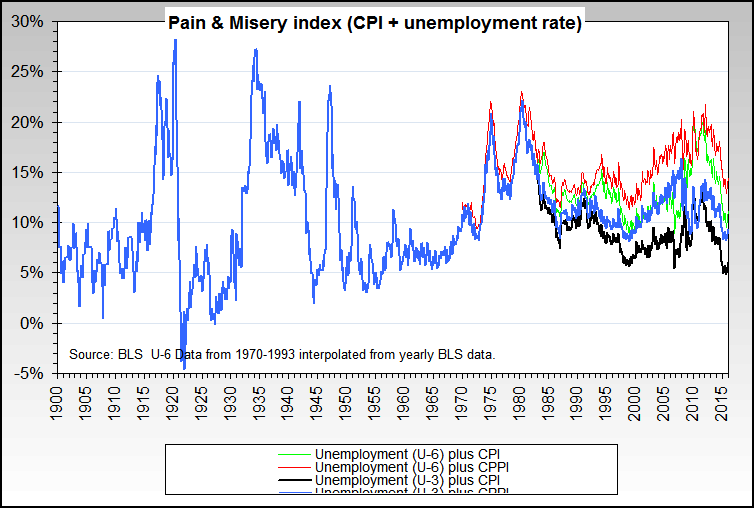

the "misery index" was a popular reference in the late 1970's. it's equal to the sum of inflation and unemployment, and reached a peak of 21.98% in 1980. official "unemployment" back then meant something a little different than today, however. the announcements these days refer to "u-3," which does not include discouraged workers or those working only part time because they can't find a full time job. what was "unemployment" in the 1970's in what we now call "u-6." similarly, the definition [or, if you prefer, "calculation method"] of inflation has changed markedly. using the old definitions, the misery index is now about 24%.

data: http://www.shadowstats.com/alternate_data

[bart, i don't know if you chart the misery index, but it might be a popular feature]

data: http://www.shadowstats.com/alternate_data

[bart, i don't know if you chart the misery index, but it might be a popular feature]

Comment