from contraryinvestor.com;

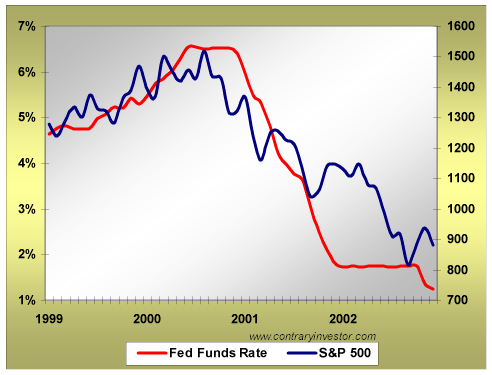

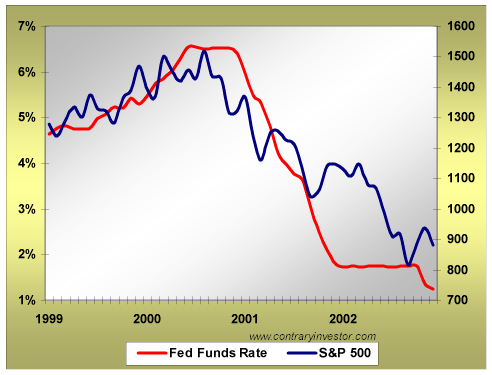

In June of 2000, the Fed went “on hold” with their monetary tightening of the prior period. And as you can perhaps make out in the chart, as the Fed pause went into effect, the S&P rallied. Clearly the thought at the time, as we believe is the case today, was that monetary policy reigned supreme. It could cure all economic and market maladies. Unfortunately that was not to be the case as corporate capital spending literally fell off of a cliff, corporate earnings were negatively influenced, and these factors took the real economy into what was ultimately to be a mild recesionary interlude. So here we stand today with the Fed now on pause in terms of further rate hikes. Here we stand with the equity markets having now rallied back from their summertime lows, as they did off of their springtime lows in 2000. And here we stand today facing what we believe will be a slowdown in consumer spending ahead, as opposed to capital spending slowing in late 2000 through 2002. Are we looking at a conceptual “rhyme”? Are investors once again assuming interest rates cure all ills as opposed to looking at the components of consumer and capital spending demand and the influence of that demand on corporate earnings? From our vantage point, it sure seems the markets are much more reactive to anything related to forward interest rates as opposed to the trajectory of forward earnings driven by consumer and business demand.

A few last comments and we’ll move on. You know that virtually everything we commented on up to this point has to do with real economic fundamentals. If indeed the US economy slows ahead based on our expectation of a slowdown in consumer spending, we’re convinced the Fed will panic. They have no other tricks up their sleeves. If indeed this comes to pass, you can bet your last dollar that liquidity will once again be force fed into the system. You may have seen that just last week the Fed did two coupon passes in one day, followed up by a very substantial two week temporary open market liquidity injection. Although we don’t want to sound like we’re talking out of both sides of our mouth, Fed liquidity is the big wildcard we need to remember to respect. If indeed the Fed creates yet another liquidity mushroom cloud somewhere ahead, we need to once again “follow the money”. Personally, although we need to remember that our personal opinions are for show and not dough, we believe the market is wrong to expect ever ascending double-digit corporate earnings growth in a slowing consumer environment. Additionally, we also believe the market is incorrect to attribute omniscience to a group of human beings called the FOMC. Could it be that current equity market action is indeed anticipating a Fed panic attack somewhere in the next six to twelve months whereby excess liquidity created by the very same finds its way into equities solely as a default choice (given that the residential real estate cycle is spent)? We need to remain open to this possibility, especially in terms of risk management activities. We’re convinced that at some point credit and liquidity creation will no longer be able to save the macro economic day, so to speak, but that doesn't mean the Fed won’t die trying.

A few last comments and we’ll move on. You know that virtually everything we commented on up to this point has to do with real economic fundamentals. If indeed the US economy slows ahead based on our expectation of a slowdown in consumer spending, we’re convinced the Fed will panic. They have no other tricks up their sleeves. If indeed this comes to pass, you can bet your last dollar that liquidity will once again be force fed into the system. You may have seen that just last week the Fed did two coupon passes in one day, followed up by a very substantial two week temporary open market liquidity injection. Although we don’t want to sound like we’re talking out of both sides of our mouth, Fed liquidity is the big wildcard we need to remember to respect. If indeed the Fed creates yet another liquidity mushroom cloud somewhere ahead, we need to once again “follow the money”. Personally, although we need to remember that our personal opinions are for show and not dough, we believe the market is wrong to expect ever ascending double-digit corporate earnings growth in a slowing consumer environment. Additionally, we also believe the market is incorrect to attribute omniscience to a group of human beings called the FOMC. Could it be that current equity market action is indeed anticipating a Fed panic attack somewhere in the next six to twelve months whereby excess liquidity created by the very same finds its way into equities solely as a default choice (given that the residential real estate cycle is spent)? We need to remain open to this possibility, especially in terms of risk management activities. We’re convinced that at some point credit and liquidity creation will no longer be able to save the macro economic day, so to speak, but that doesn't mean the Fed won’t die trying.

Comment