Announcement

Collapse

No announcement yet.

RE Fraud/Condo Conversions

Collapse

X

-

Re: RE Fraud/Condo Conversions

good catch. who could have known?Originally posted by Laura View Post

Dancing, Booze and Overpriced Houses

The housing bubble is reaching absurd, bacchanalian heights, which can only mean one thing: it's getting ready to collapse.

ericjanszen [iTulip, Inc.] | POSTED: 06.01.05 @00:11 (Originally posted on AlwaysOn Network)

MIAMI, May 22—In the last month alone, you could salsa with dancers in fringed hot pants at Aqua, hear a drag queen D.J. at Cynergi or watch stunt men ricochet off a trampoline at Soleil.

Nightclubs? No. Carnival acts? Not quite.These were launch parties for condominium projects, one of the stranger forms of nightlife in a city obsessed with real estate. Alcohol and music were abundant, but so were sales agents and brochures with statements like, "It is the impeccable aesthetic of textures and calming shades—limestone and blue marble—that further distinguish these voluminous spaces."There are times when I write this column that I feel like a Bible-thumping Evangelist of Doom, tromping back and forth across the blogosphere with an "End Is Near" placard strapped to my virtual ass. Never thought I'd see the day that I'd preach the evils of alcohol, dancing, and music to round out the role, but in the current instance, parties for condo sales are getting my attention. They signal that something is ready to happen, and it's not the Second Coming. Seven years of bubble-watching and research suggest that boozy condo celebrations mark the beginning of the end of the housing bubble.

—Salsa Dancers and Stunt Men? Must Be a Miami Condo Project, The New York Times (registration required)

Sober analysts tell us that the current bubble system not only encourages the financially disciplined among us to eschew ascetic tendencies to save now and party later, it actually makes partying our duty as citizens of the Bubble Cycle system:

"Bretton Woods II, by linking mercantilist emerging market countries, notably China, into a de facto monetary union with the United States, represents a positive shock to global aggregate supply relative to global aggregate demand. Consequently, it is America's global civic duty to live beyond its means. And it is the Federal Reserve's global civic duty to facilitate American hedonism, because in the face of a positive structural shock to global aggregate supply, notably labor, American hedonism is not inflationary."

—Fundamentals In Technical Drag Are Still Fundamentals, PIMCO

Students of asset bubbles will note that the dominance of perverse market incentives is a reliable asset bubble indicator. If you've been reading my analyses since November 1998, you know that the last time I called a bubble top was on March 6, 2000, when I warned about the 1990s stock market bubble, saying that "We're almost there..." This was followed by the April 5 piece, "A Bear Market is Born."

Since 2002, I've written twice about the housing boom, the latest bubble in the Bubble Cycle series of asset bubbles that started in the 1970s. The 2002 piece "Early Stage Housing Bubble 2002" noted that housing prices are rising far faster than incomes, especially in major markets such as Los Angeles, New York, and Washington, D.C. These are the "regional housing bubbles" that Greenspan finally noted last week—a few years late, as usual.

In November 2004 I wrote a follow-up piece for AO, "Housing Bubbles Are Not Like Stock Bubbles," in which I suggested that when the housing bubble ends, it will seize up rather than crash, and not any time soon. Like most bubbles, the housing bubble was destined to go on and on and on, like your in-laws' Miami vacation photos, the ones that they insist you see—each and every 800 of them—when you're visiting them in Cleveland for Thanksgiving.

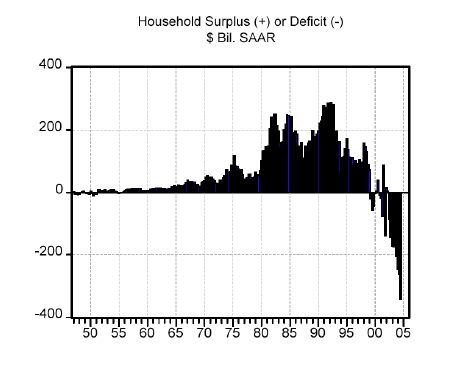

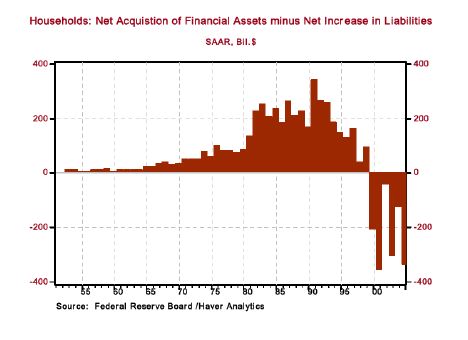

Here are a few pictures from Northern Trust Co., taken of our three-year vacation in housing bubble hell.

If you're not feeling at least a little queasy after looking at these pictures, then maybe you're numb from the booze and the dancing.

General acceptance of the existence of a bubble signals a terminal stage. We can now safely say that we have arrived at this stage, because the housing bubble has hit the mainstream press. In addition to the New York Times article above, here are two more recent examples:

On the House: As Prices Rise, Homeowners Go

Wall Street Journal (registration required)

Riding the Boom

Fortune Magazine

Another indicator that we're topping out is the spread of the bubble to previously untouched areas of the U.S. Not only that, but the global aspect of the phenomenon indicates that this is a liquidity-driven asset bubble, in a late stage of development.

Now nearly everyone believes that there's a bubble in housing. In a recent Wall Street Journal online poll, 81% of respondents said that there's a housing bubble, with 31% of them predicting that it'll pop this year, and 49% believing that it'll keep on chugging along.

James Bianco, head of investment research firm Bianco Research, takes an interesting view of asset bubbles. He doesn't believe that bubbles end when there's general agreement on the existence of a bubble. Rather, a bubble pops only after everybody has concluded that pricing is in fact rational.

Not so. Once the meme of a bubble becomes widely accepted, all that's needed to complete the cycle is an event that serves as the psychological catalyst for the collapse. In the case of the 1990s stock market bubble, it was mutual fund phantom income selling in April 2000, which flooded the market with sell orders. (In April 2000, millions of folks found themselves having to pay massive taxes on unrealized gains in the value of mutual funds that had gone up tremendously in the year 1999. They had to sell stocks and mutual funds in order to raise sufficient capital to pay capital gains taxes.) Since most market participants had by then accepted the idea that they were participating in a bubble (in other words, were infected with the bubble meme), anxious market participants interpreted the wave of phantom income selling as the start of a long-anticipated selling panic, which in turn started an actual selling panic.

What will collapse the housing bubble now that just about everyone accepts its existence? An unpredictable event that gets a lot of potential property buyers thinking that a lot of selling is taking place—or is about to take place—in one of the major regional speculative markets, such as Los Angeles or Boston, and for the news of that event to spread to other markets. Circulation of this new meme will be followed by an end to speculative buying as investment buyers exit, leaving the rest of us behind in our now overpriced homes.

Dancing, Booze, and Overpriced Houses - June 2005

Comment