Announcement

Collapse

No announcement yet.

Yowsa. Gotta watch this bloomberg video :)

Collapse

X

-

Yowsa. Gotta watch this bloomberg video :)

Last edited by blazespinnaker; September 16, 2006, 11:28 PM.Tags: None

-

Re: Yowsa. Gotta watch this bloomberg video

peter schiff of euro-pacific capital gives a concise presentation of ka-poom theory [he doesn't call it that], along with some description of the economic mechanisms which will drive a major change in the structure of the global economy.

i will summarize what [i think] he said.

he says that weakness in the u.s. economy will trigger a significant decline in the dollar vis a vis other currencies, and especially vis a vis asian currencies. a recession here will lower u.s. demand enough so that, for example, global oil demand will fall. the dollar's fall will be such that the price of oil will nonetheless rise in terms of u.s. dollars; but it will fall in terms of other currencies. this same process will raise the cost in u.s. dollars of food, consumption goods, and commodities, but in so doing will destroy enough u.s. demand that overall global demand will fall, and the prices of those items will fall for non-u.s. consumers. the fall in the dollar will also coincide with a sell-off in bonds which will raise interest rates, raising the cost of servicing adjustible rate mortgages. the fed will be dragged along to higher short term rates, trying to get longer rates contained without resorting to non-traditional market interventions which would lead to hyper inflation. [this last sentence is more than what he said- he just stated that the fed would be dragged to higher rates by the fall of the dollar. i am postulating a mechanism for that phenomenon.] the recession will be measured not in quarters but in years. [this last statement, on the duration of the recesssion, is pretty much verbatim.]

a fall in u.s. demand sufficient to lower total global demand will lower prices of tradeable goods and services to non-u.s. consumers, which will be stimulative to foreign economies. foreign domestic demand will rise and companies aimed at non-u.s. domestic demand will do well, while those dependent on export to the u.s. consumer will be hit.

he specifically recommended gold and silver, foreign energy companies - especially canadian income trusts, and foreign reits to get income streams in foreign currencies.

please let me know if this summary is indeed accurate.Last edited by jk; September 17, 2006, 08:29 AM.

-

possible weakness in the schiff scenario

a brief quote from an article, source market watch, which asks the question "is the boom in commodities over?":

"if an investor believes the U.S. economy is going into a prolonged slowdown, then the highs for oil are in, according to Phil Flynn, a senior analyst at Alaron Trading. If instead he sees a soft landing for the economy, then demand for oil will flourish again, he said."

the schiff interview i just sent you would argue that a prolonged slowdown in the u.s. economy would mean the highs for oil and other commodities are in FOR FOREIGN CURRENCY-BASED TRADERS, while the high would NOT be in for U.S. DOLLAR BASED ACCOUNTS.

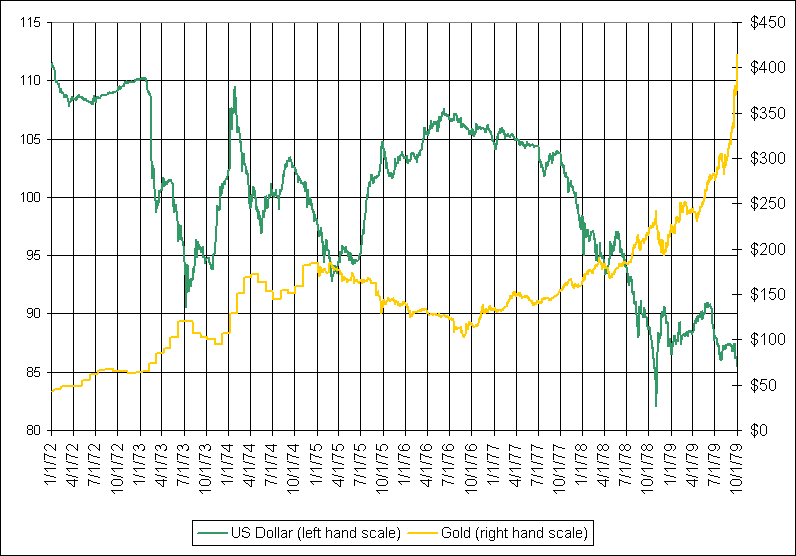

here is a chart of gold in the early 1970's

and here is a table of the highs and lows for gold since '72. you'll notice that in 1973 gold was cut in half, from 126 to 64, not a fun time for holders of gold.

YearYearly

HighYearly

LowYearYearly

HighYearly

Low197270.0044.00

1990423.75345.851973126.0064.00

1991403.00344.301974195.00117.00

1992359.60330.20 1975185.00135.00

1993406.70326.10 1976142.00102.00

1994397.50369.65 1977168.00127.00

1995396.95372.40 1978243.65165.70

1996416.25367.40 1979524.00216.55

1997367.80283.00 1980850.00474.00

1998314.60273.40 1981599.25391.25

1999323.50252.801982488.50296.75

2000325.50264.101983511.50374.25

2001291.45256.651984406.85303.25

2002 342.75 277.75 1985340.90284.25

2003 417.25 319.90 1986442.75326.00

2004454.20 375.00 1987502.75390.002005536.50 411.10 1988485.30389.051989417.15358.50

the schiff scenario depends on foreign demand picking up somewhat, even as u.s. demand goes in the toilet. but china could go into a slump because of the various malinvestments made there in both state owned enterprises and redundant fdi based production capacity. if there is a global recession/depression, and foreign demand drops along with u.s. demand, then commodities are over and the dollar might rise as a safe haven, based on the u.s.'s relatively stable political/legal environment, not on economic strength.

Comment

-

Re: possible weakness in the schiff scenario

If I'm not mistaken your numbers or interpretation are off. Gold started 1973 around $64, moved up to about $126, then down to about $90.Originally posted by jkhere is a chart of gold in the early 1970's

and here is a table of the highs and lows for gold since '72. you'll notice that in 1973 gold was cut in half, from 126 to 64, not a fun time for holders of gold.

....

During the "official period" of the '73-'74 recession, gold almost doubled... and was also very volatile as the chart shows.

Comment

-

Re: Yowsa. Gotta watch this bloomberg video

Yes, jk, it seems to be a fair summary, nice work.Originally posted by jkpeter schiff of euro-pacific capital gives a concise presentation of ka-poom theory [he doesn't call it that], along with some description of the economic mechanisms which will drive a major change in the structure of the global economy.

i will summarize what [i think] he said.

he says that weakness in the u.s. economy will trigger a significant decline in the dollar vis a vis other currencies, and especially vis a vis asian currencies. a recession here will lower u.s. demand enough so that, for example, global oil demand will fall. the dollar's fall will be such that the price of oil will nonetheless rise in terms of u.s. dollars; but it will fall in terms of other currencies. this same process will raise the cost in u.s. dollars of food, consumption goods, and commodities, but in so doing will destroy enough u.s. demand that overall global demand will fall, and the prices of those items will fall for non-u.s. consumers. the fall in the dollar will also coincide with a sell-off in bonds which will raise interest rates, raising the cost of servicing adjustible rate mortgages. the fed will be dragged along to higher short term rates, trying to get longer rates contained without resorting to non-traditional market interventions which would lead to hyper inflation. [this last sentence is more than what he said- he just stated that the fed would be dragged to higher rates by the fall of the dollar. i am postulating a mechanism for that phenomenon.] the recession will be measured not in quarters but in years. [this last statement, on the duration of the recesssion, is pretty much verbatim.]

a fall in u.s. demand sufficient to lower total global demand will lower prices of tradeable goods and services to non-u.s. consumers, which will be stimulative to foreign economies. foreign domestic demand will rise and companies aimed at non-u.s. domestic demand will do well, while those dependent on export to the u.s. consumer will be hit.

he specifically recommended gold and silver, foreign energy companies - especially canadian income trusts, and foreign reits to get income streams in foreign currencies.

please let me know if this summary is indeed accurate.

Schifff suggested (recommended?) two "Canadian income trusts:" BTE-Baytex Energy Trust and HTE-Harvest Energy Trust. From Bigcharts.com, the yields are 9.38% and 14.77% respectively. Don't such yields suggest that these are very risky investments?

Further, without listening to 18 min video again, it seems that most everything he recommended is not available to the average American because the stocks were all listed on foreign exchanges. When asked about how average American could invest, his answer was something like "good question, glad you asked, and our company can get you into these investments" [not verbatim] One possibility if one accepts Schiff's contentions and is moved to "protect" oneself with the foreign diversification he recommended, could be the only party likely to make money could be Schiff's company.Jim 69 y/o

"...Texans...the lowest form of white man there is." Robert Duvall, as Al Sieber, in "Geronimo." (see "Location" for examples.)

Dedicated to the idea that all people deserve a chance for a healthy productive life. B&M Gates Fdn.

Good judgement comes from experience; experience comes from bad judgement. Unknown.

Comment

-

Re: Yowsa. Gotta watch this bloomberg video

the energy trusts are very much dependent on oil/gas prices in order to maintain their cash flow and dividends. they also are significantly smaller than "majors" and have limited reserves. harvest, for example, has a proved plus probable reserve life of 9.5 years. so some of the payout you are getting is actually a return of capital. if they do nothing to increase reserves - either through exploration or acquisition - then at the end of 10 years or so they evaporate, and so would their 14% payout. think of it as buying a certain number of barrels of oil and then selling some of them every year.Originally posted by Jim NickersonSchifff suggested (recommended?) two "Canadian income trusts:" BTE-Baytex Energy Trust and HTE-Harvest Energy Trust. From Bigcharts.com, the yields are 9.38% and 14.77% respectively. Don't such yields suggest that these are very risky investments?

Further, without listening to 18 min video again, it seems that most everything he recommended is not available to the average American because the stocks were all listed on foreign exchanges. When asked about how average American could invest, his answer was something like "good question, glad you asked, and our company can get you into these investments" [not verbatim] One possibility if one accepts Schiff's contentions and is moved to "protect" oneself with the foreign diversification he recommended, could be the only party likely to make money could be Schiff's company.

i spoke with someone at euro-pacific just last week, in order to find out about their services and commision structure. i couldn't get a straight answer over the phone - it sounded like everything got negotiated depended on the volume of transactions you deliver. if you're buying say $25k positions to hold for a significant period of time, i was told commissions might be in the 2-3% range.

i have bought canadian trusts through the pink sheets, and you never know what kind of price you're getting, and how much you're getting reamed on the bid/ask spread and currency conversions. so it's hard for me to assess whether this is a good deal or not.

are there more knowledgeable people here who can chime in, please?

Comment

-

Re: possible weakness in the schiff scenario

you're right, bart. i think gold was virtually cut in half somewhere along the way but couldn't find good info. my point is just that big corrections come with the territory.Originally posted by bartIf I'm not mistaken your numbers or interpretation are off. Gold started 1973 around $64, moved up to about $126, then down to about $90.

During the "official period" of the '73-'74 recession, gold almost doubled... and was also very volatile as the chart shows.

Comment

-

Re: Yowsa. Gotta watch this bloomberg video

ask about a $27k canadian purchase of avf.un or pif.un. what kind of spread, what kind of commision?Originally posted by blazespinnakerI live in canada and I have a fellow from Raymond James constantly trying to put me into these income trusts.

If you want, post a bunch of transaction costs and I'll follow up with this guy and we can compare prices.

Comment

-

Re: Yowsa. Gotta watch this bloomberg video

good one. we got to start keeping track of the ka-poom imitations. so far we got bill gross with his "last bond market" and now schiff with his prediction... does he have a name for it yet?

Comment

-

Re: possible weakness in the schiff scenario

Cool. The almost 50% drop started in very late '74 - here's a chart covering 1972 through late 1979:Originally posted by jkyou're right, bart. i think gold was virtually cut in half somewhere along the way but couldn't find good info. my point is just that big corrections come with the territory.

Comment

-

Re: Yowsa. Gotta watch this bloomberg video

I was fortunate enough to have had the TV tuned to Bloomberg when this exchange originally aired. Jaw dropping to the floor in amazement that somebody with such unconventional yet frank and clear-eyed views was being allowed to explain them on TV. Most air time goes to the Wall Street and Washington establishment views. Kudos to Bloomberg for giving an articulate guy like Schiff a chance to reach an audience perhaps not familiar with his thoughtful points.Originally posted by blazespinnakerFinster

...

Comment

-

Re: Yowsa. Gotta watch this bloomberg video

Anyone with more experience with Canadian Income Trusts? Several are listed on NYSE and AMEX, but it seems that Canada keeps a 15% tax right off the top of the dividend. Seems like a possible way to play currency and peak oil scenarios at the same time.

Comment

-

Re: Yowsa. Gotta watch this bloomberg video

I've owned a couple for some years. I wouldn't let the tax issue sway you one way or the other. You'd want to double check with your tax adviser, but the ones I own qualify for the preferred 15% US rate and the foreign tax credit. So the 15% withheld is a wash, basically putting their dividends on par with those paid by US companies.Originally posted by javacat97Anyone with more experience with Canadian Income Trusts? Several are listed on NYSE and AMEX, but it seems that Canada keeps a 15% tax right off the top of the dividend. Seems like a possible way to play currency and peak oil scenarios at the same time.

While to some the high yields signify risk, the ones I am familiar with have been paying those yields without dipping into capital; i.e. they represent real economic profit. With the recent selloff, I view them as strong bargains. As always, DYODD...Finster

...

Comment

Comment