Gold prices have seen a breathtaking decline from the mid $700s as recently as this spring to well below $600 today, much of that occurring in a first wave off the highs and a second over the past several days. Energy prices are down sharply and Morgan Stanley's Steven Roach is declaring the commodity bull over.

Should we be buying gold, selling it, or holding it?

There are two parts to the answer. First, realize that while we can speculate as to what the price of anything will do in the future, there are other considerations that we can assess with certainty. In particular, we don't have to speculate as to how much gold we have right now, all we need do is look at our portfolio and get a solid answer. The second part is our analysis and speculation as to what the price will do in the future.

Let's put these two aspects together. To do so, we frame the question in terms of what proportion of gold we ought to have in our portfolios, relative to how much we think we ought to have. Once we have done that, the question as to whether to buy, sell, or hold is put on a firm footing.

To illustrate, let's assume that the ideal amount of gold to have in one's portfolio is unknown, but that it is more than 0% and less than 100%. If we examine our portfolio and see that we have no gold at all, the answer is clear. Buy. If we find that our portfolio consists entirely of gold, the answer is equally clear. Sell.

Next, let’s see if we can narrow down that 0%-100% range a bit. What does the rest of our portfolio look like? Is any of it fairly well correlated with gold? For example, if 50% of our portfolio is silver and the rest natural resource stocks, we ought want less gold than if the everything else we had was tech stocks and bonds!

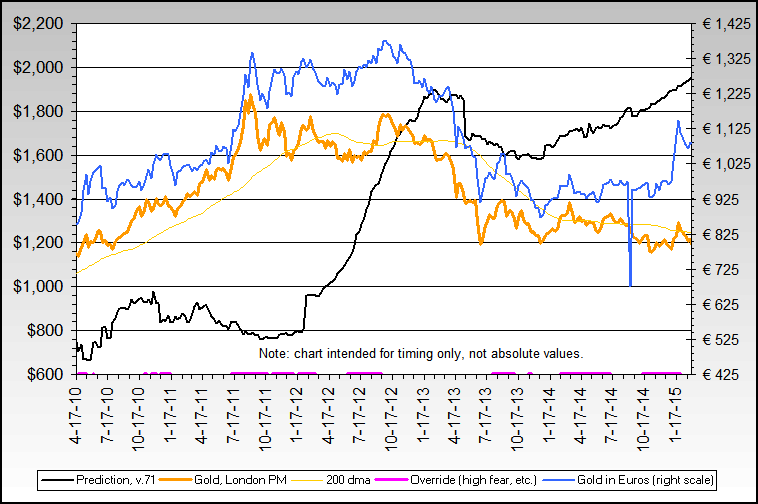

And what do we think will happen to gold prices? We don’t know if gold is now bottoming, nearing a bottom, or has several months or so of further weakness to go. It is by no means certain, but I’m posting my latest gold forecast chart below. An in depth examination of history, however, and an analysis of what has happened in the past under similar financial and economic circumstances, suggests that somewhere down the road, very probably within the next few years, gold prices will be at multi-thousand-dollar levels. The Federal Reserve is in the latter stages of an inflation-fighting effort, and evidence of some deflationary forces, including slumping house prices as well as commodity prices and perhaps stock prices, is mounting. Practically as day follows night, the next part of the cycle will see the Fed fighting economic weakness, which means rate slashing and liquidity pumping. It is this reflationary effort which is likely to spur the next big leg up in gold prices. For historical precedent, recall the 1970’s where an overarching secular inflationary cycle was punctuated in the middle by a deflationary countertrend. Gold prices, which went up by over twenty times, did so in two distinct phases, with a corresponding countertrend decline of demarcation.

In my view, then, let’s suppose the rest of our portfolio is a neutral mix of broad stocks, bonds, and cash, with perhaps some real estate. In this context, about 25% of the total portfolio value in gold is not at all unreasonable, and is probably about ideal for investors with more than a couple years’ time frame, given both the nearer term uncertainty and longer term bullish outlook. Folks who are more conservative or more skeptical about the outlook could employ a few percent less, and those more aggressive or more bullish could employ a few percent more. And as alluded to before, one naturally would also consider the composition of the remainder of the portfolio.

With the above assumptions in mind, then, the answer boils down to this. Do you have substantially less than 25% of your portfolio in gold? Then buy. Do you have substantially more than 25%? Then sell. If you’re pretty close, then hold.

Should we be buying gold, selling it, or holding it?

There are two parts to the answer. First, realize that while we can speculate as to what the price of anything will do in the future, there are other considerations that we can assess with certainty. In particular, we don't have to speculate as to how much gold we have right now, all we need do is look at our portfolio and get a solid answer. The second part is our analysis and speculation as to what the price will do in the future.

Let's put these two aspects together. To do so, we frame the question in terms of what proportion of gold we ought to have in our portfolios, relative to how much we think we ought to have. Once we have done that, the question as to whether to buy, sell, or hold is put on a firm footing.

To illustrate, let's assume that the ideal amount of gold to have in one's portfolio is unknown, but that it is more than 0% and less than 100%. If we examine our portfolio and see that we have no gold at all, the answer is clear. Buy. If we find that our portfolio consists entirely of gold, the answer is equally clear. Sell.

Next, let’s see if we can narrow down that 0%-100% range a bit. What does the rest of our portfolio look like? Is any of it fairly well correlated with gold? For example, if 50% of our portfolio is silver and the rest natural resource stocks, we ought want less gold than if the everything else we had was tech stocks and bonds!

And what do we think will happen to gold prices? We don’t know if gold is now bottoming, nearing a bottom, or has several months or so of further weakness to go. It is by no means certain, but I’m posting my latest gold forecast chart below. An in depth examination of history, however, and an analysis of what has happened in the past under similar financial and economic circumstances, suggests that somewhere down the road, very probably within the next few years, gold prices will be at multi-thousand-dollar levels. The Federal Reserve is in the latter stages of an inflation-fighting effort, and evidence of some deflationary forces, including slumping house prices as well as commodity prices and perhaps stock prices, is mounting. Practically as day follows night, the next part of the cycle will see the Fed fighting economic weakness, which means rate slashing and liquidity pumping. It is this reflationary effort which is likely to spur the next big leg up in gold prices. For historical precedent, recall the 1970’s where an overarching secular inflationary cycle was punctuated in the middle by a deflationary countertrend. Gold prices, which went up by over twenty times, did so in two distinct phases, with a corresponding countertrend decline of demarcation.

In my view, then, let’s suppose the rest of our portfolio is a neutral mix of broad stocks, bonds, and cash, with perhaps some real estate. In this context, about 25% of the total portfolio value in gold is not at all unreasonable, and is probably about ideal for investors with more than a couple years’ time frame, given both the nearer term uncertainty and longer term bullish outlook. Folks who are more conservative or more skeptical about the outlook could employ a few percent less, and those more aggressive or more bullish could employ a few percent more. And as alluded to before, one naturally would also consider the composition of the remainder of the portfolio.

With the above assumptions in mind, then, the answer boils down to this. Do you have substantially less than 25% of your portfolio in gold? Then buy. Do you have substantially more than 25%? Then sell. If you’re pretty close, then hold.

Comment