This analysis is almost identical to what I have seen on iTulip back in the spring of 08: huge dips in the price of Gold/Silver.

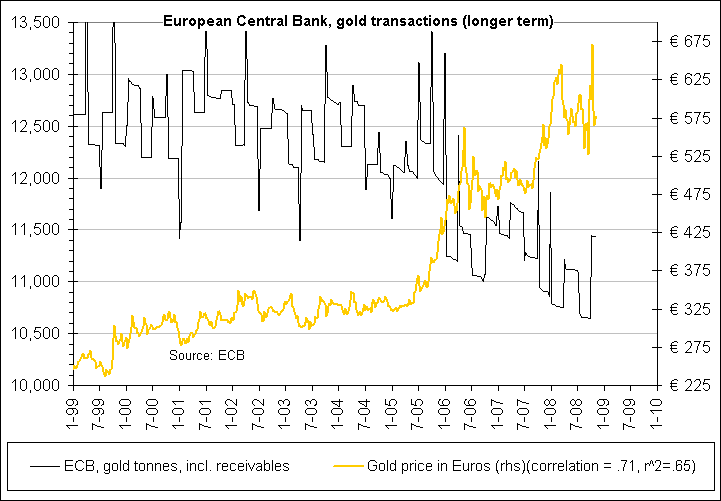

This guy makes for a convincing argument (even includes a graph). Here are some interesting comments made by the author:

This guy makes for a convincing argument (even includes a graph). Here are some interesting comments made by the author:

[As it is clearly illustrated in the above chart, the nearly identical large sales of gold contracts in a short period of time over consecutive days at precisely the same time are indicative that the sellerís intent was clearly not to maximize their sale price.]

and then...

[The entire U.S. official gold reserves are approximately 8,140 metric tones or at $955 per ounce $274 billion, resulting in the notional value of

commercial bank derivatives positions equaling about 48% of the entire U.S. official gold reserves.]

commercial bank derivatives positions equaling about 48% of the entire U.S. official gold reserves.]

and further down the letter:

[...the total notional amount of derivatives greatly exceed each bankís total assets,...]

So much so for "betting against the house"...

The question is: What happens the day the house is no more?

Ah, I almost forgot, here is a copy of the letter sent to the CTFC:

Comment