by floyd norris, ny times

September 7, 2006, 12:01 pm Inflation Sign? Don’t Bet on It.

There was much concern on Wednesday over a report showing that unit labor costs surged in the first quarter.

But there should not have been. It was not wages that were going up. It was the stock market.

Robert Barbera, the chief economist of ITG, points out that the driving force in that change was a revision in the figure for growth in wage and salary income. And while you may think wage and salary income is just that — the money you get directly from your employer — the government also includes the profits people make from cashing in stock options.

“It almost certainly was a consequence of an explosive exercise of options,” Mr. Barbera said.

When the government first estimated the first quarter figure for growth in wage and salary income, it came up with an annual rate of 7 percent. That was reasonable based on the data it had, which come from the monthly employment numbers. But since then it has gotten real data, which led to the increase.

The stock market struggled late last year, and then rose nicely early this year. What this almost certainly means is that a lot of people cashed in their stock options. That is good for them, but it is not a sign of inflation.

Mr. Barbera says he expects that the pace of options exercises slowed down in the second quarter, and that the annual rate of growth in wage and salary income for that quarter will be cut back from the first estimate of more than 7 percent to just 1 or 2 percent. If so, in three months we’ll hear that unit labor costs have settled down.

He points to the first quarter of 2000, when wage and salary income grew at a rate of 15 percent, but then fell to 2 percent in the second quarter. Then, as now, it was the options.

The problem with this number is not that it is wrong; it is that the Federal Reserve may pay attention to it and think that it needs to tighten again. The economy is slowing, and higher rates are not what it needs.

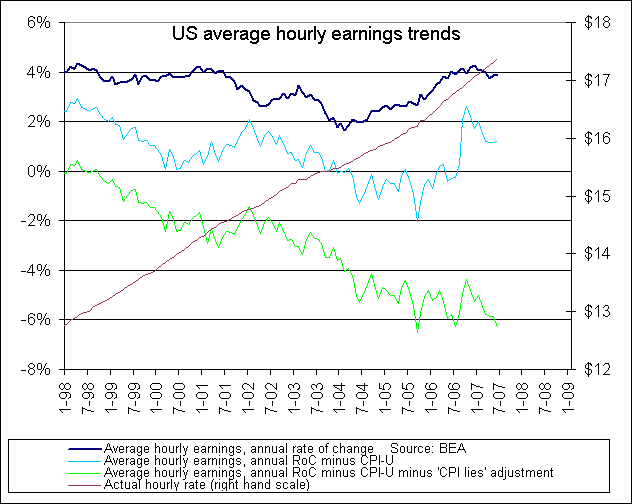

jk comment - should have known better than to think the hoi polloi were getting a bigger piece of the pie. and so wage data is no longer inconsistant with a deflationary lurch.

September 7, 2006, 12:01 pm Inflation Sign? Don’t Bet on It.

There was much concern on Wednesday over a report showing that unit labor costs surged in the first quarter.

But there should not have been. It was not wages that were going up. It was the stock market.

Robert Barbera, the chief economist of ITG, points out that the driving force in that change was a revision in the figure for growth in wage and salary income. And while you may think wage and salary income is just that — the money you get directly from your employer — the government also includes the profits people make from cashing in stock options.

“It almost certainly was a consequence of an explosive exercise of options,” Mr. Barbera said.

When the government first estimated the first quarter figure for growth in wage and salary income, it came up with an annual rate of 7 percent. That was reasonable based on the data it had, which come from the monthly employment numbers. But since then it has gotten real data, which led to the increase.

The stock market struggled late last year, and then rose nicely early this year. What this almost certainly means is that a lot of people cashed in their stock options. That is good for them, but it is not a sign of inflation.

Mr. Barbera says he expects that the pace of options exercises slowed down in the second quarter, and that the annual rate of growth in wage and salary income for that quarter will be cut back from the first estimate of more than 7 percent to just 1 or 2 percent. If so, in three months we’ll hear that unit labor costs have settled down.

He points to the first quarter of 2000, when wage and salary income grew at a rate of 15 percent, but then fell to 2 percent in the second quarter. Then, as now, it was the options.

The problem with this number is not that it is wrong; it is that the Federal Reserve may pay attention to it and think that it needs to tighten again. The economy is slowing, and higher rates are not what it needs.

jk comment - should have known better than to think the hoi polloi were getting a bigger piece of the pie. and so wage data is no longer inconsistant with a deflationary lurch.

. I think JK raises an important point. Typically it's the "capitalists" being made out to be profiting at the expense of workers. But the capitalists are the owners of the stock - which these days are much the working class, through 401(k)s, pension plans, IRAs, and whatnot.

. I think JK raises an important point. Typically it's the "capitalists" being made out to be profiting at the expense of workers. But the capitalists are the owners of the stock - which these days are much the working class, through 401(k)s, pension plans, IRAs, and whatnot.

Comment