Re: Michael Hudson on Freddie/Fanny

+1

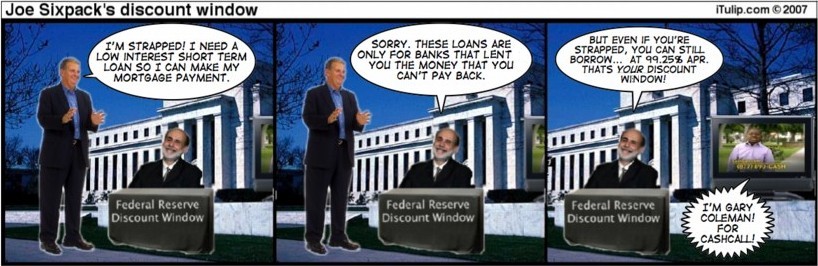

While free market and libertarian ideas are seductive, in the real world we have politicians in the pockets of the financial institutions. To be sure, this is partly the voter's fault. But the reality is that the vast majority of voters are easily manipulated and blinded to the truth. Is this paternalistic? Sure, but have you seen the morons running around (and running) this country?

Originally posted by metalman

View Post

While free market and libertarian ideas are seductive, in the real world we have politicians in the pockets of the financial institutions. To be sure, this is partly the voter's fault. But the reality is that the vast majority of voters are easily manipulated and blinded to the truth. Is this paternalistic? Sure, but have you seen the morons running around (and running) this country?

astute and pithy observations that whole Hudson thing to me looks like total verbal rubbish (being polite). The solutions proposed by Hudson ignore the whole fundamental problem, in fact exacerbates the distortions, and goes even further along the road of non responsibility for oneself and one's own decisions. Oh we poor little people being ripped off by the big baddies. The corruption exhibited by the elites and corporates is certainly on an horrific scale. However it is all part of the same disease.

astute and pithy observations that whole Hudson thing to me looks like total verbal rubbish (being polite). The solutions proposed by Hudson ignore the whole fundamental problem, in fact exacerbates the distortions, and goes even further along the road of non responsibility for oneself and one's own decisions. Oh we poor little people being ripped off by the big baddies. The corruption exhibited by the elites and corporates is certainly on an horrific scale. However it is all part of the same disease.

Comment