'WALL-E' and Shiller's new 'irrational pessimism'

By Paul B. Farrell, MarketWatch

Last update: 7:35 p.m. EDT July 7, 2008

Escape into bubble-thinking on the 'Fatburger Luxury Space Cruise Ship'

We saw similar bizarre "third episode" economic theorizing earlier this year in venture capitalist Eric Janszen's "The Next Bubble" article in Harper's magazine. After analyzing the dot-com and subprime bubbles, Janszen predicted "alternative energy" will be Wall Street's next megabubble, which will then self-destruct around 2013, leaving losses of $20 trillion for investors to "mop up after yet another devastated industry," while Wall Street "will already be engineering its next opportunity."

Notice the flaws common to Shiller and Janszen's bizarre economic theorizing? Shiller predicts we'll first have another "epidemic of excessive financial optimism," then a wave of "irrational pessimism and distrust." Janszen, also sees a new bubble coming in the boom/bust cycle, but then adds that the only way the American economy can exist is if Wall Street's "bubble-blowing machine" keeps feeding on itself, in an accelerating succession of ever-bigger bubbles, ad infinitum.

Unfortunately, both Shiller and Janszen are wrong. Their economic predictions parallel the problems of America's depleted and exhausted military. The Pentagon isn't ready to fight a nuclear WWIII. Likewise, Wall Street lacks the firepower to blow another mega-bubble. After closing Bear Stearns and Countrywide ... writing off what'll eventually be $1.3 trillion ... selling huge equity to sovereign funds ... and now facing a long domestic recession in housing, unemployment and consumer spending ... Wall Street can't finance a $20 trillion "alternative energy" bubble.

But that's not the big reason their predictions are preposterous: Forget that new "third episode" bubble. Forget predictions of a perpetual Wall Street bubble-machine. The real problem is: We need to stop escaping into bubble-thinking and face reality. We're still in a bust cycle, still collapsing, still sinking deeper into a recession. There is no "third episode" ahead, just a dark extension of the "second episode," Wall Street's megastupid subprime-credit crisis.

--

what the **** is this guy smoking? has he ever read this site? did he read the harper's article? he thinks ej likes paulson? guess he missed...

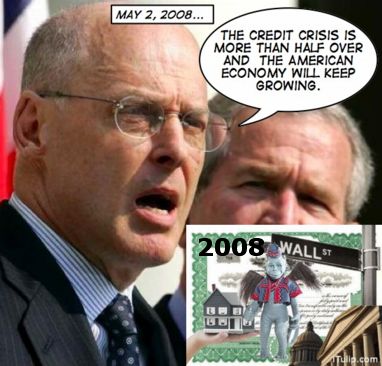

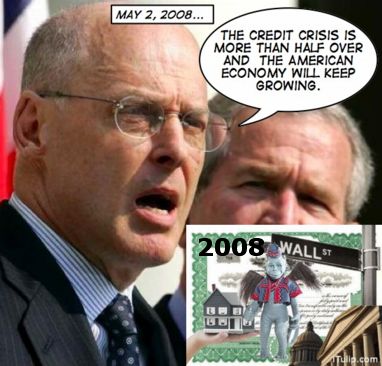

2008 Flying Monkeys of the FIRE Economy Award

and the winner is...

...and 500 other articles here...

farrel... what an moron.

By Paul B. Farrell, MarketWatch

Last update: 7:35 p.m. EDT July 7, 2008

Escape into bubble-thinking on the 'Fatburger Luxury Space Cruise Ship'

We saw similar bizarre "third episode" economic theorizing earlier this year in venture capitalist Eric Janszen's "The Next Bubble" article in Harper's magazine. After analyzing the dot-com and subprime bubbles, Janszen predicted "alternative energy" will be Wall Street's next megabubble, which will then self-destruct around 2013, leaving losses of $20 trillion for investors to "mop up after yet another devastated industry," while Wall Street "will already be engineering its next opportunity."

Notice the flaws common to Shiller and Janszen's bizarre economic theorizing? Shiller predicts we'll first have another "epidemic of excessive financial optimism," then a wave of "irrational pessimism and distrust." Janszen, also sees a new bubble coming in the boom/bust cycle, but then adds that the only way the American economy can exist is if Wall Street's "bubble-blowing machine" keeps feeding on itself, in an accelerating succession of ever-bigger bubbles, ad infinitum.

Unfortunately, both Shiller and Janszen are wrong. Their economic predictions parallel the problems of America's depleted and exhausted military. The Pentagon isn't ready to fight a nuclear WWIII. Likewise, Wall Street lacks the firepower to blow another mega-bubble. After closing Bear Stearns and Countrywide ... writing off what'll eventually be $1.3 trillion ... selling huge equity to sovereign funds ... and now facing a long domestic recession in housing, unemployment and consumer spending ... Wall Street can't finance a $20 trillion "alternative energy" bubble.

But that's not the big reason their predictions are preposterous: Forget that new "third episode" bubble. Forget predictions of a perpetual Wall Street bubble-machine. The real problem is: We need to stop escaping into bubble-thinking and face reality. We're still in a bust cycle, still collapsing, still sinking deeper into a recession. There is no "third episode" ahead, just a dark extension of the "second episode," Wall Street's megastupid subprime-credit crisis.

--

what the **** is this guy smoking? has he ever read this site? did he read the harper's article? he thinks ej likes paulson? guess he missed...

2008 Flying Monkeys of the FIRE Economy Award

and the winner is...

...and 500 other articles here...

farrel... what an moron.

Comment