Re: Do we have an oil bubble?

And my 2 cents for what are they worth:

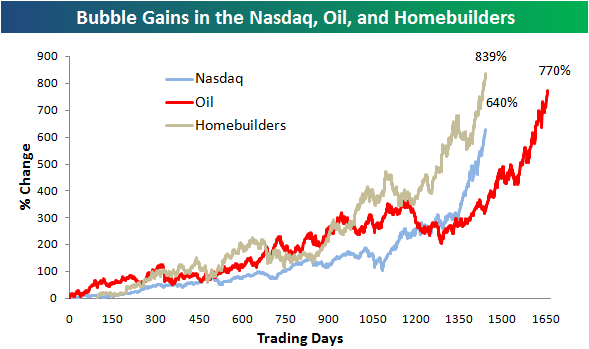

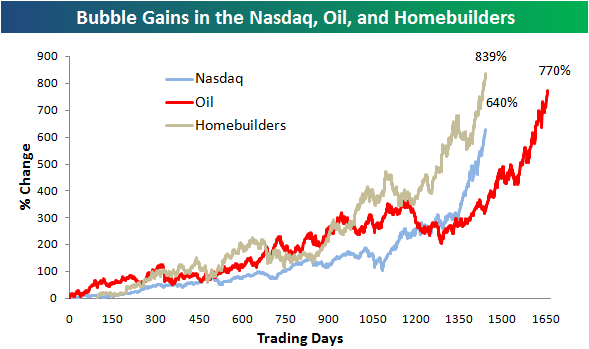

http://static.seekingalpha.com/uploa...ubblegains.png

Some insight from the down under:

http://www.businessspectator.com.au/...cument&src=sph

Originally posted by bart

View Post

http://static.seekingalpha.com/uploa...ubblegains.png

Some insight from the down under:

http://www.businessspectator.com.au/...cument&src=sph

Across the board, however, energy and commodity prices have been falling against the backdrop of a slowing world economy and continuing credit market instability.

That has created a "triple whammy" for the hedge funds, which had leveraged exposures to commodities inflated by their own speculative activities in a sector where commodity trading has experienced (until recently) relatively low margin requirements. All those things – values, leverage and margin requirements – have been reversing.

For some funds that were running long/short strategies – long commodities, short financials – the outcome will be even worse, given that financial stocks, while still weak, bottomed in July.

In one sense this was yet another disaster waiting to happen. When the credit crisis closed credit markets, smashed equity markets and engulfed property markets, commodities – buoyed by the China story – was the only hot market left to play in. A market with good fundamentals was turned into a casino as the funds piled in.

The resources sector, despite a recent modest slowing of China’s economic growth rate (from very high levels) retains good fundamentals. There is still an imbalance between demand and supply in many of the key commodities and some major impediments to boosting supply in the near to medium term.

That isn’t sufficient, however, to sustain the levels of speculative activity.

That has created a "triple whammy" for the hedge funds, which had leveraged exposures to commodities inflated by their own speculative activities in a sector where commodity trading has experienced (until recently) relatively low margin requirements. All those things – values, leverage and margin requirements – have been reversing.

For some funds that were running long/short strategies – long commodities, short financials – the outcome will be even worse, given that financial stocks, while still weak, bottomed in July.

In one sense this was yet another disaster waiting to happen. When the credit crisis closed credit markets, smashed equity markets and engulfed property markets, commodities – buoyed by the China story – was the only hot market left to play in. A market with good fundamentals was turned into a casino as the funds piled in.

The resources sector, despite a recent modest slowing of China’s economic growth rate (from very high levels) retains good fundamentals. There is still an imbalance between demand and supply in many of the key commodities and some major impediments to boosting supply in the near to medium term.

That isn’t sufficient, however, to sustain the levels of speculative activity.

)

)

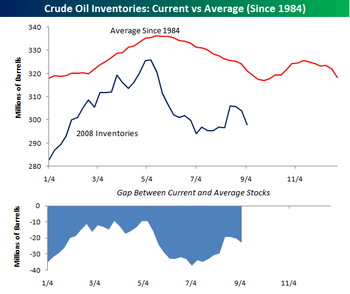

yup, it's all supply and demand

yup, it's all supply and demand

Comment