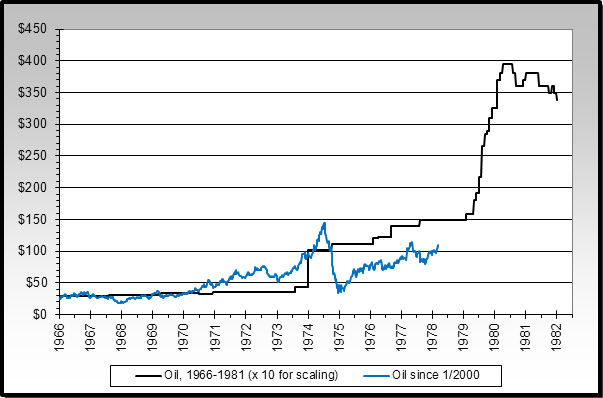

Re: We have an oil bubble : the proof

That is very interesting GRG55. I thought that the physical and virtual energy were decoupled just before the fall of Enron.

Anyway Gustav was just a Cat 3 and no major damage was inflicted on the Gulf platforms ... as a result the oil price is now down to $108/bbl

Originally posted by GRG55

View Post

Anyway Gustav was just a Cat 3 and no major damage was inflicted on the Gulf platforms ... as a result the oil price is now down to $108/bbl

Comment