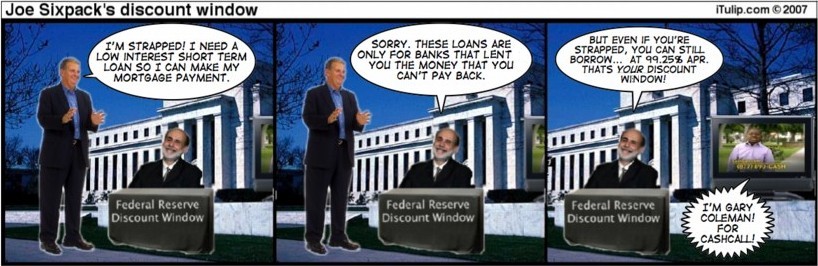

Either that or he's as two-faced as they come. Just about fell out of my chair laughing when I read this.

Seems a tad late, doesn't it? Or am I missing something?

Seems a tad late, doesn't it? Or am I missing something?

...``For market discipline to be effective, it is imperative that market participants not have the expectation that lending from the Fed, or any other government support, is readily available,'' Paulson said...

more...

more...

Watch

Watch

Comment