Announcement

Collapse

No announcement yet.

chart of the week

Collapse

X

-

Re: chart of the week

Oil has outpaced gold by a wide margin in the past 12 months. The expansion of monetary units may be the primary reason all commodities are able to rise, but it's perceived "needs" and "wants" that determine which sectors (now commodities), and which items within a sector, all that money flows through at any given moment.

I also wonder if the marked difference between wheat and corn is indeed an indication of the ethanol fuel distortion?

Oil (Blue)

Gold Spot (Orange)

Corn Spot (Yellow)

Wheat Spot (Red)

Comment

-

Re: chart of the week

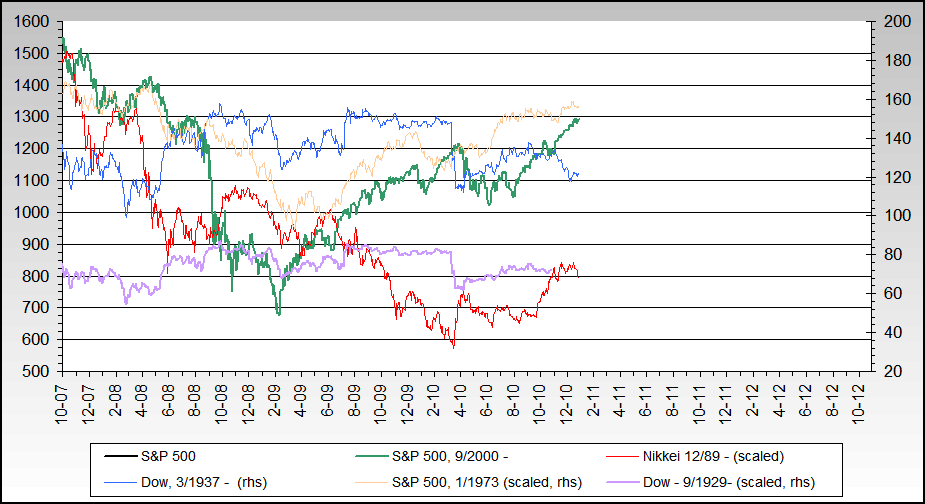

Another chart or two to make you want to go hmmm...

Comment

-

Re: chart of the week

it's worth pondering the fact that the graph shows a mean value, hidden behind which is a distribution representing the whole population. each point of increase must correspond to some part of the population maxing out their income and going into negative cash flow.Originally posted by jk View Post

Comment

-

Re: chart of the week

Gentlemen,

What do you think about one of Mauldin's latest arguments - that there is a sector rotation going on which is leading to commodity prices increasing?

I think that's a load of bull, but still an interesting concept.

Comment

-

Re: chart of the week

Disagree. This image was created for next week's commentary to provide a context for our explanation of what we think is happening.Originally posted by c1ue View PostGentlemen,

What do you think about one of Mauldin's latest arguments - that there is a sector rotation going on which is leading to commodity prices increasing?

I think that's a load of bull, but still an interesting concept.

As inflation risk increased 2001 to 2006 due to post bubble reflation, money flowed into commodities. When the debt deflation cycle (aka "credit crunch") started Q2 2007, even more money into commodities poured out of high risk debt to hedge the additional inflation risk created by central bank bailouts. Money also poured into sovereign bonds to escape default risk in corporate and agency.

As the debt deflation progresses, investors will be increasingly challenged to hide from inflation and default risk. If, as we expect, the policy of dollar depreciation is followed to counter the disinflationary monetary impact of debt deflation, the result will continue to be net inflationary.

We ask, which raft do we want to be in? Full report next week.Ed.

Comment

-

-

Re: chart of the week

A bond is a fixed income instrument (until the Wall Street magicians tried to turn some of them into stocks... good luck!) and a stock is a stock; wheat is a perishable commodity and nickel is not.Originally posted by jk View Posti thought gold was the 4th currency. and if the 4th currency is an asset worthy of analysis, why aren't the 2nd and 3rd and 5th?

Gold is unique in that it is at once a commodity, a store of value, and a means of exchange.

"Gold still represents the ultimate form of payment in the world. Fiat money in extremis is accepted by nobody. Gold is always accepted."

- Alan Greenspan - May 20, 1999

Actually, oil is the ultimate form of payment, but it's hard to keep in a safe box.Ed.

Comment

-

Re: chart of the week

Originally posted by FRED View PostActually, oil is the ultimate form of payment, but it's hard to keep in a safe box.

For those that may not know, there's a crude oil mini contract on NYMEX with a 500 barrel quantity (the full contract is 1000 barrels), and contracts go out into 2013 currently.

Using no leverage or margin, that's about $63k bonars to buy right now.

Comment

-

Re: chart of the week

Actually that is the crux of one of my long running sparring matches with our beloved Finster, Esq. I do not at all disagree with his point that excess monetary units (bonars or otherwise) are a necessary condition for inflation. But at any given point in time that inflation by no means has to manifest itself as price increases in the commodity complex, and for much of history it has not.Originally posted by c1ue View PostGentlemen,

What do you think about one of Mauldin's latest arguments - that there is a sector rotation going on which is leading to commodity prices increasing?

I think that's a load of bull, but still an interesting concept.

For example, from the point that Volcker decided that two recessions was plenty enough on his watch, we had about 15 years of steady US monetary unit inflation with steadily declining nominal commodity prices. The holders of the excess monetary units (surplus to personal or national "basic necessities", as applicable) chose to flow their excess funds through just about any other asset class than commodities - bonds, Japanese equities and real estate, US and European commercial real estate, tech stocks, sovereign debt, and finally global housing [especially in the financial centres].

During the decade of the 1990's [long before the property bubble was really evident] buyers of US rental property, as one example, were making a decision to "flee dollars" in favour of an asset that, in their minds, only "went up" with time. That was their observation and, conscious or not, it was a move to protect themselves against the historical depreciation of their monetary unit.

Now that inflation and the Fed's famous "inflation expectations" are ratcheting up people are "fleeing dollars" into the so-called "hard(er)" asset classes for perceived additional protection from the ravages of a more rapidly depreciating monetary unit. Sounds like a [secular] sector rotation to me.

Tried that argument on our Shadow Fed Chairman too. Still recovering from the skin grafts after being shot down in flames...Originally posted by FRED View PostActually, oil is the ultimate form of payment, but it's hard to keep in a safe box.

Comment

Comment