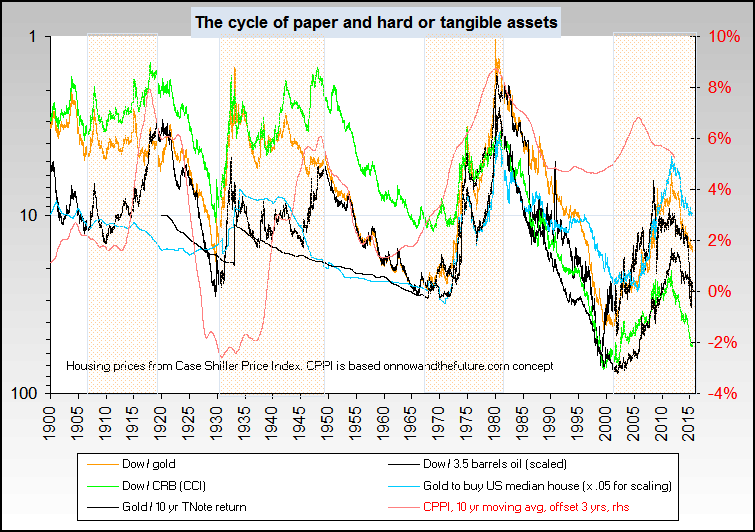

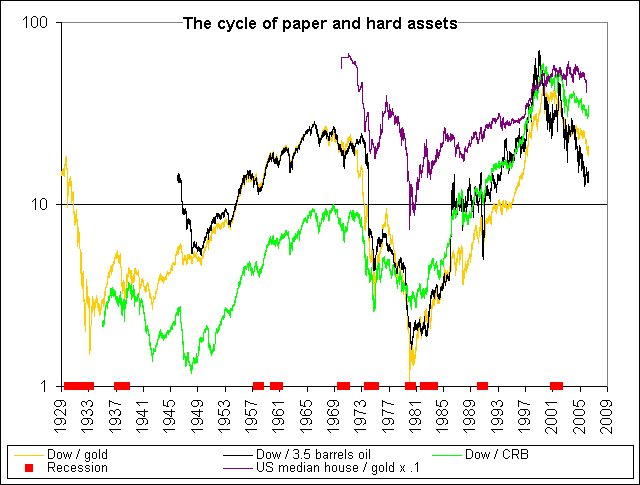

In the wake of surging oil prices over the past couple of years, there has been great renaissance in discussion about Peak Oil. Such discussions may have great long term relevance, but to the extent they arise in the context of these recently surging oil prices, they miss the point. Let’s take a look and see if we can determine to what extent these surging oil prices have to do with peak oil and to what extent they may be due to other factors. We will see that only a small fraction of the price increase has to do with oil per se becoming more precious.

First, let's look at the oil prices we all see and hear every day. Over the past five years, oil seems to have risen over three and a half times in price.

Next, however, we will look at oil prices in ounces of gold. Real money. This gets the dollar and other paper currencies out of the equation completely, so we can see what has really happened to the price of oil. The picture is dramatically different. In fact, when you measure it in real money, the price of oil has gone nowhere in the past five years.

For a longer term perspective, we next look at the price of oil in ounces of gold since 1970. Over 36 years, in dollars, the price of oil has gone from about $3.35 to $75 - up about 20 times or 1900%. In gold, the price has gone from 0.10 ounces to about 0.11 ounces, or about 10%.

Folks, peak oil is real, but it's a long term issue, and is responsible for little of the current run up in prices. Getting obsessed with energy supply just leads you to miss the Big Story here - destruction of the currency.

Is it peak oil?

No.

Is it inflation?

Yes.

First, let's look at the oil prices we all see and hear every day. Over the past five years, oil seems to have risen over three and a half times in price.

Next, however, we will look at oil prices in ounces of gold. Real money. This gets the dollar and other paper currencies out of the equation completely, so we can see what has really happened to the price of oil. The picture is dramatically different. In fact, when you measure it in real money, the price of oil has gone nowhere in the past five years.

For a longer term perspective, we next look at the price of oil in ounces of gold since 1970. Over 36 years, in dollars, the price of oil has gone from about $3.35 to $75 - up about 20 times or 1900%. In gold, the price has gone from 0.10 ounces to about 0.11 ounces, or about 10%.

Folks, peak oil is real, but it's a long term issue, and is responsible for little of the current run up in prices. Getting obsessed with energy supply just leads you to miss the Big Story here - destruction of the currency.

Is it peak oil?

No.

Is it inflation?

Yes.

Comment